Summary

If you are a business operating in Singapore that makes more than S$1 million in revenue, you will be required to register your business for Goods and Services Tax (GST). GST registration is mandatory for most companies operating beyond this threshold in the country. However, if you are a company that deals in zero supply goods or tax-exempt goods, you do not have to be GST registered. Nevertheless, you can still choose to register for GST voluntarily.

What is GST?

The Goods and Services Tax or GST in Singapore is an indirect consumption tax levied on goods and services produced in Singapore. The Inland Revenue Authority of Singapore (IRAS) is the collecting authority for GST-registered companies. GST is charged on the final product, meaning that consumers are the ones who have to bear the tax. GST-registered companies simply act as the collecting agent who pays the tax to IRAS.

Who should register for GST?

Any business in Singapore that makes a taxable revenue of over S$1 million in a year must register for GST. However, if you make zero supplies, tax-exempt or deemed goods, you will not require GST registration even if your taxable revenues exceed S$1 million.

However, you could still choose to register for GST voluntarily because of the numerous advantages that it provides. Read here.

Stepwise Process for GST Registration for Singapore Companies

When you apply for IRAS GST registration, there are certain steps you need to complete to get your GST registration number.

1. Identify your type of GST registration in Singapore

Before going to the MyTax portal to register for GST, you must determine the type of registration you are going for. Do you have to register for GST mandatorily? Or are you opting for voluntary GST registration? If you produce taxable goods and services in the country and your business revenue exceeds S$1 million, you must apply for GST registration. Suppose you are a small business that wants to claim input tax credits or become a GST registered company for its benefits. In that case, you can apply under the voluntary GST registration process. You must know the category under which you are applying before starting the process.

It is also advised for companies to register and complete the e-learning course on GST basics. It provides the knowledge required for registering for GST, helps you identify which category you fall into, and explains the process of filing GST returns. For companies that are voluntarily registering for GST, it is mandatory to complete the e-learning course and pass the quiz that accompanies it.

However, you can skip the course if:

- The company director, proprietor, partner or trustee has prior experience with managing other GST-registered businesses

- You have appointed an Accredited Tax Adviser or Accredited Tax Practitioner to prepare and file your GST returns

- Your company plans to register under the Overseas Vendor Simplified Pay-Only Registration Regime.

2. Submit your GST registration application

Once you have determined your GST registration type and completed the e-learning course, you can register for GST on the MyTax portal. You have to be authorized in the Corppass to access the GST registration service on the portal digitally. Singapore Corporate Access (or Corppass) is the authorization system for all businesses to complete any corporate transactions with the government online. If you do not have a Corppass account, you must create one.

Once you have Corppass access, you will need to submit electronic copies of supporting documents before the application process ends. The list of documents are elaborated in the section below. If you are doing voluntary IRAS GST registration, then you must sign up for GIRO to make your GST payments and get refunds. You will have to send the original copy of the completed GIRO registration form to 55 Newton Road Singapore 307987 once you submit your GST registration in Singapore online. Make sure you submit a complete application, mentioning all the details about your business and GST-related queries. Attach the GIRO registration if you are a voluntary applicant. Otherwise, your application may be considered withdrawn.

3. Wait for GST registration to process

After submitting the GST registration to IRAS, you will have to wait for the authorities to process your application. This can take up to 10 working days. The IRAS may request additional documents or information to complete the process. Submit all of this duly to get your GST registration number on time.

If you are applying voluntarily to become a GST registered company, then your GIRO form will need to be approved by your bank for GST registration. This may take up to three weeks. In most cases, the bank will directly inform you if your GIRO application has been processed. If your application is declined, you will also be notified. You will then have to approach your bank for further information. The IRAS will not provide details regarding GIRO or send you a notification for acceptance or rejection of your GIRO application.

4. Receive your GST registration number

If your GST registration application is successful, you will get a notification to your registered address about the success of your application. The letter will typically contain the following details:

- Your GST registration number, which you can then print on all your invoices, credit notes, tax invoices, receipts, etc.

- The effective date of GST registration. You can start charging your customers GST only after this date.

You may also receive SMS notifications or emails if you have provided a registered mobile number and email address.

What if you are late in applying?

Suppose you are a business for which it is mandatory to register for GST in Singapore. In that case, your effective registration date will be backdated to the correct date when you should have registered for GST or become liable to pay GST.

If you register voluntarily, there will be no backdating. You will be registered for GST within two weeks of receiving the approval letter.

Documents for GST registration requirements

When you apply for IRAS GST registration, you must submit the following documents in soft copy along with your GST registration application:

Section A Documents

1. Business constitution

If you are a business with a Unique Entity Number (UEN), your requirements will be as follows, depending on the kind of business that you are:

- As a company/ Limited Liability Partnership, you will need to submit the latest updated copy of your ACRA business profile

- Partnerships, Limited Liability Partnerships and Joint Ventures will also have to submit their latest ACRA business profile along with the appointment of the local agent details, if applicable

- As a Sole Proprietor, you will need to submit your latest ACRA business profile and appointment of local agent details, if applicable

- Other organizations such as charities or management corporations will have to submit certification of registration or constitution as given by the relevant agency

- You can make use of Aspire's Kickstart product to register with ACRA.

If your business does not have a UEN, then you must submit the following:

- A Joint Venture must submit partnership agreements, joint venture contracts, deeds, letters of undertaking or any other document that provides evidence of its constitution, rules and activities. You must also submit Form GST F3 and appointment of a local agent, if applicable

- An Incorporated Overseas Entity must submit a certificate of incorporation that is translated into English and is notarized as well as the appointment of the local agent

- Trusts and funds must submit their agreement, contract, deed or any other document supporting the registration

2. Business activities

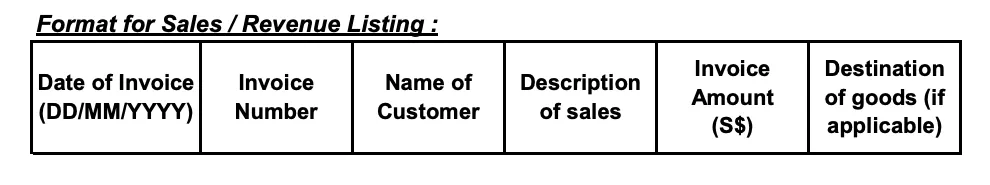

- You will need to submit sales or revenue details for the previous two months in the following format:

- Copies of three recent invoices issued to customers, including shipping documents or all invoices if you have issued less than three

- You will also need to submit a list of your business purchases for the previous two months in the following format:

- Along with that, you will need to submit copies of three recent purchase/suppliers' invoices, including shipping documents or all invoices if you have made less than three business purchases, and one copy of a recent overseas invoice from your supplier, if applicable

3. Future sales and purchases

You must provide a complete and total description of your business plan, including details such as what products or services your business will be selling or providing, how they will be purchased and delivered, how your business will be financed, the complete details of your potential or confirmed suppliers and a list of your potential or confirmed customers. You are required only to submit 20 of these. If the list exceeds 20 suppliers or customers, it will suffice to submit just 20.

4. License or permit

You will also need to submit a copy of the license, permit or approval from the relevant authorities to operate your business.

5. Business transfer

Suppose you have purchased or taken over the business from another GST registered company. In that case, you will need to submit a copy of the agreement or any other documents supporting the business transfer.

6. Type of registration

If you have to register for GST mandatorily, you will be required to submit the following documents:

- A copy of the GST Registration Liability page of the GST Registration Calculator before 2019 if your taxable supplies exceeded S$1 million before 2019

- A copy of documents supporting that your forecasted taxable supplies exceed S$1 million in the next 12 months

- A copy of the documents supporting that your forecasted imported services will exceed $1 million in the next 12 months

If you are registering for GST voluntarily, you will need to submit:

- GIRO Application Form within five days of GST registration application to the concerned address

- Acknowledgement from the e-learning course "Overview of GST"

Section B Documents

If the following documents are available, you must submit these also for GST registration:

- A copy of the latest Profit and Loss account, including reports and notes to accounts. It is okay if it is not audited.

- A copy of the rental agreement (including an invoice for rental and payment evidence of deposit or rental paid, if any) for your business office, warehouse, or shop or a copy of the Home Office Scheme approval from HDB / URA for your business office if you are operating your business from your residence.

- A signed "Acceptance Copy" of the option to purchase/ sales and purchase agreement (if you have purchased a property for your business)

- Any other documents to support that you are making or have the intention to make taxable supplies, out-of-scope supplies or exempt supplies

If you are submitting for GST registration offline, the same procedure applies. The IRAS will only accept offline applications if your business does not have access to the MyTax portal. You will need to submit GST F1 form along with the supporting documents to IRAS.

What is a security deposit, and who needs it for GST registration?

In case one or more of your partners or directors have outstanding income tax penalties, or a partner or director or another business related to yours has outstanding taxes or penalties, you have to provide a security deposit as a backup. The security deposit will be used to cover the tax or penalties if the concerned person does not pay up.

The Comptroller of GST may also require you to submit a security deposit if they consider it needed for any reason.

The security deposit amount will be notified to you once the GST registration application is in process. The security deposit will need to be in the form of a banker's guarantee or insurance bond.

If the issues with the IRAS are resolved, the security deposit may be waived.

What happens if I register late for GST?

If you are late registering for your GST, you will violate the law. A late penalty payment of 5% will be applicable on your GST filing. As already mentioned, you will receive a date backdated from the time you are eligible to pay GST. If you fail to make payment after 60 days of the first demand note being issued, another 2% penalty will be added for each month that the tax remains unpaid. The penalty will keep growing up to 50%. The maximum penalty for late payment of GST is 55%.

GST registration in Singapore for overseas entities

Suppose you are an overseas entity that does not have a business establishment in Singapore or an overseas supplier or overseas electronic marketplace operator registering for GST under the Overseas Vendor Registration Regime. In that case, you can choose one of the following methods to register for GST:

- GST registration is compulsory if you import goods into the country and sell them under your business name and your taxable supplies in Singapore exceed S$1 million. You could also register for GST voluntarily to get input claims. You will also need to appoint a local agent in Singapore to register for GST.

- You could also appoint a GST-registered Singapore agent to import and supply goods on your behalf. The agent will be responsible for filing GST. You don't have to register for GST in that case.

Suppose you are an overseas supplier or overseas electronic marketplace operator registering for GST under the overseas vendor registration (OVR) pay-only regime. In that case, you will need to submit an application using the OVR form. You do not have to appoint a local agent to handle your GST filing in Singapore, but if you are registering for GST voluntarily, you may need to provide a security deposit.

GST registration in Singapore for joint ventures

A joint venture registered with ACRA will be considered a legal entity and can register for GST.

If you are a Joint Venture that is not registered with ACRA, you can only register for GST if the following conditions are met:

- The Joint Venture is a distinct entity with documents supporting its governance, objects, rules and activities. The evidence could be in partnership agreements, Joint Venture contracts, deeds or letters of undertaking.

- The members who are undertaking the business are common for the Joint Venture

- The JV makes taxable supplies

- Every member participates in the business that the JV carries out

- At least one member has been chosen and is authorized by the others to be the representative to file and pay GST and fulfil other GST obligations on behalf of the JV

If all JV members are not Singapore residents or do not have their usual place of residence in Singapore, a local agent in Singapore must be appointed to handle all GST-related activities in the country. The agent will be responsible for accounting and paying GST. The JV must submit a duly completed letter notifying the IRAS of the local agent appointed.

Conclusion

Now that you know the GST registration requirements and how to go about applying for GST registration in Singapore, you can apply for GST on the MyTax portal. However, before you do that, it may be prudent for you to download and read about the Responsibilities Of A GST Registered Company In Singapore

%201.webp)

.webp)