Summary

After an exciting first half of 2024, it's the perfect time for midyear reviews and fresh strategies. We’re thrilled to bring you a load of new features and enhancements to help your business achieve its goals for the rest of the year. Curious to see what’s new?

Explore our July highlights here 👇

Business Account

FX Payout APIs

Enabling payouts via a web app is manual, time-consuming, and error-prone. With our FX payout APIs, you can now programmatically disburse money worldwide from USD or SGD to any currency of your choice.

Free Aspire-to-Aspire Transfers

Why bother with slow transfers and expensive SWIFT fees? Same currency and FX transfers between Aspire accounts are instant with zero transaction fees. Start sending money to other Aspire accounts instantly. Applicable to USD, SGD, EUR, and GBP accounts.

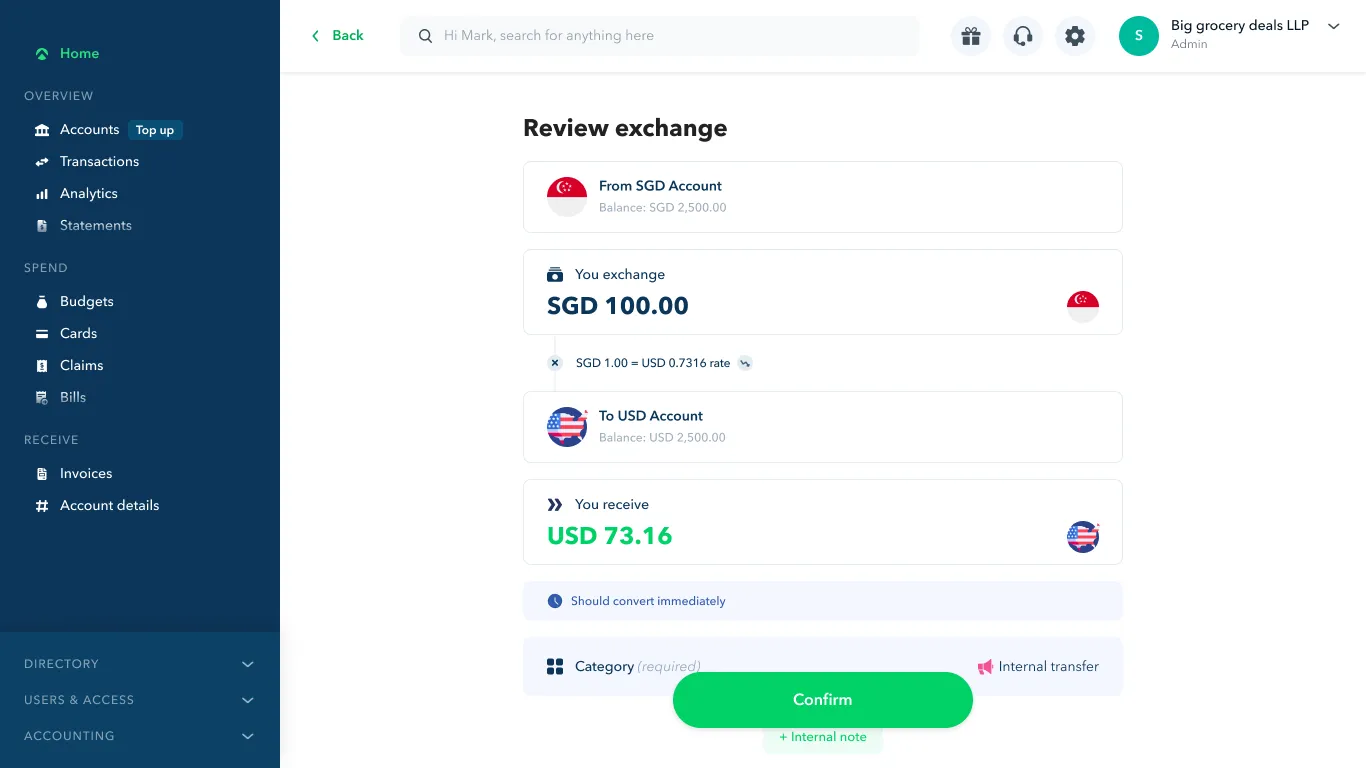

Instant FX Conversions

It used to take 2 to 3 days to convert funds within your Aspire balance. Now, you can transfer money from one currency account to another instantly and at no additional cost. Applicable to conversions between SGD, USD, EUR, and GBP accounts.

Recipient Validation

Incorrect recipient information is among the leading causes of failed transactions. We’ve partnered with LexisNexis® Risk Solutions to create a validation process that helps minimise potential errors. Our recipient validation function will prevent you from accidentally creating a recipient if you input invalid or incorrect details.

Notification Management Revamp

We’re streamlining notifications to make way for a cleaner UX. Now, you can reorganise notifications based on more relevant categories like features or usage. Also, you can now set minimum amount thresholds to trigger notifications, so you’re always up to speed on card and account transfers.

Expense Management

Card APIs

We’re pleased to release Card Management API beta to help supercharge your financial operations! With the ability to create single-use virtual cards, paying suppliers is now easier than ever. Create and manage cards, set spend controls, and freeze, or block cards — all in real-time for seamless and secure spending.

In-App Fraud Reporting

Nothing is more distressing than the fear of fraud. We’ve enabled Fraud reporting from within the app, so you can now raise card transaction disputes or report fraud immediately. The process is also automated, so there’s no hassle with dispute forms or tickets. Once you’ve submitted the details on the app, the case is assigned to the Card Ops team for action.

HK Physical Cards

Aspire physical cards have arrived in Hong Kong! Clients in Hong Kong can now use their physical cards for offline purchases and ATM withdrawals inside and outside Hong Kong. A fee of HKD 118 applies for each physical card.

Failed Card Creation Update

For greater clarity and transparency, we’re improving the Card Creation process to include clear and timely updates. Whether your card is in the Processing or Failed stage, you’ll receive periodic messages notifying you of its status and outcome. In addition, we’ve shortened the activation process for new card creations to reduce wait times.

Monthly Analytics Digest

.webp)

AI is a powerful tool that businesses can use to stay ahead of the curve. Each month, in addition to your bank statement, we’ll send an Analytics Digest that provides valuable data and insights into your finances. You can easily track KPIs like the amount of cashback earned, your inflows and outflows, outstanding bills and receivables, and other metrics to better optimise your cash flow.

Payment Solutions

Advance settlement Improvements

Advance settlement is now available to all clients. We’ve also introduced more competitive pricing and withdrawal options. Previously, advance settlement withdrawals were limited to Mandiri Bank accounts. Now, you can withdraw to multiple banks. In addition, you may enjoy lower fees depending on the paymode, like eWallets, QRIS, etc.

Delayed capture API

The Delayed Capture API allows merchants to authorise payment at the time of sale and receive the funds later. This rollout will cater to clients in industries like hospitality and e-commerce. It’s a common business practice to authorise the transaction when taking pre-bookings or orders, and only debit the customers’ funds after providing services.

User Access

Intercom Help Center

We’ve migrated to Intercom Help Center as the primary support hub for our users. This new help center is fully integrated with chat support, allowing an in-app preview of any article within the chat window. It also serves as an effective self-help portal, offering better-categorised articles and multi-language support. Try it today.

Passkeys for Login

While Aspire boasts some of the best-in-class security practices in the industry, we’re constantly looking to enhance your safety. We’re ditching Passwords for Passkeys on both our web platform and app. With built-in 2-factor authentication, you can now enjoy a faster, more secure, and password-less login.

Homepage Revamp

The Aspire app homepage is sporting a sleek new look. Gone is the crowded UI. We’ve optimised the space, eliminated redundant menus, and updated icons for smoother navigation. This way, you can focus on the things that matter most.

If you’re interested in automating your financial processes and manage your expenses better, talk to our sales team for more information.

.webp)

%201.webp)

.webp)