Take control of your company spend

Set budgets to track expenditure in real-time. Stay in control with spend limits. Delegate and scale your business with ease

.avif)

Trusted by 50,000+ modern businesses

Powerful budget management for complex organisations

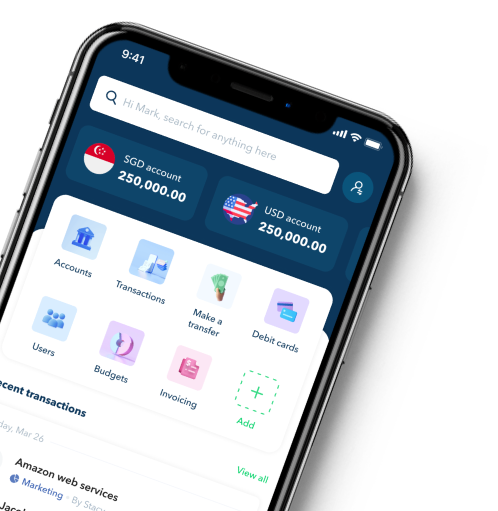

Track expenditure in real-time

Set up budgets and sub-budgets to gain real-time visibility on various categories of company spend

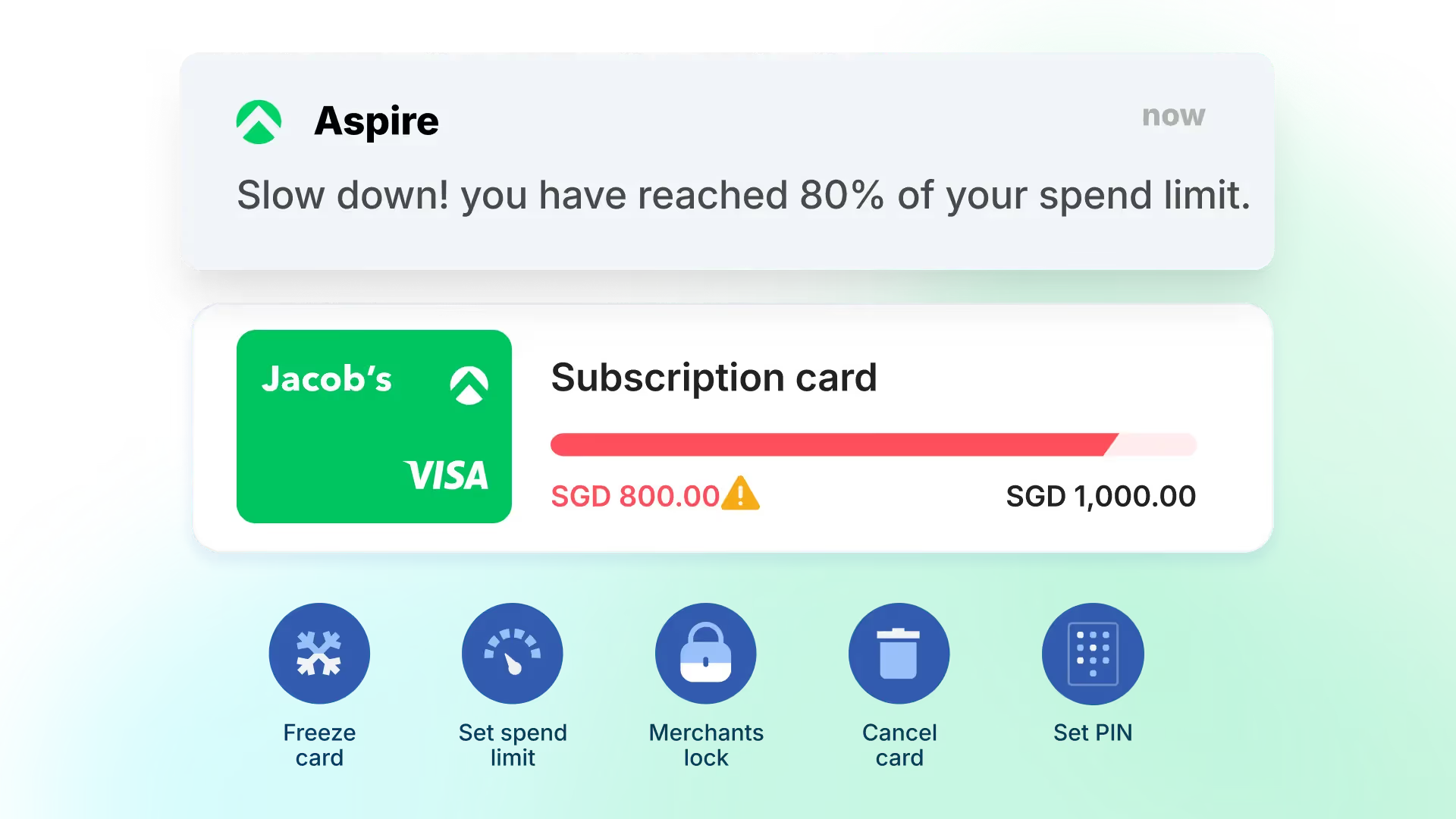

Get more control

Spend limits help you allocate and adhere to your plan. Get notified when you’re reaching your budget

Built for efficient teams

Deploy multi-level budgets across teams, designate budget owners, all while retaining complete visibility

Additional features to enforce your budgets

Set up budgets to gain real-time visibility

Get a bird’s eye view of your company’s spend in real-time, so you can make better business decisions, faster

Set spend limits to ensure you stick to your budget

No more overspending. We’ll even ping you to stay on track

If necessary, adjust budgets and limits with a couple of clicks

Build sub-budgets that work for your organisation

Craft comprehensive budgets for your entire organization, across different departments, geographies or programs

Set top level budgets for each quarter or department, then create sub budgets for more granular tracking

With up to 3 levels of sub-budgets, you can easily allocate and manage spend within budgets

Flexibly create, edit, or move multi-level budgets and spend limits anytime

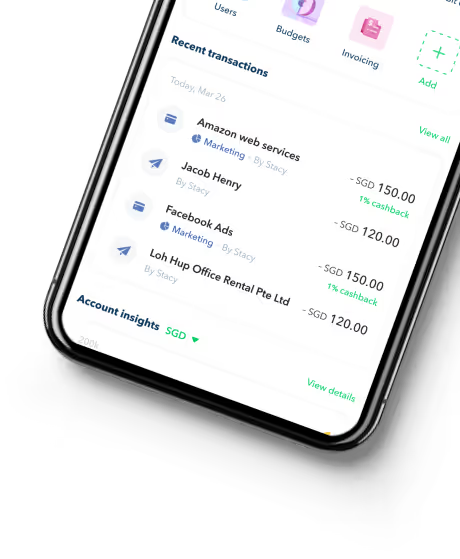

Say goodbye to manual paper chasing

Automated receipt reminders and a seamless uploading experience makes manual paper chasing a thing of the past

Access and easily search all your transaction records, all in one place

Integrated with your accounting software

Close your books twice as fast, with all transactions synced with major accounting software. When you're building in hyper-growth mode, there's no room for errors

Our advanced integrations include receipt attachments with text recognition, line items, and payment status updates

Hear it first from our customers

Gregory Van

CEO of Endowus

Holly Qian

Head of Finance, First Page Digital

William Chong

Finance Director at Glints

FAQs about Aspire budget

Which transactions can I cover under the Transfer Approval Policy?

- Transfer Approval Policy settings are applicable for outbound transfers including Bill payments, and transfers from Budgets. Claims transfers and Card payments are not covered.

- Transfer Approval Policy settings are applicable for the same currency transfers from SGD, IDR, and USD accounts and foreign currency transfers from SGD accounts.

- Transfer Approval Policy settings are NOT available for foreign currency transfers from USD accounts at the moment. This feature is coming soon!

Note: The Transfer Approval Policy feature is only available to select Beta users. To get early access to this feature, contact our customer care team at support@aspireapp.com

Who can view invoices on the Bills dashboard?

- Admins and Finance users can view all company invoices (including drafts)

- Budget Owners can view all invoices (including drafts) linked to their budget. They cannot view invoices linked to budgets where they are not the Budget Owner.

- Employees and Budget Members can only view invoices created by them. They cannot view invoices created by other users.

FAQs about budget

What do you mean by budget?

A budget is the estimation of upcoming expenses, which is then used to set spending limits.

What is budgeting?

Budgeting is the process of creating a budget, or the plan of how much money to spend where within a specified time duration

What is the purpose of budgeting?

The purpose of creating a budget is to set limits on how much money you are willing to spend within a given time period

What are the 4 methods of budgeting?

The most commonly used methods of budgeting are incremental, activity-based, value-based and zero-based budgeting.