Summary

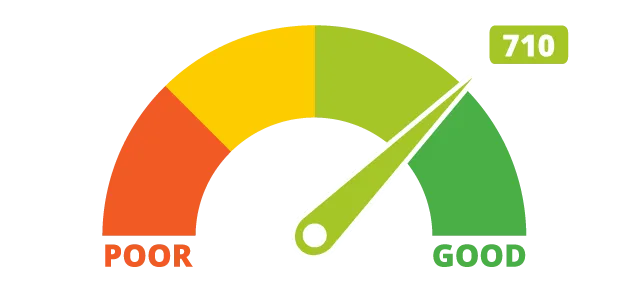

Whether you are new to the term or if you're looking for ways to improve your credit score quickly in Singapore, these tips might come in handy.A credit score is a 3 digit number that determines the creditworthiness of an individual or a business. It is usually based on a credit report and the information is sourced from a credit bureau.

More about the importance of Credit Bureau Singapore (CBS) can be found here.

The higher your credit score is, the more favourable it will be for you to qualify for personal loans, business loans, or credit cards. Though you don't plan on applying for loans in the near future, it is still advised to have a good credit score. So when outstanding expenses arise, you have no problem getting approval for loans.

Previously we have discussed 10 mistakes that could ruin your business credit score and how to avoid them. Now, this article will cover ways to raise the bars on your credit score.

4 Ways to Improve Credit Score Fast:

1. Pay bills on time

This is the most simple and underrated way to improve credit score. However, if you missed paying your bills on time once, it may negatively affect credit scores. Not just credit card bills or any current loans you have, but also student loans, rents, utilities, phone bills, etc.No procrastination, please. If you're late on any payments, pay them back as soon as possible. Due to this, it is advised to set up a calendar reminder or an autopay.

2. Apply new credit accounts only as needed

Opening accounts just to have a better credit mix won't improve your credit score. Only open new credit accounts as needed. Unnecessary credit may harm credit score, for example, by tempting you to overspend and accumulate debt.

3. Verify inaccuracies in your credit reports

Check your credit reports by requesting for your reports and dispute any inaccuracies in your report. If you spot an error, you should dispute the mistake with supporting evidence to the bureau who issued the incorrect report.

4. Don't close unused credit cards

Fortunately, skip the hassle in closing unused credit cards because closing an account may increase the credit utilization ratio. Well, this is if the credit cards are not costing money in annual fees. Having fewer open accounts but owing the same amount may lower credit scores.

How Long Does It Take To Improve Credit Score?

Unfortunately, there is no precise way to predict how soon you can improve your credit score. One thing for sure is depending on the time it takes to update your credit report. It may take several weeks for changes to appear on your credit report so stay consistent.

At Aspire, we envision a world where business owners have fast and simple access to the funding they need to grow. That’s why we’re on a mission to create an all in one Finance Operating Platform for growing businesses in Southeast Asia. Our current product provides SME and startup owners in Singapore with financial flexibility through a line of credit of up to S$150k. Which, can also be used to make business payments to enjoy 60 days free credit terms. With no monthly fees or obligations to withdraw, you only pay interest on the amount you end up using. Opening an account is free and can be done online here.

%201.webp)

.webp)