Summary

Did you know that the average company in Singapore spends $20,000 on overseas payments each year?

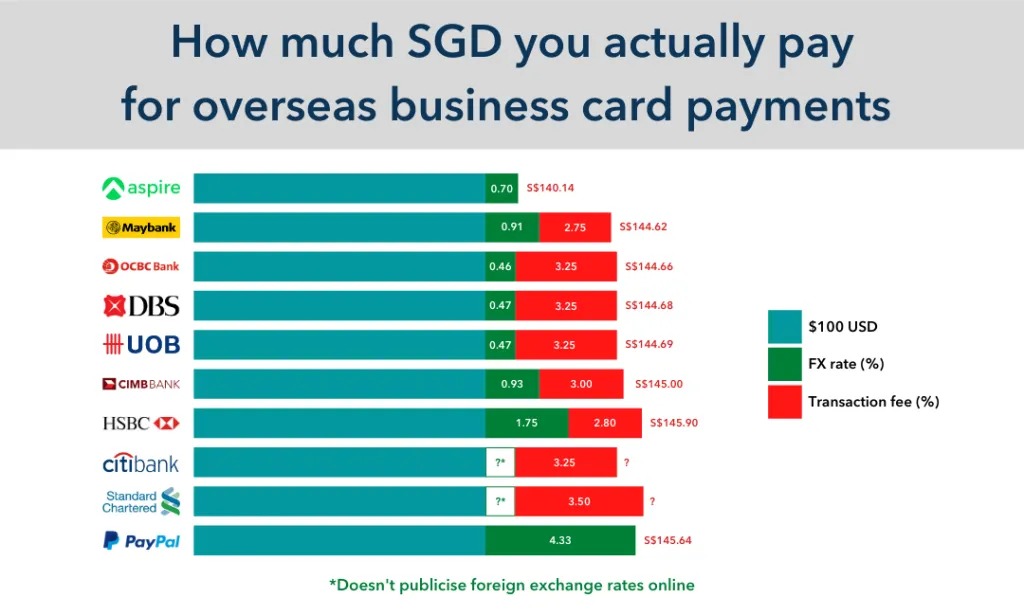

On average (excluding Aspire), that translates to $5,280 lost per company per year due to FX markups and fees. How did we come to this conclusion?

Methodology

Our team researched on corporate card comparison with different business accounts in Singapore.

– $100 usd across 4 banks

– amount in SGD

The result of the research is as shown in the figure below. How much customers are being charged for an overseas card payment of 100 USD using different business accounts in Singapore:

Findings

We studied that most actually banks charge less on their exchange rate, which is then used to be the main unique selling point when communicating with customers.

However, some customers tend to overlook the other fees, such as transaction and administration fees, that come with the total cost, which is where most banks charge more than the exchange rate.

On average, that’s how companies end up losing $5,280 a year just to FX markups and fees.

There's a better way

As a business owner, we have the right to know how much exactly we are going to pay before purchasing a product or service. Banks have long sought to take advantage of the lack of transparency associated with a foreign exchange purchase, slapping on high hidden fees and margins that they keep. In today’s increasingly global world, businesses are global by nature and are expected to have a portion of their monthly expenditures expensed in a foreign currency.

The good news is that there’s a better way. At Aspire, we aim to help businesses like ourselves save money from hidden and costly fees. We charge zero fx fees, and a low transparent markup of 0.7% from the real exchange rate – yes, the rate you see on Google.

On top of that, we provide digital businesses with cashback of up to 1% on marketing and Software-As-A-Service (SaaS) spend. Cashback payouts will be amde monthly in SGD, credited directly into your Aspire Account.

Conclusion

We found out that most of the institutions are transparent with their exchange rate and transaction fees (inclusive of administration fees), which is key to building trust with customers.

There are a lot of factors in deciding which account is the best for your business. Of course, there are key advantages to each institution. However, if your business does a lot of international transactions, you want to consider the cheapest alternatives as your main account to prevent unnecessary expenses from costly fees.

Getting an Aspire Card is free with no minimum spend, or monthly fees. You’ll enjoy no FX fees, and can make payments with confidence at a low transparent rate, and earn cashback while you’re at it.

Apply and start saving today: aspireapp.com

%201.webp)

.webp)