Summary

In our previous article, we discussed what FinTech means for ecommerce: a world of opportunity. While we've covered the big-picture trends, it's time to get down to the nitty-gritty. Here are the FinTech innovations that will help ecommerce sellers boost their online sales, and fast.

Ecommerce players today face a different set of challenges than traditional business owners do. Digitally-savvy customers expect more than ever from their online transactions, demanding speed and convenience when they're shopping online. What's more, ecommerce sellers now have online sales seasons to grapple with. Which, as a result, produce massive revenue fluctuations over the financial year.

Psst… you might also be interested in:

What FinTech Means for Ecommerce

What We Learned at Innovfest Unbound 2019

Different problems demand different solutions. Online shop owners in popular marketplaces, such as Shopee or Lazada, need to capitalise on the digital platforms they're hosted on. But how?

Thankfully, there are a whole host of financial innovations that can support the growth of your ecommerce business. Here's how you can boost your online sales using payment and lending FinTech innovations...

Payment Innovation

As we've previously covered, payment innovation is benefiting both the demand and supply side. In this article, we're spotlighting technology that e-commerce sellers can use to bring customers to their online stores, and keep them there.

Digital Wallets

A system that securely stores users' payment information and passwords for numerous payment methods and websites.

Investopedia

Digital wallets allow users to make payments online, swiftly and seamlessly. There is a link between bank accounts of individual users with their digital wallet. Moreover, user credentials are securely stored and verified during transactions.

Most digital wallets offer an integration with your ecommerce platform or website, so buyers don't have to toggle between tabs or applications just to make payment. This provides less friction when buyers would have to open a separate banking app. Another benefit of using digital wallets is lower transaction cost. Many digital wallets are still at the phase of acquiring users. Mostly willing to provide their services at a very low cost or even free of charge.

Integrated Payment Gateway

An e-commerce system that helps support modern retail or other types of sales of products and services, over the Internet or at brick-and-mortar stores.

Techopedia

An integrated payment gateway can give your online shop multiple payment options to cover all consumer bases. There are many ways to segment your users; the most popular categorization is by region. If you opt for regional segmentation, consider providing these 3 payment options:

- Bank transfer should be the most used by users who live in cities and have access to banking accounts.

- Credit card is usually the best option for buyers who are abroad because VISA and Mastercard are common everywhere in the world.

- Offline channels are also the most common payment options available to buyers in less developed or less digital markets.

Remember not to isolate buyers without easy access to traditional financial institutions. For instance, if your product is sold in brick-and-mortar mini marts, make sure you have a cash payment option available! The good news is that there are payment gateways that have integrated all the above options, so you just need to connect with one of them.

Instalments or Pay-Later

Another payment innovation that is very much appreciated by e-commerce buyers is the instalment or pay-later option. This is especially popular among people with lower incomes, so they can still make their online purchases without sacrificing their daily lifestyle.

Partnering with online credit companies in your country can provide instalment or pay-later option. Their systems should be able to be integrated seamlessly, and they will handle all operational matters including background checking during the application, as well as bad debt collection. These companies usually have fast and easy application processes, but relatively higher interest rate.

Lending Innovation

Another challenge faced by ecommerce sellers is managing fluctuations in online sales revenue over the financial year. Besides the traditional calendar holidays like Christmas and Chinese New Year, online merchants also have to contend with digital sales seasons like Single's Day (11.11) and Cyber Monday.

Of course, it's definitely a good thing to see demand skyrocketing during these periods, but you can't boost your online sales at these crucial junctures without goods to sell. That means more stock— and more capital to purchase that stock. While these seasonal patterns can produce huge fluctuations, they aren't completely unpredictable. You can expect the unexpected by utilizing FinTech lending innovations.

Revolving Lines of Credit

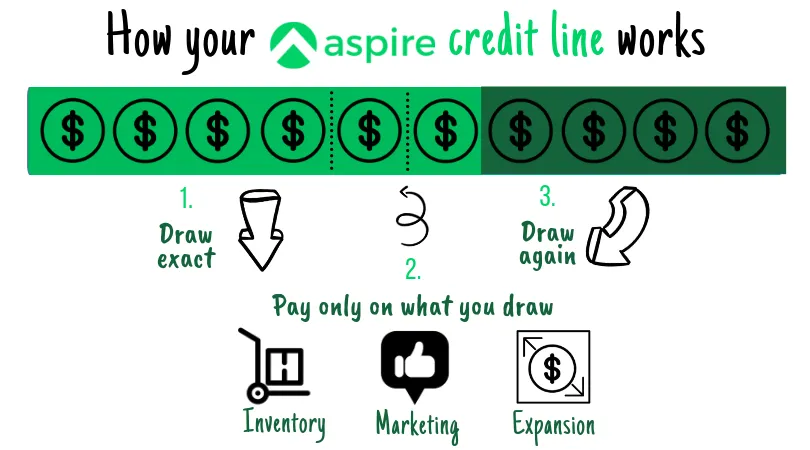

A merchant offering a certain amount of always available credit to an individual or corporation for an undetermined amount of time.

CreditCards.com

Having a ready line of credit means you can withdraw funds from your limit at any time— an ideal financing solution for those tricky seasonal fluctuations.

You will be able to withdraw any amount from your limit after your profile has a credit line approval. Some online lenders can offer disbursements from your line of credit in the form of unsecured loans. Your credit line is restored to its original limit so you can draw again when the next peak period swings by once you repay your withdrawn funds plus the agreed-upon interest rate.

Invoice Financing

[A form of borrowing that] allows businesses to obtain loans based on the value of payments their customers owe.

ValueChampion

Sometimes ecommerce players also have to deal with receivables and invoices— for instance, when they are selling in bulk to other parties, like distributors or B2C firms. Invoice financing allows you to get paid first from a third-party financial institution if the due time for the receivable payment is still long-off and you already need cash to get your stock ready for a peak season.

There are various forms of invoice financing, but here's the basic idea: You register the paying party, and that party just has to validate that they will indeed pay you for the receivables in the future. The financial institution will then give you the cash upfront, and take over the responsibility of collecting payment from the other party in the future.

In a nutshell

We've covered how merchants can boost their online sales using FinTech to facilitate new payment and lending services. The really good news?

Sellers on ecommerce platforms can now make doubly good use of these innovations. Aspire's integrations with Lazada and Shopify help us serve you better and faster. We use your digital data points to speed up the risk assessment process: instead of having to wait for days with traditional lenders, you'll get access to a credit line and invoice financing in hours... so you can boost your online sales today.

Psst… you might also be interested in:

%201.webp)

.webp)