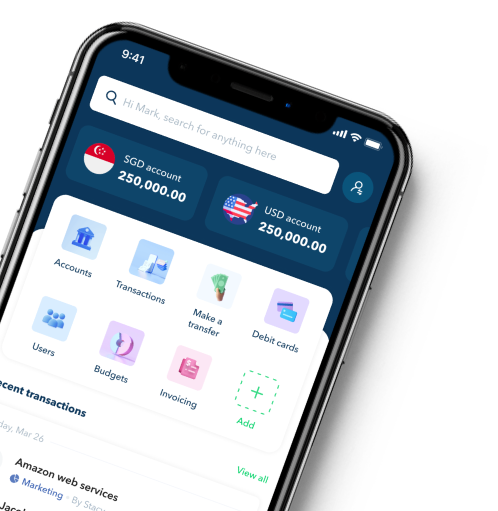

Benefits that scale as you do

*The return rates are based on 7-day performance as of 2nd Dec 2025. Returns are not guaranteed and are projected based on how much your money could potentially grow over a year. This investment product is non-capital guaranteed and is not a deposit product. All investments are subject to investment risks, including the risk that you may lose all or part of your principal invested amount. Past performance is not an indicator of future performance. View the fund's historical performance for USD here and SGD here. The monthly fee is charged per business legal entity (note: one business legal entity may have multiple accounts).

Compare features

Receive: From 0.34%

Instant conversion: From 0.22%

Send via SWIFT: USD $15 for SHA, USD $30 for OURS

worth up to USD $75/month

International via local and SWIFT: From SGD $0.30

Daily limit of USD $500 per card (or equivalent)

$4 per additional spend user/month

$4 per additional spend user/month

worth up to SGD $600 per month

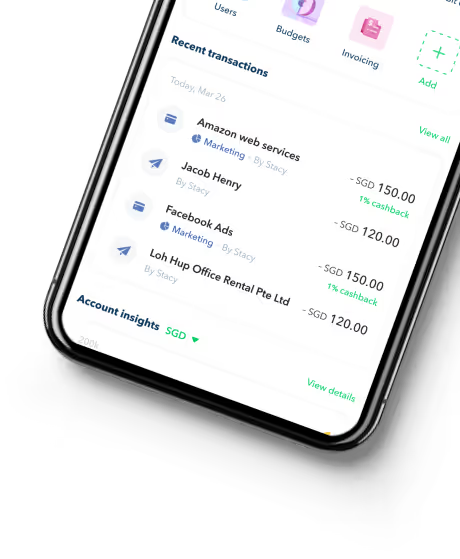

Hear it first from our customers

Gregory Van

CEO of Endowus

Holly Qian

Head of Finance, First Page Digital

William Chong

Finance Director at Glints

FAQs

Are there any setup fees?

No, Aspire does not charge any setup fees. Opening an account is completely free, making it easy for businesses to get started without upfront costs.

Any minimum balance or deposit required?

No, Aspire does not require a minimum balance or deposit. In addition, it’s part of our mission to ensure transparent pricing. You will always know how much you're charged before you pay.

Is Aspire safe?

Aspire adheres to strict compliance standards, use advanced encryption technology. Your funds are safeguarded with Tier 1 bank like DBS Singapore, in full compliance with the Payment Services Act 2019 (PSA) under the Monetary Authority of Singapore (MAS). Aspire Group also takes pride in partnering with global regulated financial institutions including Citibank, JPMorgan and Visa.

For more information, check out how Aspire works.

How long does it take to open an account?

Opening an Aspire account is quick and hassle-free. Our account opening can be as fast as 1 day, but note that the timeline varies depending on the nature of your business. Rest assured that your business registration is 100% online, and you will be allocated to an onboarding manager to support you fully during the registration process.