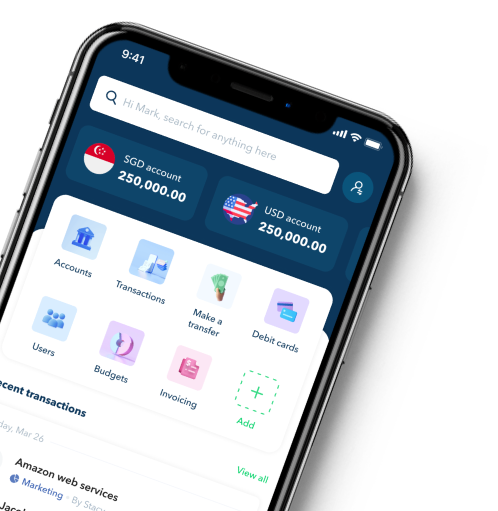

Open Your Global Business Account From Anywhere

A domestic and foreign currency account for local and international payments. Supporting all major currencies, it’s the perfect solution for retailers, wholesalers, traders and Web3 companies

Trusted by 50,000+ modern businesses

Send and receive in multiple currencies

100% remote account opening

Sign up for your global business account from anywhere in the world. 100% online and hassle-free

Fast, affordable international payments

Enjoy savings on international payments with great FX rates. See costs upfront before making transfers

Your funds are safe with Aspire

Have peace of mind with guaranteed security. Your funds are safeguarded with Tier-1 banks in Singapore

For businesses all over the world

Quick and remote access to your account

Account opening is 100% online. You don't have to be based locally to use our Global Business Account

Open local collection and sending accounts in USD, EUR, GBP, SGD, IDR and other major currencies

Get your own unique account numbers to receive, invoice and accept money from international customers in their preferred currency

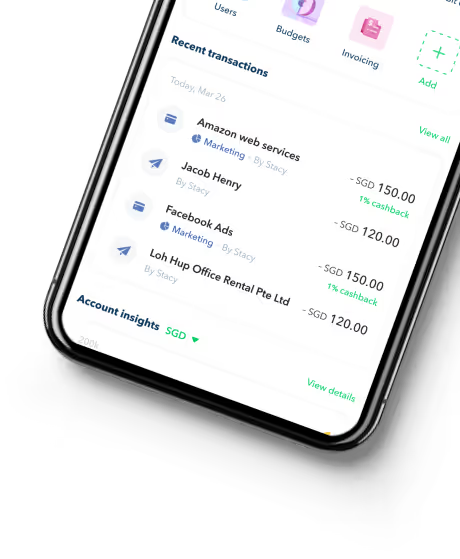

Save money on international and local payments

Avoid unnecessary conversion fees. Hold and pay in foreign currencies with great FX rates and free local transfers

No hidden fees, no account opening fees, no maintenance fees

Send money across the world and convert to 30+ currencies at mid-market rates with low transparent fees

Try our FX calculator to see the difference in savings

Try our forex calculator for real-time, indicative rates and see how Aspire is a cheaper, faster, and more transparent way to send money abroad. You can check the forex transfer rates for numerous international currencies.

*The calculator is an indication of our real-time rates for SGD foreign transfers. Actual exchange rates may differ based on the use case. For the most updated and accurate rates please access them by logging in to your account.

Keep your funds safe and secure

Your deposits are 100% safeguarded with a Tier-1 bank in Singapore

Your funds are always available to you, anytime you need it

Mitigate risk and protect your funds with Aspire

Hear it first from our customers

Gregory Van

CEO of Endowus

Holly Qian

Head of Finance, First Page Digital

William Chong

Finance Director at Glints

FAQs about Aspire Global Account

What is a global account?

A global account is an account specifically designed to manage finances across different currencies. It simplifies dealing with multiple currencies, which is especially beneficial when conducting international transactions, such as purchasing goods or transferring money to individuals or entities in foreign countries.

A global account is invaluable for businesses engaged in global trade that require seamless cross-border financial management. Global accounts can help provide cost savings through reduced currency conversion fees, streamlined international payments, and access to international financial opportunities.

Can I open a USD, GBP or EUR account in Singapore?

Yes, you can open a USD, GBP or EUR account in Singapore, and you have two main choices. Traditional banks like Citibank, OCBC and UOB offer global accounts, but this typically involves visiting a branch, providing necessary documents, and meeting minimum deposit requirements.

Alternatively, fintech providers like Aspire offer a quicker and more convenient option. With them, you can open a global account entirely online, often within a day. Keep in mind that account features and fees can vary widely, so it's essential to research thoroughly to find the right global account that suits your needs best.

What is the benefit of having a global account?

A global account is an invaluable asset for businesses with international operations. It simplifies expenses such as travel, foreign invoices, and online purchases from international merchants. This account streamlines transactions with clients who pay in USD, EUR, GBP, IDR or SGD, eliminating the need for currency conversion and exchange rate fluctuations.

Furthermore, having a global account ensures readily available funds, providing the flexibility to cover various expenses or convert to SGD when favourable exchange rates apply. It also enables businesses to diversify their portfolio by trading in multiple currencies, gaining a competitive edge, and making significant savings during repeated transactions.

.jpeg)