Transparent pricing,

No hidden fees

Send: From 0.4%

Hear it first from our customers

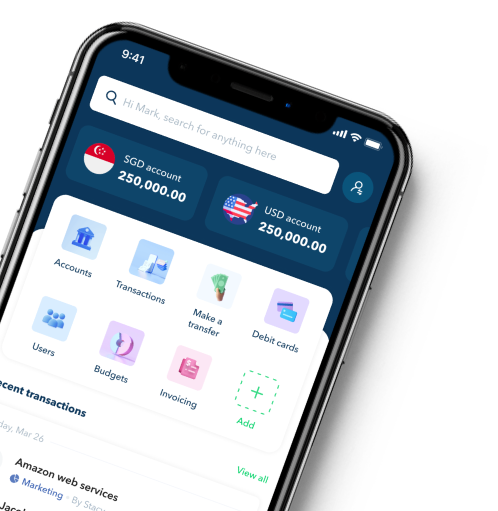

Gregory Van

CEO of Endowus

Miranti Dyah Prawitasari

Corporate Accounting Manager

Arni Maulidya

Finance at Avoskin

FAQs

Are there any setup fees?

No, Aspire does not charge any setup fees. Opening an account is completely free, making it easy for businesses to get started without upfront costs.

Any minimum balance or deposit required?

No, Aspire does not require a minimum balance or deposit. In addition, it’s part of our mission to ensure transparent pricing. You will always know how much you're charged before you pay.

How long does it take to open an account?

Opening an Aspire account is quick and hassle-free. Our account opening can be as fast as 1 day, but note that the timeline varies depending on the nature of your business. Rest assured that your business registration is 100% online, and you will be allocated to an onboarding manager to support you fully during the registration process.