Aspire for

Mid-sized Companies

Manage and automate your company’s finance with ease

Aspire offers a complete end-to-end solution from a global business account, corporate cards, expense management and access to market leading FX rates. Everything on a single platform

Trusted by 50,000+ modern businesses

Simplify business spending and streamline financial processes

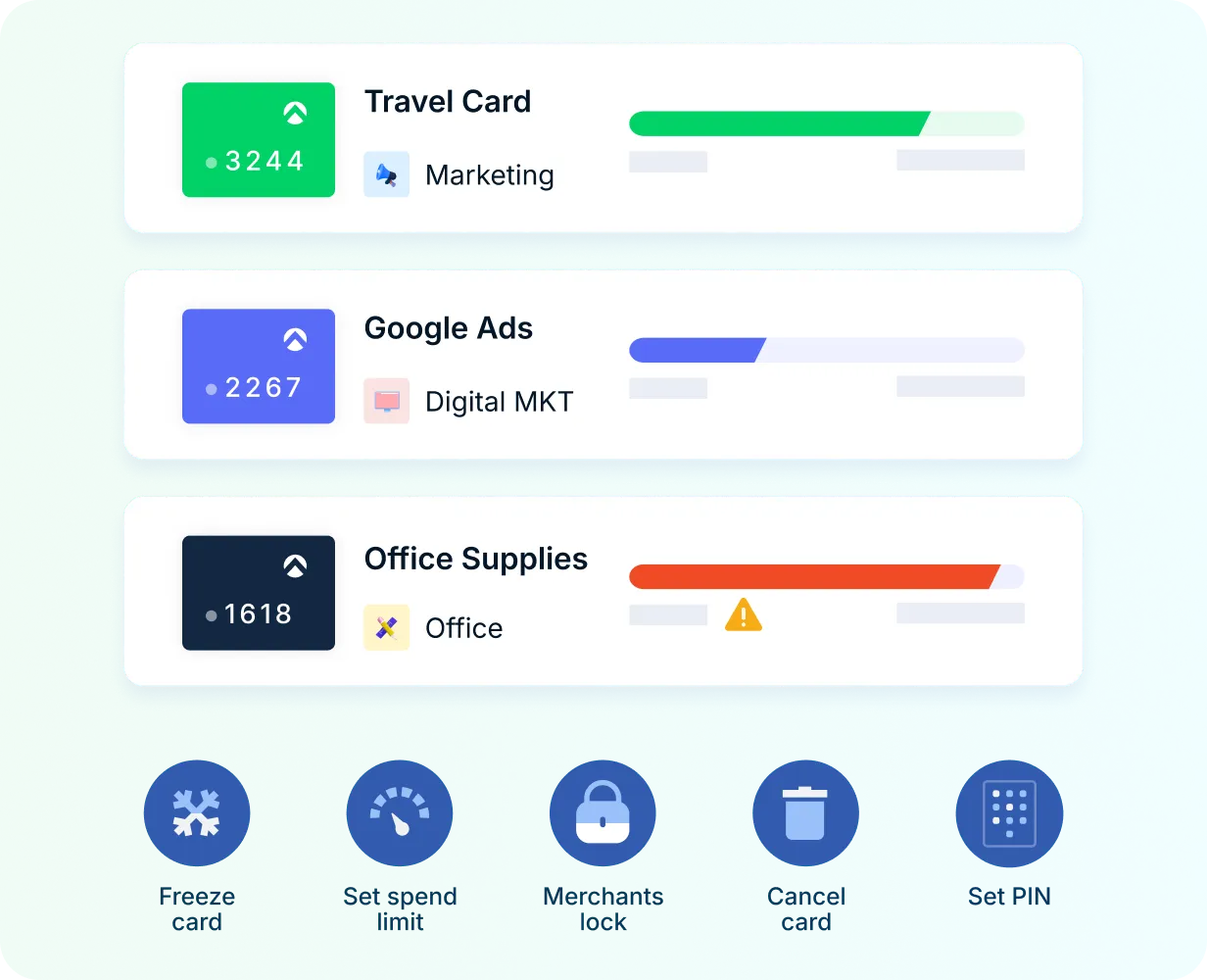

Issue unlimited cards to your team, and enable faster and distributed purchasing in a safe and secure manner

View spends in realtime at a client or project level. Generate expense reports without having to wait till the end of the month

Eliminate manual admin for the entire team with centralised software and powerful accounting automation that drastically streamlines expenses

Aspire vs Spenmo

.webp)

Increase finance operational efficiency

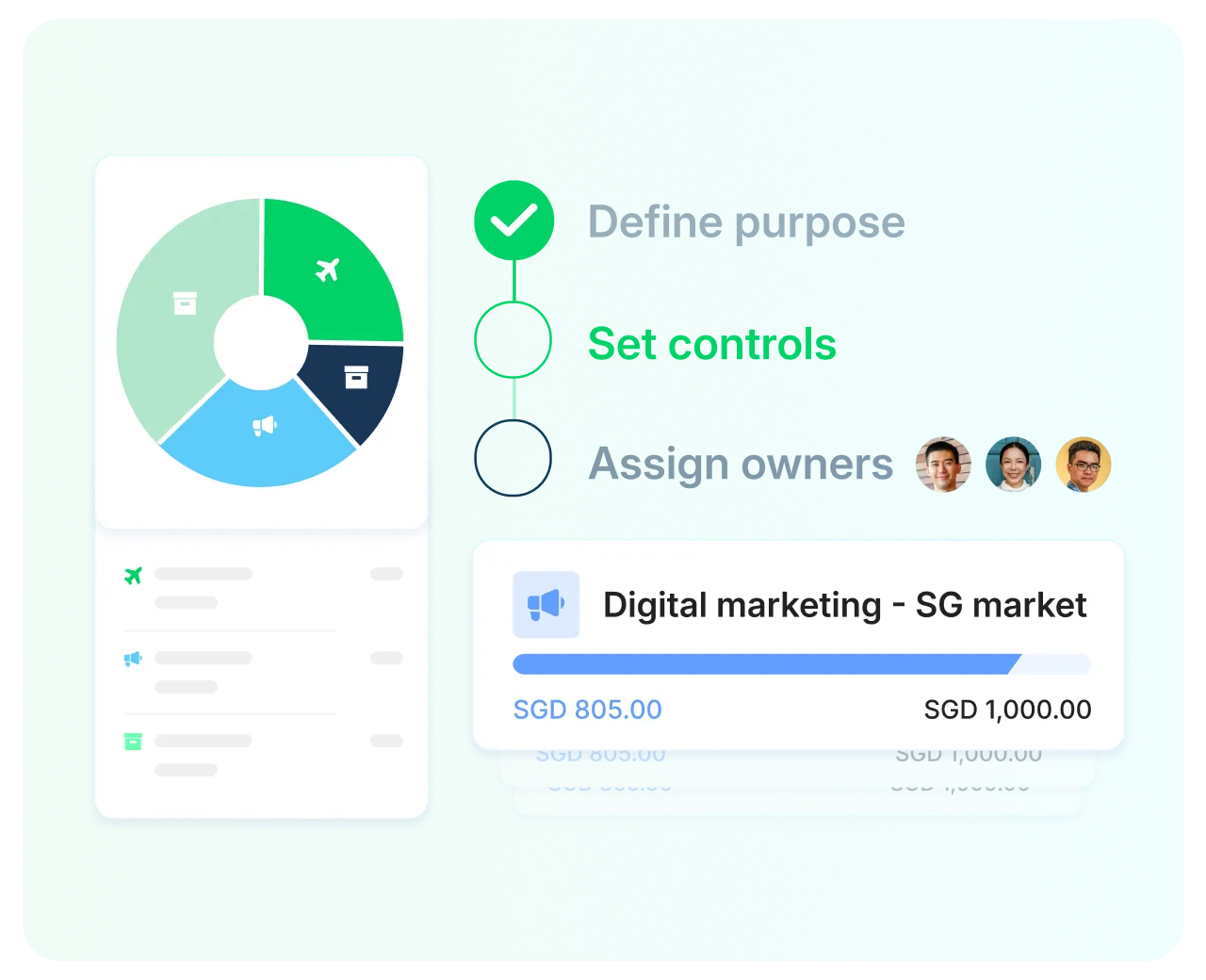

Keep spending organised with budgets and spend policies

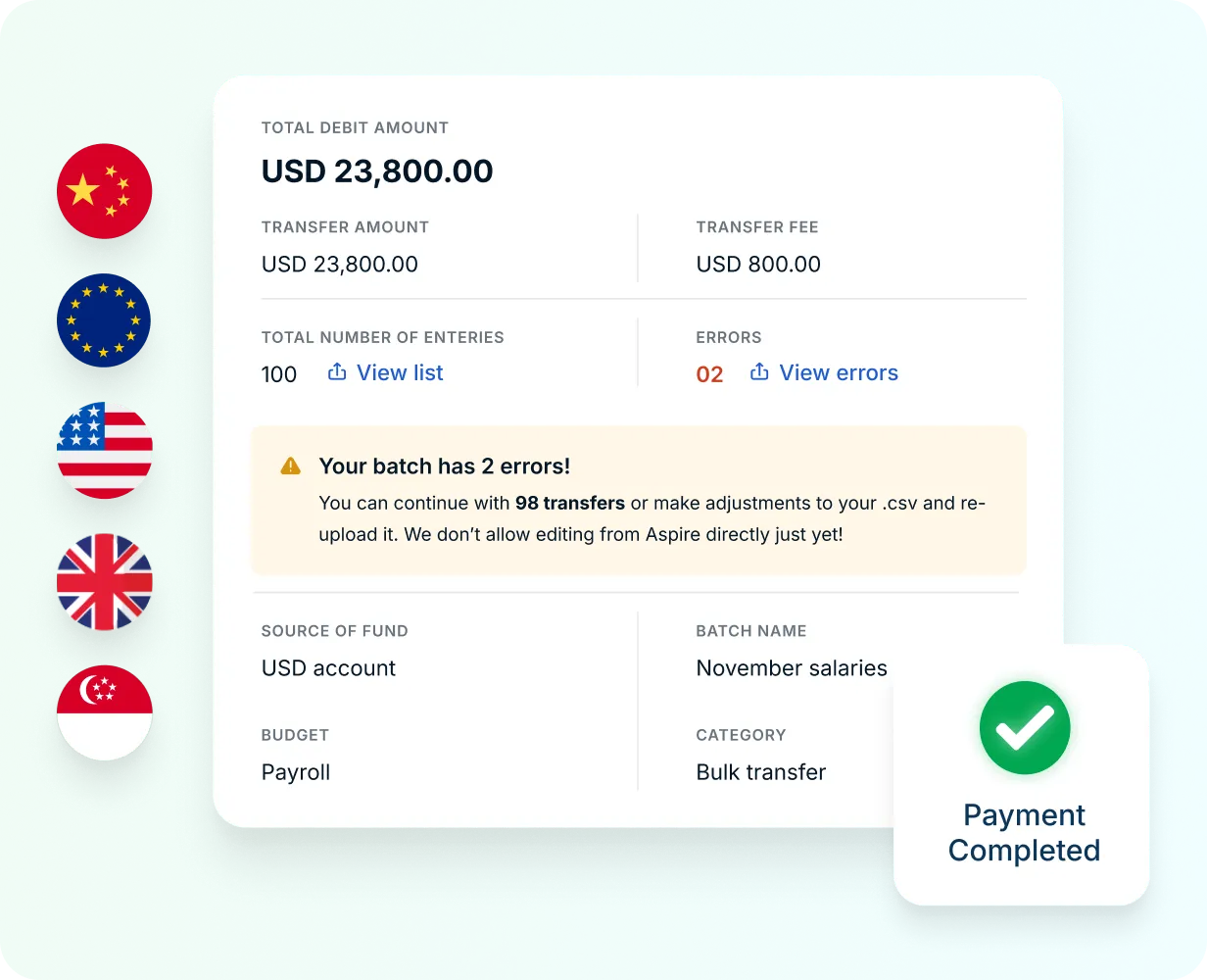

Automate your payroll and bulk payments

%20(1).webp)

Learn how Multiplier has optimised its expense and budget processes with Aspire

FAQs on Aspire platform and products

FAQs on Aspire OS white-label

Reach out to us!

Request a demo

Experience the future of business finance today

Open your free account

Experience the future of business finance today

Contact Sales

Find out how Aspire can support your business goals