Summary

- Break-even analysis is a financial method used to determine the point where your business’s revenue equals its costs, meaning no profit, but no loss either

- Break-even analysis shows how many units you need to sell to cover costs, guiding pricing, production, and investment decisions

- Follow 5 key steps to make break-even analysis: identify variable unit costs, calculate fixed costs, set your selling price, estimate sales volume, and use a spreadsheet to model and visualise your break-even point

- You can use break-even formula (BEP = Fixed Costs ÷ [Price – Variable Costs]) to calculate how many units you need to sell to break even, and adjust for changes in price, costs, or output

- Reduce your break-even point faster by increasing margins, cutting costs, improving operational efficiency, and optimising your sales strategy

- Avoid common mistakes such as overestimating sales, ignoring market trends, or excluding cost fluctuations. Regularly reviewing your analysis keeps it accurate and actionable

Break-even analysis is an important tool for making business decisions. Businesses need to perform a break-even analysis to assess their current financial situation, plan for future growth, and decide whether investing in a new venture is worth the risk.

What is a break-even point?

The break-even point (BEP) is when a business's revenues and expenses are equal; this signifies that the company is not earning a profit or losing money. In other words, the company has reached the point where its production costs equal its product revenues. When a company hits the break-even point, also known as the point of break-even, it stops operating at a loss.

Understanding break-even analysis

By understanding how to do break-even analysis, you can make decisions about pricing, production, and profits that will help you maximise your profits and make your business successful.

There are several fixed overhead costs associated with owning and operating a business, such as rent, salaries, taxes, and insurance. Add in the variable costs like supplies, materials, labour costs, research and development, and marketing, among others, to get the overall costs. On the other hand, total revenue describes the money a business makes from selling its products or services. The break-even point is important for businesses because it shows them how many sales they need to make to start making a profit.

Simply put, the BEP is the point at which sales proceeds to cover all costs. If you sell less, the business will suffer a loss, and if you sell more than that, the business's gross earnings will start to rise.

What is a break-even point example?

XYZ Enterprises manufactures tires with total fixed costs of SGD $30,000 and variable costs of SGD 20. The company set the sale price per unit for these tires at SGD $45.

In this case,

Break-even point = 30,000/ (45-20) = 1200 units

So, based on the aforesaid break-even analysis, the BEP (break-even point) for Sigma is 1200. For XYZ to break even on these fixed and variable manufacturing expenses, at least 1200 units of the product must be sold.

Relationship between Break-even Point and Sales

Since the break-even point is defined by total cost, revenues have no direct bearing on the break-even point. However, whether a business reaches its break-even point depends on sales revenues. A business experiences a loss if sales are below total costs and it does not reach the break-even threshold. When a business doesn't generate enough revenue to reach the break-even mark, debt builds up over time, ultimately leading to the business closing its doors.

Relationships between price, volume, fixed costs, and variable costs

The relationship between fixed costs, variable costs, price, and volume is complex. Still, it can be summarized in the following way: Fixed costs, such as rent and insurance, stay the same regardless of production volume or price. Variable costs, on the other hand, vary in accordance with production volume or pricing. Examples of variable expenses include labor, raw materials, and transportation. It is important to consider fixed and variable costs and pricing when calculating a company's overall profit or loss. For example, an increase in production expenses may be offset by higher prices if properly managed — leading to a higher profit margin despite an initial increase in expenditure from variable costs.

In order for a business to remain profitable and balance fixed costs, variable costs, price, and volume, it must have the right combination of all these elements. It is the job of the business owner or manager to keep an eye on these components and adjust accordingly.

How Does Cutting Costs Affect the Break-even Point?

When it comes to cutting costs, the break-even point is impacted. For example, the break-even point will decrease if a business reduces costs such as overhead expenses, materials costs, or wages and salaries. This means that the business will need to generate less revenue to reach profitability. Conversely, if a business increases costs, the break-even point will increase - requiring more sales to reach a profitable situation. Therefore, adjusting expenses affects when a company achieves its intended profit level.

Why is break-even analysis vital for business growth?

Break-even analysis is a data-driven way to gain insights into a business and reach the point of profitability faster.

Break-even analysis assists businesses in determining how many units must be sold to avoid losses.

It optimizes production practices and directs resources appropriately, resulting in smarter decisions when assessing risk and determining which strategies should be employed by the business.

In the early stages of your business, if you learn how to do break-even analysis, it can help you determine profitability and adjust pricing.

Entrepreneurs can plan inventory levels using break-even analysis to ensure that they have goods ready for sale for a predetermined time.

Break-Even Analysis: A Crucial Tool for Business Owners

Startup: A break-even analysis is crucial for a new business. It advises management on how to price their products realistically. Break-even analysis also reveals whether the new company is profitable according to its business plan.

Innovate and develop: Before beginning production of a new product, the business must focus on a break-even analysis to see whether the new investment will be a good decision for the business.

Business model modification: The break-even analysis applies if a business model changes, such as going from retail to wholesale. This analysis will assist the business in deciding whether or not to adjust a product's selling price.

Benefits of a break-even analysis

- If you learn how to do break-even analysis, it will help you identify and understand their fixed costs, variable costs, and break-even points.

- It can be used to make informed pricing, production levels, and other strategic decisions.

- It can help businesses to monitor their financial performance and track progress toward profitability.

- To help determine the minimum level of sales or production the business needs to achieve to stay in business.

- To aid businesses in setting prices for their products or services.

- It can help you limit risk by avoiding unprofitable investments or product lines

A business has to do a break-even analysis because it determines whether the business can last in the long run. There are 5 easy steps to make a break-even analysis or break-even point calculation.

5 easy steps to make a break-even analysis

1. Determine Variable Unit Costs

There are two types of costs. First is the total variable costs. Total variable costs are costs that change proportionately with the changes in volume or capacity. The greater the capacity, the greater the total variable costs and vice versa.

The second type is the fixed costs. For example, the cost of using gasoline on a vehicle is calculated by mileage but the price of each liter of gasoline remains constant and is not affected by mileage.

As an illustration, the price of petalite is $8 per liter. 1 liter of petalite can cover a distance of 20 km. So what is the calculation of variable costs per unit? In this example, the cost of petalite per km is $8:20 = $0.4.

2. Determine Fixed Costs

Fixed costs can be more important than variable costs, and these costs have two characteristics. The first characteristic is that fixed costs do not change or are not influenced by a particular period or activity.

So the unit fixed cost is inversely proportional to the change in volume. If the volume is low, the unit fixed costs are high. On the contrary, at high volumes, the unit fixed costs are priced low.

For example, the carrying capacity of a passenger car is 50 passengers daily, so it can carry 1,500 people in a month. If you want to increase the number of passengers to more than 1,500 people every month, you must increase the number of cars to transport passengers.

From the total number of passengers, we must calculate the depreciation cost to get the estimated cost per unit with the formula:

(Purchase price - Residual value): Estimated usage

(SGD $200,000 - SGD $20,000): 10 years = SGD $18,000.

In this example, fixed costs or annual depreciation costs are SGD $18,000 or SGD $1,500 per month. After the depreciation costs are obtained, the cost per unit of each passenger can be calculated using the formula:

Unit costs per month = Fixed costs per month: Number of passengers per month

3. Determine Unit Selling Price

Determining the unit selling price is certainly very important for your business growth and profit. When you set a new selling price, you can then find out how to calculate your sales profit.

The way to calculate net profit per unit can be calculated after finding out the cost and the selling price per unit. Here are some of the important factors in determining selling prices:

I. Customers

A product is intended to attract the attention of customers and potential customers to buy the product. So, you have to make sure that the selling price of your product is indeed a price that can easily be accepted by the customers.

Do not set the price too high because it can be rejected by the customer and do not set it too low because it leads to losses.

II. Competitors

It is also necessary to look at the selling prices offered by competitors who have similar products. You must make sure that the selling price of your product can compete with the selling price of competing products. That means that you also need to pay attention to your level of profit.

If the predetermined level of profit causes the price to be too expensive, then it may be a good idea to apply the method of calculating product profit and loss by lowering the potential profit to get a price that is not too far away from the price offered by competitors.

III. Cost

This is the most important factor in determining the selling price of the product. Do not set the selling price lower than the costs because you will end up with a loss.

4. Determine sales volume and unit price

The break-even points will change as the sales volume and the unit price changes. Calculation of break-even points are as follows:

BEP = FC : (P-VC)

BEP: Break-even Point

FC: Fixed costs

P: Unit price

VC: Variable costs

From this breakeven point (BEP) formula, we can observe that the break-even point is equal to the total fixed costs divided by the difference between the unit price and the variable costs. You also have to note that in this formula, fixed costs are expressed as the total of all overhead costs for the company.

While the price and variable costs are expressed as costs per unit or the amount for each unit of product that is sold.

5. Create a spreadsheet

To calculate breakeven point (BEP), you will make or use a spreadsheet then convert the spreadsheet into a graph. The spreadsheet will plot break-even for each level of sales and product prices.

The graph will also show you the break-even for each of the prices and expected sales volumes.

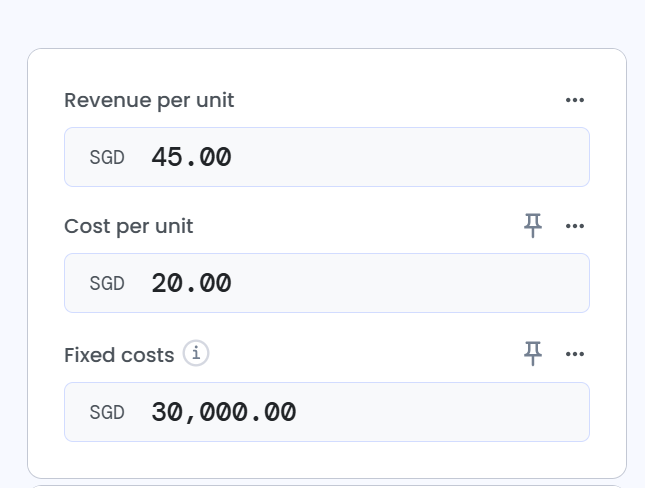

To make this more practical, you can use free break-even analysis templates to calculate your break-even point. Simply enter your fixed costs, variable costs, and selling price, and the template will automatically generate the result. Let’s see how this works using the XYZ company example mentioned earlier, by inputting the figures into the free template provided by Omni Calculator.

Information:

- Total fixed costs = SGD $30,000

- Variable costs = SGD $20

- Selling price = SGD $45

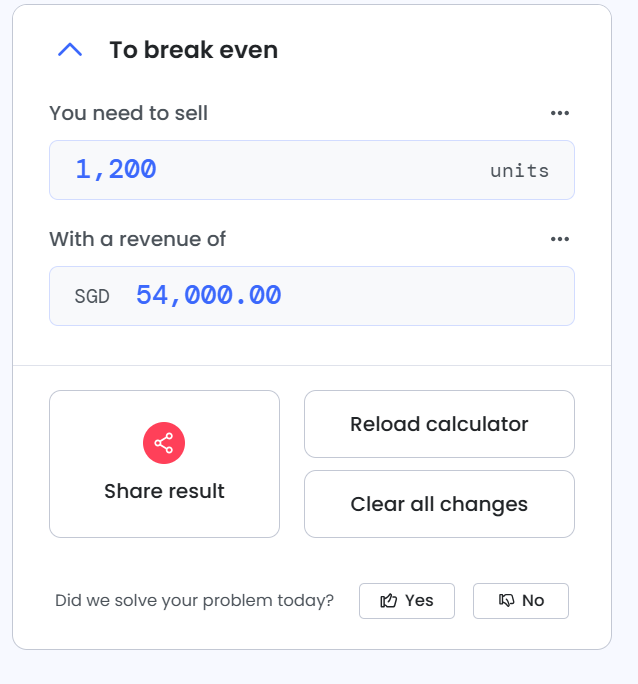

Once you input the above information into the template, the tool will calculate how many products you need to sell to break even.

Step 1: Input the total fixed cost, the variable cost, and the selling price.

Step 2: The calculator will automatically generate the results. According to the Omni Calculator template, XYZ company needs to sell 1,200 units of the product to reach the breakeven point.

Psst... You may also be interested in: 7 Minutes Complete Guide to Business Cash Advance for Startups

Limitations of Break-Even Analysis

Break-even analysis is a popular and widely used tool for making business decisions. However, it is important to understand the limitations of this tool before making any decisions.

Focuses only on fixed costs

Generally speaking, break-even analysis only considers fixed expenses. This implies that it does not account for any variable expenses, including those for labour or supplies. Because of this, it may be challenging to determine an organisation's break-even point precisely.

Ignores risk

Break-even analysis ignores risk since it believes that the anticipated future cost and sales circumstances are known and fixed.

Price and profitability assumptions

Break-even analysis assumes that all products or services are sold at the same price. But in practice, costs might differ based on the good or service, the market, and other elements. The break-even analysis presupposes that all items or services are equally profitable. However, certain goods or services may be more profitable than others. Because of this, it may be challenging to anticipate profitability, sales, and revenue with accuracy

How to lower the break-even point?

If you want to learn how to lower the break-even point, then the four strategies can assist you in lowering your break-even point. Increasing prices, reducing costs, boosting efficiency, and optimising output are all ways to ensure you achieve your break-even point as quickly as possible by generating more revenue with the same expenses.

Increase Prices

One of the most common ways to lower your break-even point is to increase your prices. By charging more for your products or services, you will be able to earn more income while still maintaining the same amount of expenses. This will help you break even faster.

Reduce Costs

Another strategy you can use to lower your break-even point is to reduce your operating costs. This includes reducing overhead expenses, such as reducing staffing, eliminating wasteful spending, and streamlining processes.

Improve Efficiency

Improving efficiency is an important step for lowering your break-even point. Investing in updated technology and tools can help you get more done with fewer resources, leading to greater profits and faster break-even points.

Maximize Output

Achieving maximum output from your processes can help you accomplish more with the same amount of time and resources. This can enable you to break even more quickly, as you can spread the costs of production of your products and services across a larger quantity of goods.

Common Mistakes to Avoid in Break-Even Analysis

Now that you learn how to lower break even point, let us look at the common mistakes to avoid in the break-even analysis. Calculating the break-even point is needed for efficient decision-making and is a crucial financial exercise for the business. However, while doing it, avoid the following mistakes.

- Do not overestimate the sales volume. If the sales forecast is overly optimistic and inflated, the break-even calculations can be skewed. The business might believe it would be profitable sooner than it actually can.

- Do not neglect the existing marketing conditions, such as the market, trends, competitors, and the prevalent economic atmosphere. These factors can result in unrealistic break-even projections. For instance, situations such as an economic downturn or increased competition directly affect not just the sales volume but the price, too. Ensure all these factors are considered before conducting a break-even analysis for reliable results.

- Do not forget to consider fluctuations in variable costs. This can occur due to different factors, ranging from any change in the production process to inflation and supplier costs. Unless these fluctuations are considered, the break-even analysis might result in overly optimistic production of profitability or underestimate the costs incurred.

- Another common mistake to be avoided is not considering the fixed cost. As with variable costs, considering fixed costs such as insurance or long-term maintenance is needed to ensure the break-even analysis offers a reliable prediction.

- Apart from all this, every business must regularly revisit its break-even analysis to ensure they are updated with the current costs and prices prevalent in the market, depending on the conditions.

Whether it is a new product offering, a change in cost structures, or economic uncertainty, the frequency of conducting break-even analysis will differ. Regularly performing this analysis and reviewing it ensures the business makes the most of the opportunities available while minimising the risks.

Additionally, it’s important to acknowledge that break-even analysis should be seen as a guiding tool, not a guarantee. Assumptions about demand, prices, or costs can shift over time, which means projections may not always reflect reality.

How to Get to The Break-Even Point Faster?

Here are some suggestions businesses can use to reach the break-even point quickly. From reducing fixed costs and improving operational efficiency to reducing variable costs and targeting margin products and services, businesses can maximise their earnings while reducing expenses.

Here are some key strategies that can be used to get to the break-even point faster.

Reduce costs

Two types of business costs incurred are fixed and variable costs. Fixed costs include overhead expenses such as administrative costs, rent, and utilities. Variable costs include the cost of labour, raw materials, and other items directly related to production or manufacture. By reducing both these costs, it becomes easier for a business to reach its break-even point quickly.

High-margin products and services

If a business decides to offer its products and services at a higher cost without affecting the existing demand, it can increase its margins and achieve the break-even point.

Enhance operational efficiency

If a business can streamline its operations, it will become easier to enhance production and reduce waste while maintaining the required output. In turn, this brings the business a step closer to achieving its break-even point.

Optimise marketing and sales strategies

By optimising the business's sales strategy and targeted marketing campaigns, they can effectively reach their target audience and increase the average order value. In turn, this increases the conversion rate and drives sales. A combination of these factors will help the business achieve its break-even point quickly.

Importance of Running Multiple Scenarios for Better Business Planning –The Power of Scenario Analysis

The business environment is seldom stagnant and is almost always dynamic. In such a situation, if a business relies too much on a specific set of assumptions, the predictions or projections might not be entirely reliable. When it comes to a break-even point or break-even analysis, scenario analysis is needed. It helps businesses explore various possibilities depending on the variables that keep changing. Whether it is fixed cost, selling price, or variable cost, if a business uses various variables, the projections are also different.

Here is a simple example of how changing variables, such as fixed cost or selling price, affects the business's ability to achieve its break-even point.

For instance, let's assume a smartphone application comes with a selling price of SGD $10 per download. Let us assume that a business can achieve its break-even point by selling 35,000 units at SGD $10 each. However, if the selling price increases by SGD $2 and is now SGD $12, the number of units it needs to sell to break even comes down. So, the business needs to sell its unit while achieving its break-even point. This is a simple example of how changing even one variable can affect the break-even point.

Importance of Running Multiple Scenarios for Better Business Planning

Here are the different reasons why running multiple scenarios is always better for business planning.

Better resource allocation

An important reason why businesses must undertake scenario analysis is its results and optimum resource allocation. For instance, a lower selling price might be more attractive to customers, but it means the business must increase its sales volume. This means the business might need to dedicate more resources to customer acquisition, targeted marketing, and conversion.

Carefully analyse risks and opportunities

While planning, analysing risks and opportunities is needed. The only way a business can effectively take stock of the potential risks and opportunities is by evaluating multiple scenarios. This is where multiple scenario analysis steps into the picture. For instance, a higher selling price requires a lower sales volume and can increase profitability. However, it might potentially reduce consumer demand. Similarly, a lower selling price can increase consumer demand but reduce the business's profit margin.

Effective decision-making

The ability to make informed and better decisions and select efficient business strategies becomes easier when various scenarios are thoroughly examined. From the pricing strategy to cost-cutting measures or launching an advertising and marketing campaign, scenario analysis offers the business much-needed insights that are data-driven.

Enhanced communication

Another benefit of analyzing multiple scenarios is that it improves the business's communication with its stakeholders and investors. When these important parties are provided multiple outlooks based on wearing factors, possibilities, and variables, it instils a better sense of confidence in the business's ability to perform and plan for contingencies.

Summary

Whatever business you want to run, capital is definitely important. If you need additional business capital but you feel reluctant to borrow from a bank, you can consider using Aspire.

Frequently Asked Questions

The key components a business must consider while performing a break-even analysis are:

- Fixed costs

- Variable costs

- Selling price per unit

- Break-even point in terms of units

- Contribution cost (selling price minus the variable cost per unit)

- Margin of safety

The most straightforward means to perform a break-even analysis is by using spreadsheets. Whether it is Excel or Google Sheets, this is the simplest tool available.

Apart from this, a variety of online tools can be used, such as break-even analysis calculators, accounting and financial software, cost accounting software, and pricing tools.

Break-even analysis is not an industry-specific metric. Any business, regardless of whether it is e-commerce, transportation, entertainment, health and fitness, technology, manufacturing, retail, construction, etc., will benefit from break-even analysis. Whether it is a small or large business, a diversified company, or a startup, everyone can benefit from this because it promotes efficient decision-making based on data-driven insights.

The most common challenges businesses run into while performing break-even analysis are:• Accurately estimating the fixed costs• Price fluctuations caused by market conditions• Not determining the variable cost per unit• Overlooking the opportunity cost • No clear estimate of sales volume

Break-even analysis can be used for multiple products, but the process becomes slightly complicated when compared to analysing a single service, product, or offering. While dealing with multiple products, it's important to determine how each offering affects the business costs and its respective sales mix.

Depending on the business type, changes in the cost structure, sales environment, and the overall dynamics of the market and industry, the frequency of break-even analysis differs. Usually, it is recommended that it be performed quarterly or annually for regular review. However, its frequency will change while introducing new products, when a business experiences significant changes in pricing or costs, and during periods of economic uncertainty.

Break-even analysis is a beneficial tool for startups because it helps them plan for business growth while determining the timeline to register profits. It helps startups identify their pricing strategy, predict the profitability timeline, establish realistic financial goals, optimise funding and investment decisions, and mitigate risk.

It’s also worth noting that investors and lenders often request a company’s break-even calculations during fundraising. Demonstrating a clear understanding of when your business will become profitable shows not only financial discipline but also strengthens your credibility in due diligence.

If the break-even point is too high, it means your business will take longer to achieve the desired profitability. It also means a higher sales volume must be generated to meet the business costs. This can seem problematic, but by reducing fixed costs, lowering variable costs, increasing the price of product offerings, and increasing selling costs, the break-even point can be lowered. Similarly, diversifying the product or service offerings and reevaluating the marketing strategies is also recommended.

Fixed costs are expenses that remain constant, despite the volume of production, such as salaries and rent. Variable costs are expenses that fluctuate depending on the production volume, such as raw materials and commissions.

- Investopedia - https://www.investopedia.com/terms/b/breakevenanalysis.asp

- Corporate Finance Institute - https://corporatefinanceinstitute.com/resources/accounting/break-even-analysis/

%201.webp)

.webp)