Automate your organisation’s payable process

Pay invoices by forwarding an email, optimise your cashflow, and manage all your bills in one place.

Trusted by 50,000+ modern businesses

Better workflow, better cash flow

Save time

Let our AI-assistant take care of the manual data entry, while you focus on growing your business.

Optimise cash flow

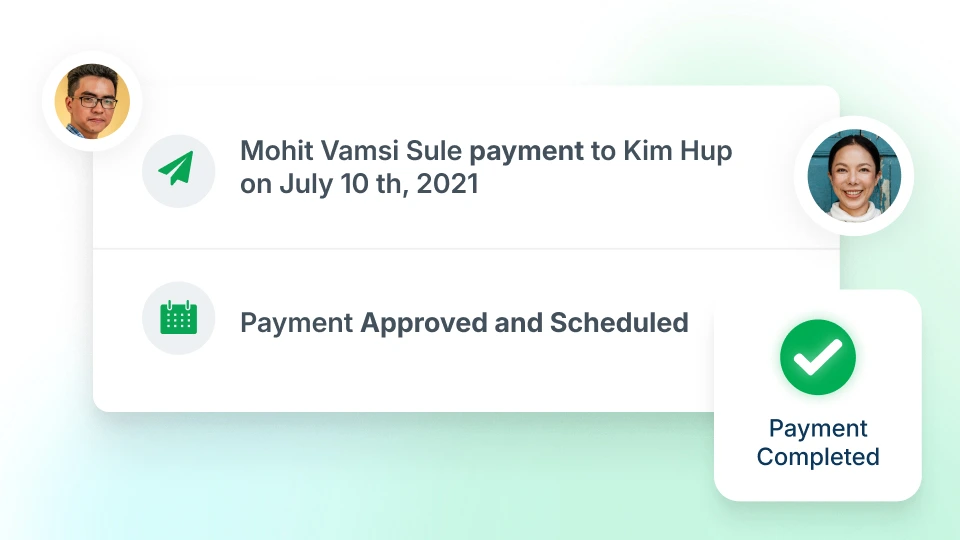

Choose to schedule invoice payments to maximise payment terms. Transfers are only made upon your approval.

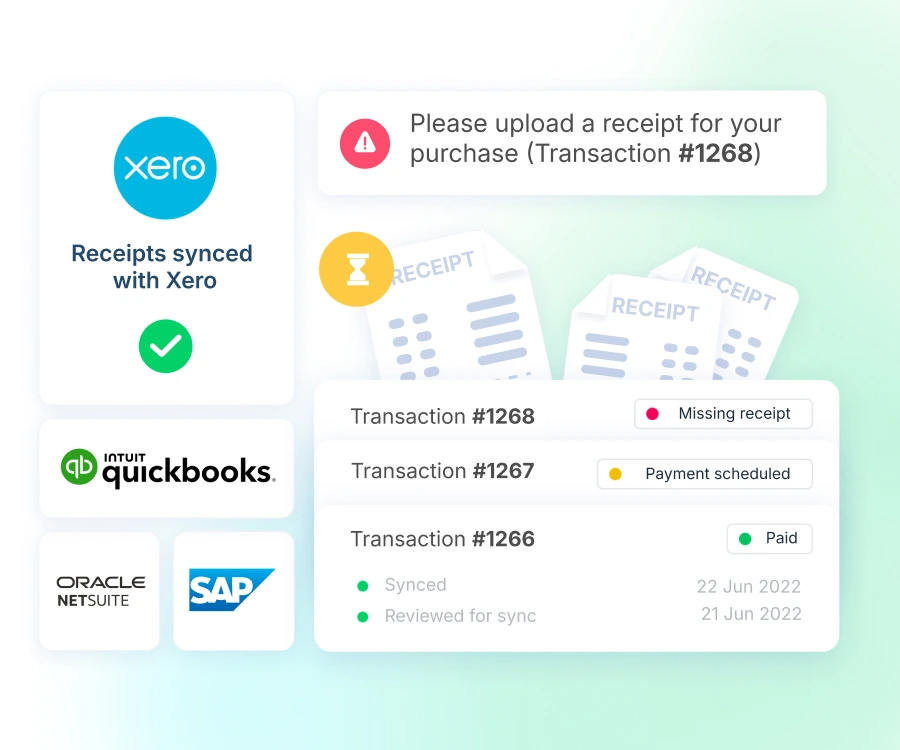

Stay in sync

Get real-time visibility on your payments. Seamlessly integrated with your accounting software.

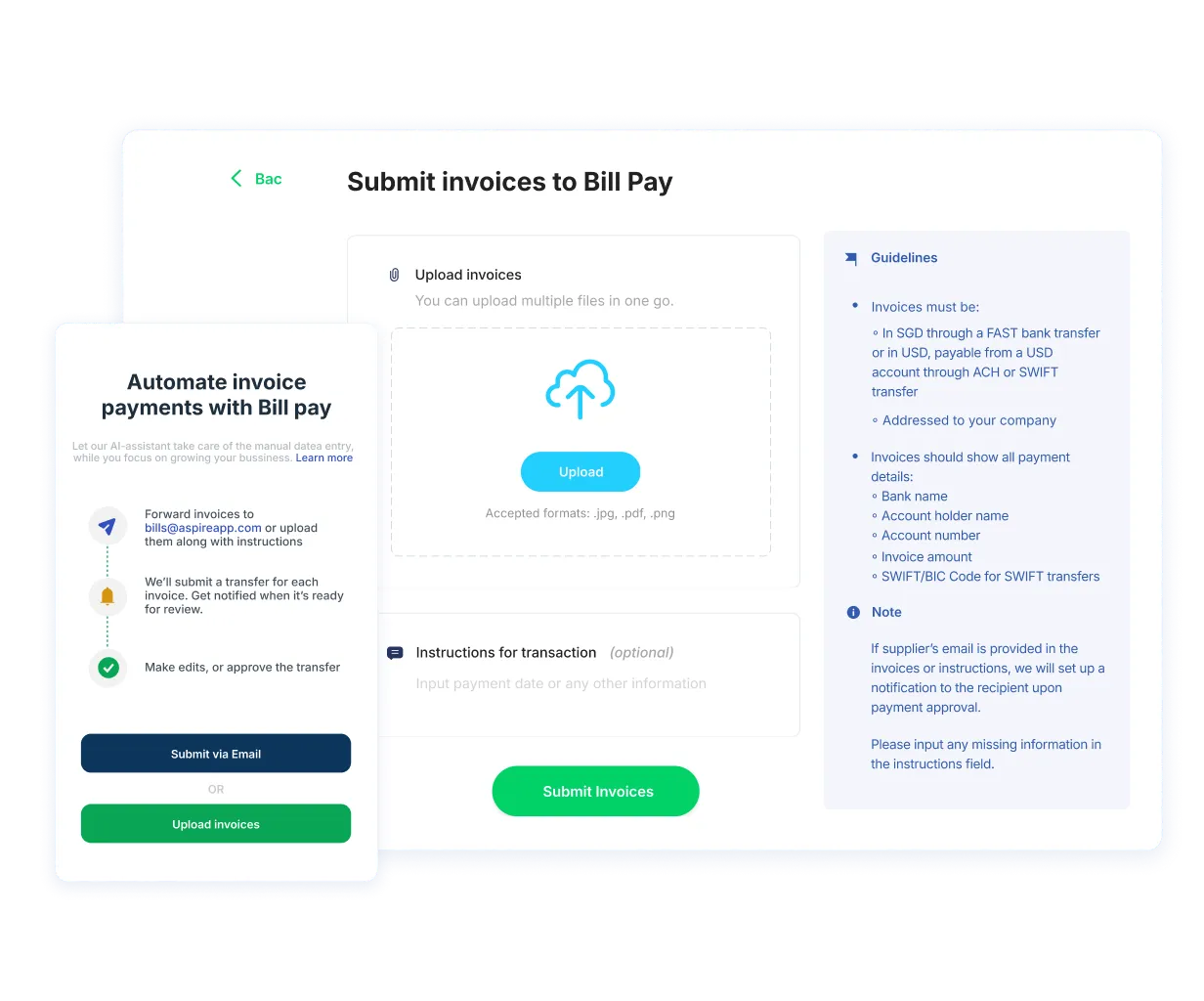

How it works

Save hours and reduce error rates

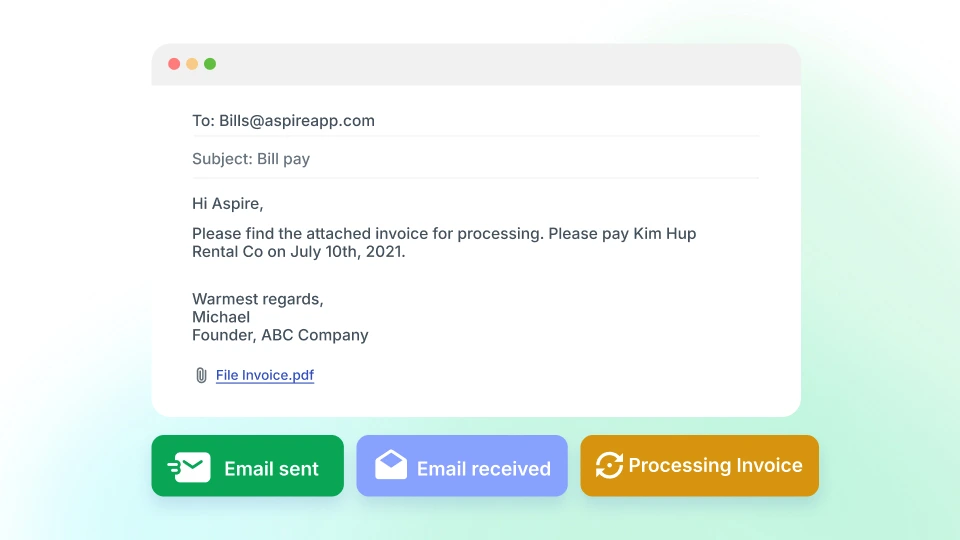

As easy as forwarding an email

It takes an average of 120 clicks to pay an invoice. Aspire makes it as simple as sending an email. AI automatically inputs data directly from your invoices, eliminating manual entry and reducing errors.

Schedule payments to optimise your cash flow

Maximise your cashflow by paying invoices only when they are due. It's as easy as including the instructions to 'pay on due date' when forwarding your bills.

Works with your team, and your accounting software

Automate and streamline your payables process across your organisation, without the added headcount.

Close your books twice as fast with transactions synced with your accounting software.

Hear it first from our customers

Gregory Van

CEO of Endowus

Holly Qian

Head of Finance, First Page Digital

William Chong

Finance Director at Glints

FAQ about Aspire Business Account

How do I get started with Bills?

Our Bills feature helps you manage all your bills, saving you valuable time and money. The Bills service is included in your Aspire subscription. There are two ways to create a Bills transfer:

Upload invoices directly on the Bills dashboard:

Key-in invoice details like amount, recipient, due date and initiate the Bills transfer. Based on your role and the company’s settings, you may be able to make the transfer directly or submit an invoice for approval. You can track the status of invoice payment and due date on the Bills page.

Who can create, submit and approve Bills?

Any user, irrespective of their role can create an invoice under the Bills feature and save it as a Draft. The following users can Submit an invoice:

- Budget owners with transfer permissionsInvoices not linked to a budget:

- Admins

- Finance users with transfer permissions

- Finance users with submit permissions

The following users can approve an invoice (based on the company’s approval settings):

- Admins

- Finance users with transfer permissions

How is the Bills feature different from Bill Pay?

Our Bills page introduces several new features to help you manage your vendor payments easily.

- View all vendor payments on the Bills page

- You can now track and view all your vendor payments on one page. These transactions are also available on the Transactions page.

- Track invoices by payment status

- You can track the invoices as per their status like Draft, Pending payment, Payment scheduled, Payment initiated, Paid, or Canceled.

- Track invoices by the due date

- Know at a glance which invoices are due soon and which ones are overdue.

- Upload invoices and create a payment instantly

- No need to wait for a few hours between uploading an invoice and the payment creation. You can directly create the invoice payment from the Bills page and make the transfer.

What has not changed in the Bills feature in comparison to Bill Pay?

- Forward bills bills@aspireapp.com to and our AI assistant will create the transaction within a few hours.

- These transfers will also be visible on the Bills dashboard, where Admins and Finance users can review, edit and approve the transfers.

Which bills can I forward? Are there any limitations?

You can forward bills in any currency. We currently support the following payment types:

- SGD transfers through the local FAST network

- International transfers in any of our supported currencies

- USD transfers paid via ACH or SWIFT- IDR local transfers

What do the different Bill statuses mean in the Bills feature?

You may see various statuses on your Bills dashboard. Here’s what they mean:

- Draft - The invoice has been saved as a draft and has not been submitted yet. Admins and Finance users have access to view all draft invoices.

- Pending Payment - The invoice has been submitted, and is pending approval

- Payment Scheduled - The invoice has been approved, and has been scheduled for payment. The payment will be automatically initiated on the scheduled date.

- Payment initiated - The payment has been initiated for the respective invoice.

- Paid - The payment has been completed successfully for the respective invoice.

- Failed - The payment was initiated but was unsuccessful. Contact our customer support at https://aspireapp.com/contact-us to understand why the payment failed.

- Canceled - The payment was rejected or canceled. The person rejecting or canceling the payment can provide a reason at the time of cancellation.

- Due in - The payment is due in a few days. This is based on the due date mentioned on the invoice.

- Overdue by - The payment is overdue. This is based on the due date mentioned on the invoice.

What bills can I forward? Are there any limitations?

You can forward any bills that can be paid via SGD through a FAST transfer. International billing for Bill Pay is coming soon, but will not be available for the beta program.

Will I be able to edit the transactions after they are entered?

Yes. You will receive a notification once the transaction has been created in your account. Log in to confirm or edit the details, and hit approve once you're ready.

How much does it cost?

The Bill Pay service is free when you sign up with Aspire. Aspire's free subscription includes a suite of features such as spend management, corporate cards and borderless payments.

Is there a limit to the number of bills I can send?

No. You can forward as many bills as you'd like.

Can I submit documents other than invoices?

We also accept statements of accounts or any document supporting a payment request. Make sure the supplier account details show in the statement or in your email to Bill pay. Let us know if you wish to pay the full amount or a partial amount.

Is there a limit to the number of bills I can send?

No. You can forward as many bills as you'd like.

Can I submit documents other than invoices?

We also accept statements of accounts or any document supporting a payment request. Make sure the supplier account details show in the statement or in your email to Bill pay. Let us know if you wish to pay the full amount or a partial amount.

Can I schedule payment for a future date?

Payment requests will be set up for immediate payment upon your approval, unless otherwise requested. Feel free to include instructions such as “schedule payment on due date”, and we’ll take care of it.

Will the transfer recipients be notified?

If the recipients email is specified in the invoice, we will automatically send a notification to that email. If you would like to send notification to another email or mobile number, please specify that in your instructions.

.png)