Summary

As a business owner, you’ll need to take charge of your finances by ensuring everything is well-organised. One of the most effective ways to get your business finances in order is by keeping your business account separate from your personal one. It's basically making sure financial challenges, like debts or legal issues that affect your business, don't break through to your personal assets.

But What Exactly Is a Business Checking Account?

A checking account for a business is similar to a personal checking account. The main difference is that it'll be in your company's name, giving your payments a professional touch. A business checking account allows you to perform various financial tasks, including depositing and withdrawing funds, paying suppliers and employees, and managing your day-to-day financial activities.

In addition, business checking accounts come with extra perks designed just for businesses. Online banking, mobile banking, overdraft protection, and the option to request business cheques are all part of the package! These features are tailored to make managing your business finances effortless and convenient.

How Is a Business Checking Account Different From a Business Bank Account?

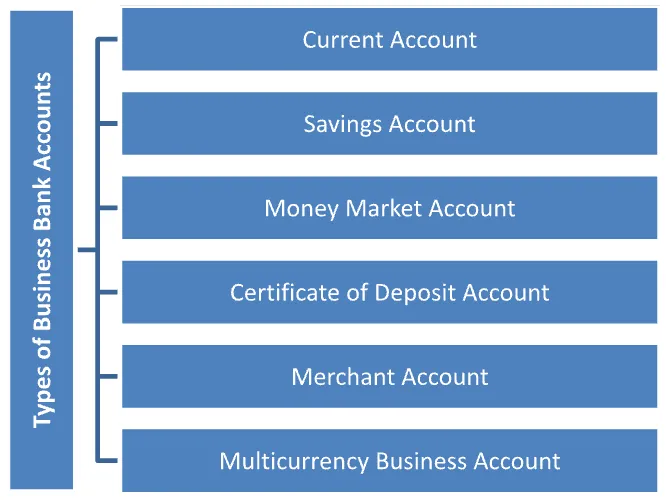

A business checking account is a type of account that falls under the category of a business bank account. Within this category, you'll find other accounts like business savings, merchant services accounts, multi-currency accounts, and cash management accounts, each serving specific needs.

Simply put, a business checking account is a subset of a business bank account that provides essential features for daily financial operations.

How Does a Business Checking Account Work?

Opening a business checking account is similar to getting a personal one. You'll need to provide essential details like your business's legal name, registration info, and tax ID or Employer Identification Number (EIN). Sometimes, you may have to submit proof of business ownership or articles of incorporation. Your account will be up and running once you've completed the required paperwork, submitted the necessary documents, and made an initial deposit.

After setting up your business checking account, you can manage the following types of transactions:

- Cheque writing: You can order cheques under your business name. So, when you pay someone, it comes from the business, not your personal account.

- Deposits: You can start making deposits once the account is ready. That includes money from sales, customer payments, and any other income your business makes.

- Expenses and Payments: You can use the account to pay for business operations like payments to suppliers, rent, utility bills, employee salaries, and other costs.

- Debit card payments: With your business checking account's debit card, you can make purchases for your business. Some banks even let you get employee debit cards, so your staff can buy items for the business, but only up to your limits.

- Banking Services: With a business checking account, you might gain access to additional banking perks, such as business loans, merchant services, or lines of credit, which can support the growth of your business.

- ACH transfers: You can use ACH transfers for paperless payments through your business checking account. Usually, banks don't charge for receiving these transfers, but there might be a monthly fee for sending payments to vendors or service providers.

- Wire transfers: These are for moving large sums of money between different bank accounts, either domestic or international. Be ready to pay a fee for outgoing wire transfers, but incoming ones might be free.

Overall, a business checking account can make managing your company finances a breeze and create exciting opportunities for your business growth.

Checking Account vs Savings Account: Understanding the Differences

Now, let's discuss the difference between a savings and checking account. Since they serve different purposes, knowing which one might work best for your business is essential.

A business checking account is specifically crafted to handle your everyday expenses. The money you deposit there is easily accessible, and many banks provide debit cards and cheques, making it convenient to withdraw cash whenever needed. This account is ideal for holding money you'll use soon, like paying your employees, purchasing office supplies, or covering utility bills. It's the money that won't be sitting idle for too long, as it's meant for day-to-day business operations.

However, if you want to earn interest on your money, a business savings account is the way to go. The primary appeal of this account is the annual percentage yield (APY). APY means your money can grow more significantly over time due to increased interest. Some banks even waive monthly fees if you maintain a certain minimum balance each month. This account is great for saving up for emergencies or planning for your business's future. They, however, have tighter restrictions on withdrawals.

Deciding between a business checking account or a savings account depends on how you intend to use your money. You might even find that both types of accounts suit your needs. If you go for both, getting them at the same bank can be helpful for easy fund transfers, but it's not mandatory. Not all banks are the same, so checking out the details like fees, minimum balances, and interest rates is essential.

Who Should Get a Business Checking Account?

In today's fast-paced world, where side hustles are common, you might wonder if a business checking account is necessary. However, managing your finances effectively is essential whether you run a full-fledged business or engage in part-time gigs to supplement your income.

A business checking account holds great significance, even for small business setups, to achieve financial stability and success. Having a business checking account for your small business is not just a convenience; it's a wise business practice that ensures financial transparency, legal compliance, and a solid foundation for growth and success.

It is important to note that the increasing popularity of online payments in Singapore is driving the Government's ambition to become cheque-free by 2025. In fact, by November 2023, banks in Singapore started charging for issuing Singapore dollar-denominated cheques. Other options such as PayNow, FAST, GIRO, ACH and Wire transfers are available to businesses. PayNow Corporate is one of the most popular ways to transfer, where you can receive instant payments securely without the need to share your bank account numbers. It also simplifies the payment process, enhancing cash flow management and reducing administrative tasks.

What Are the Reasons to Consider Getting a Business Checking Account?

There are several compelling reasons why it can benefit any small business owner:

- Streamlined Accounting: With a business checking account, you can easily track your business' cash flow, making it simpler to manage payments from customers, suppliers, and operating expenses. Some banks even offer integration tools to connect your business checking with bookkeeping or payroll software, making your life more accessible.

- Tax Simplification: A business checking account can make paying quarterly estimated taxes less of a headache, and it helps you clearly separate business and personal transactions for accurate tax filing.

- Professionalism and Credibility: A business checking account adds professionalism and credibility to your business. Your clients and customers will trust your business more when payments and transactions are made through an account with your business's name.

- Credit Access: A business bank account makes it easier to access credit when you need a loan.

- Protecting Assets: Keeping personal and business assets separate can protect your personal assets if your business faces legal issues or debt problems. A business checking account may offer limited liability protection, and merchant services can keep customer information secure.

- Preparing for Future Growth: Even if you don't plan for significant growth, having a business checking account opens doors to future options. It legitimises your business when applying for a business credit card or loan and makes handling financial accounting, including employee payroll, much smoother if your business grows.

How to Choose the Right Business Checking Account?

When looking for the proper business checking account, it's crucial to consider various factors impacting your business's financial well-being:

- Cash Deposit Limits: The amount of cash you can deposit into your business checking account each billing cycle may be limited by some banks. If your business frequently deals with cash transactions, finding an account with a sufficiently high cash deposit limit is essential. You can manage your finances efficiently without worrying about extra fees.

- Initial Deposit: As a small business with limited resources and funds, finding small business accounts with a reasonably low initial deposit is essential. It can help any small business get started with a business account without putting too much strain on your finances.

- Transaction Limits: Look for banks that impose transaction limits on your business checking account. They might restrict the number of transactions you can process monthly, including teller deposits, ATM deposits, cheques, and electronic debits and credits. Understanding these limitations is essential to ensure smooth financial operations for your business.

- Fees: Business checking accounts often come with monthly maintenance fees. Review the bank's minimum balance and transaction requirements to avoid unexpected expenses. By meeting these requirements, you can avoid unnecessary fees and keep your costs in check.

- Bundled Services: Some banks offer enticing benefits by providing fee waivers for a business checking account when you sign up for additional services like merchant services or business credit cards. These bundled services can add value and convenience, making them worth considering when choosing your account.

- Interest: While business checking accounts aren't typically known for offering high-interest rates, some accounts provide interest on your balance. Take a closer look at the interest rates and calculate if they outweigh any associated fees. This way, you can assess if earning interest on your balance is valuable for your business.

- Cashbacks: Many small business accounts include free business debit cards with cashback or rebate offers for both SGD and foreign currency transactions. These cashback rewards can be an excellent way to increase your earnings and get a little something back on your business expenses.

- Account Features: Being an entrepreneur means things move speedily. Choosing a checking account with features such as an online expense tracker or mobile application can help you to stay in the loop with your transactions.Other things SME owners lookout for include possible partnerships and benefits that they’ll have access to if they do choose a specific checking account.

- Branch Banking and ATMs: Although most transactions can be done online, there might be times when you require to deal in cash. If you foresee yourself having to withdraw cash frequently, the number of physical bank outlets or ATMs might be something you want to look out for in a checking account.

Now that we've discussed what a checking account is, let's dive into how to open a business checking account.

What are the available checking accounts for businesses in Singapore?

Here’s a quick look at a few of the most popular checking accounts in Singapore:

1. Aspire

Linked to the Aspire Visa Debit Card, Aspire’s Business Account is the top choice for SMEs in Singapore.

With no minimum deposit, monthly fees or account opening fees, this business account is perfect for startup and SME owners looking for a solution to their business finance problems.

Opening a business account with Aspire comes with the Aspire Visa Card, which offers 1% cashback on marketing and Saas spend—perfect for companies obsessed with running ads.

Manage your account through the Aspire app, which gives you real-time updates on incoming funds. You’ll also get to enjoy easy accounting processes through Aspire’s Xero integration.

2. OCBC

OCBC’s Business Growth Account is another popular checking account amongst business owners in Singapore. Tied to the OCBC Business Debit Card, account holders will have access to more that 1,200 ATMs islandwide.

This account ranks high with no initial deposits and a low monthly fee of just S$10. The OCBC Business Debit Card connected to the account offers 0.2% rebate on all local currency spend, and 0.5% on foreign currency spend, making it an ideal choice if you’re toggling between local and international dealings.

3. DBS

Last but not least, we have the DBS Business Digital Account. Similar to both the Aspire and OCBC Account, this account does not have any minimum deposits. However, it does come with a monthly account fee of S$18.

Account holders can apply for the Visa Business Advance Debit Card, which offers 0.3% cash rebates on all charges. Cardholders also have access to complimentary travel accident insurance.

How Do You Open a Business Checking Account?

Once you've made your decision on the bank where you want to open your business checking account, here are two methods to apply:

- Apply Online:

Some banks offer 1-day express account opening services online, making it super convenient for business owners like you. You can open business bank accounts in Singapore like OCBC Business Growth Account, DBS Business Digital Account, UOB eBusiness Account, or a Multi-Currency Business Account with Aspire right from the comfort of your computer.

If you're eligible for an online application, just fill out the form on the bank's website, and voilà! Your business account will be ready in a day.

To qualify, you typically need to be a single director (the only shareholder and authorised signatory) or a sole proprietor and already have a personal account with that bank. Just have your Accounting and Corporate Regulatory Authority (ACRA) business registration number and personal bank details (like your PIN) handy. Depending on the bank, you might need to submit some additional documents too.

- Go to the Bank:

Some banks may require you (the director) and other authorised signatories to be physically present at the bank to open the account.

If you prefer the traditional way, go directly to the bank and inquire about their requirements.

Usually, you'll need to submit documents like:

- Bank Account Application Form,

- Board resolution with signatory appointment details

- Certified copies of NRIC/Passport of directors, authorised signatories (including residential address info)

- ACRA Business Profile Search

- Certificate of company incorporation

How Long Does It Take to Open a Business Checking Account?

It can vary. Depending on bank verification, some get it done in a day, and others may take a few weeks. Ensure you have proper documentation and consider being present during setup to avoid delays. Get your paperwork ready, and you're good to go!

How Many Business Checking Accounts Should a Business Have?

The number of business checking accounts you should have depends on your specific needs. Consider the following reasons why some small business owners choose to have more than one business checking account:

- Business Structure: If you manage multiple business entities or operate distinct lines of business, maintaining separate checking accounts for each can be a valuable strategy to keep your finances well-organised and streamline your accounting processes.

- Expense Segregation: Keeping day-to-day expenses separate from longer-term costs, such as payroll and quarterly taxes, may benefit your business.

- Financial Management: While there are advantages to maintaining separate accounts, it's crucial to strike a balance to avoid unnecessary complications. Take the time to assess whether you have the mental capacity and enough workforce to manage all the accounts effectively.

- Tracking: Having multiple accounts can help you better track your operating income and expenses, making it easier to understand and prepare for cyclical patterns in your business.

- Avoiding Account Limits: With multiple accounts, you can handle your transactions and deposits without hitting the monthly maximums of each account.

- Earning Interest: If you have funds that you don't need for day-to-day operations, you can explore interest-bearing accounts to make your money work for you.

- Banking Relationships: Take the time to assess the offerings and benefits provided by various banks. You may find that some banks offer incentives or unique benefits for holding multiple accounts with them.

Discover the Benefits of Aspire’s Multi-Currency Business Account

If you're looking for the best banking solution for your small business, try Aspire's Business Account.

Here are some key features you'll enjoy:

- Speedy Process: Open an account in just five minutes, saving you time and hassle.

- Convenient Online Operation: Easily open, operate, and manage your account online for added accessibility.

- Multi-Currency Flexibility: Avoid unnecessary fees and save money with free local SGD, USD, and IDR transfers. Send money globally and convert to more than 30 currencies at mid-market rates, ensuring low and transparent fees, so you only pay for what's essential.

- Global Payments: Enjoy great FX rates for foreign currency transactions.

- Competitive Fees: Enjoy competitive transfer fees and market-leading foreign exchange rates to optimise your financial transactions.

- Transparent Pricing: Aspire offers clear and straightforward pricing with no hidden fees. At $0/month, you get everything you need to scale your business globally from day one.

- Affordable Pricing: Aspire offers two versions of its multi-currency accounts tailored for small and growing businesses. You can choose the free Business Account Lite or the Business Account PRO at a reasonable starting price.

- Easy Subsidiary Management: Manage all your subsidiaries on a single platform with effortless switching between business entities.

- Integration with Accounting Software: Enjoy smooth integration with your accounting software, streamlining your financial management.

- Cashback: Get rewarded with unlimited 1% cashback on card spend for digital marketing and subscriptions.

- Assistance Registering: Aspire offers the advantage of getting assistance registering your Singapore business at a favourable price while receiving an all-in-one business account.

Embrace the convenience and efficiency of Aspire's Business Account to empower your business's financial growth.

%201.webp)

.webp)