Summary

Today's digital marketing agencies and teams navigate through a plethora of digital ad platforms, ranging from global giants like Google, Facebook, TikTok, and LinkedIn to regional players such as Baidu, WeChat, Line, Naver, and more.

These platforms offer a range of options for setting budget limits on your advertising expenditure, including daily budgets, campaign budgets, account budgets, and lifetime budgets. This flexibility allows marketers to tailor their ad spending strategies to meet specific objectives and target audiences effectively.

Whether it's a solo marketer juggling a daily budget for multiple ad campaigns across various platforms for a single business, or a dynamic marketing team or agency handling ad campaigns on behalf of external clients, the importance of setting ad budgets cannot be overstressed. It is a crucial element in ensuring that ad spending stays within the assigned budgets from your management.

However, despite the best intentions, ad budget overspending remains a common occurrence. There are typically two primary reasons for this:

1. Human Errors

Mistakes happen, whether it's an inexperienced team member or an over-worked expert who accidentally inputs an extra zero, setting a campaign budget to $1000 instead of $100, or forgetting to deactivate ad campaigns. With the complexity of managing numerous campaigns on different ad platforms, such errors are not uncommon.

2. Changes in Budgets Due to Seasonality

Ad budgets often fluctuate due to seasonal events like Christmas, Black Friday, Singles Day, and Valentine's Day. The sheer traffic volume of campaigns, especially across multiple platforms, can lead to oversights in resetting ad budget limits or inadvertently prolonging promotional campaigns beyond their intended duration.

How can you prevent overspending?

To maximize your return on ad spend (ROAS), it's crucial to have a solid strategy in place to make money and prevent overspending. Here are some tips to help you stay on track:

Set clear advertising goals and KPIs

Before launching any ad campaigns, establish clear goals and key performance indicators (KPIs) that align ineffective campaigns with your overall marketing objectives. This will help you measure the success of your campaigns and identify areas where you may be overspending

Conduct thorough audience research

Understand your target audience's behaviors, interests, and preferences. This will allow you to create highly targeted ad campaigns that resonate with your desired audience, reducing the likelihood of wasted ad spend on irrelevant impressions

Leverage ad platform analytics

Most ad platforms provide robust analytics tools that can help you monitor your ad spend and performance. Regularly review metrics such as click-through rates, conversion rates, and cost per acquisition to identify underperforming campaigns and reallocate your budget accordingly

Set appropriate bid amounts

On platforms such as Google Ads, bidding too high on keywords or ad placements can quickly drain your budget. Use historical data and industry benchmarks to set appropriate bid amounts that align with your ROAS goals

Set limits or on the ad platform

Establishing budget constraints on the ad platforms serves as the initial line of defense. Whether applied to campaigns, accounts, or specific time frames, this practice is standard among digital marketers.

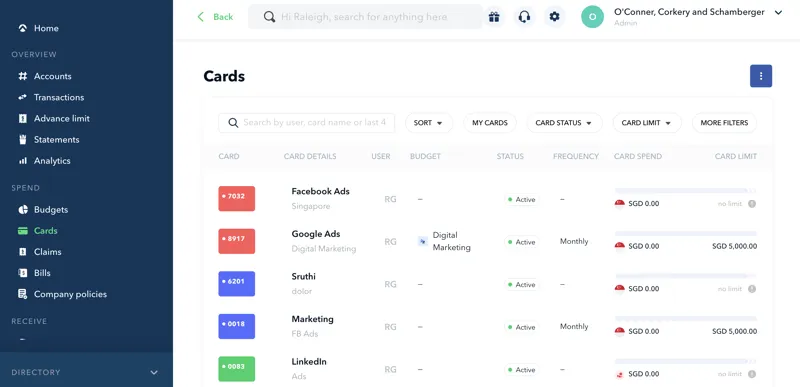

Set limits on the virtual card

Enhance your protection against accidental overspending on digital ads by utilizing card limit controls and merchant locks for platform ad billing. By setting a spending limit on the card (e.g. $1000) and restricting its use to selected merchants, you and your management gain an added layer of defense against excessive charges and get real-time visibility into spending.

Delegate ad campaigns and budget management confidently, knowing you have a secondary level of advertising budget to control with your cards. As a bonus, enjoy the benefit of a consolidated view of ad spend across all digital platforms on the aspire platform, doubling your protection without doubling your workload.

Aspire helps your marketing agency streamline ad spend for optimal results

In the ever-evolving landscape of digital marketing, the need for a comprehensive dashboard to monitor ad budget and spending is paramount. Look no further than Aspire, an all-in-one financial solutions provider that caters specifically to the unique needs of marketing agencies. Aspire offers a robust dashboard designed to empower marketing professionals with real-time insights into their ad campaigns. With customizable features and user-friendly interfaces, Aspire ensures that your agency can efficiently track and optimize ad spend, allowing for strategic decision-making and maximizing the return on investment.

Loop Marketing Group utilizes Aspire's corporate cards in their day-to-day

Furthermore, when it comes to staying one step ahead in the competitive realm of marketing, Loop Marketing Group relies on Aspire to power its innovative approach to ad payments.

Before Aspire, they had to make do with sharing one card across teams servicing multiple clients. Not only was this a security concern, but it also gave them no visibility of spend on a client/ project level. After switching to Aspire, our cutting-edge corporate cards provide Loop Marketing Group with unparalleled control and flexibility in managing ad expenses and have 1 card per client and per project.

We cover a more in-depth case study on how Loop Marketing Group stays one step ahead of its processes, powered by Aspire's corporate cards.

Subscribe to our newsletter to get the latest on tips on how you can streamline your finances.

Keen to know how Aspire can help you manage your expenses, prevent overspending, and streamline your finance processes? Talk to our sales today or get started for free.

%201.webp)

.webp)