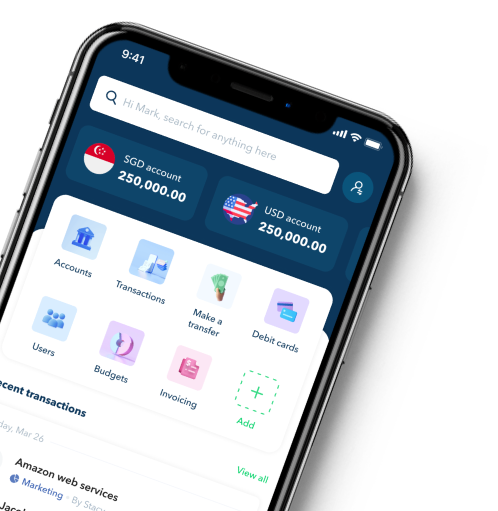

The Financial OS For Modern Businesses

A unified intelligent solution designed to manage your global business operations and scale company spend, all-in-one account

.avif)

AI powered finance, on a single platform

Business Account

Grow your business with our multi-currency accounts, all in one platform

.avif)

Corporate Cards

Streamline expenses and tracking by issuing multiple cards instantly

.avif)

Expense Management

Empower corporate purchasing and gain real-time visibility and control

Yield

Unlock returns on USD and SGD funds with daily returns

Accounting Automation

Automate your book-keeping and save hours of tedious manual work per week

FX & Payments

Get access to best-in-class FX rates and streamline payments worldwide

.avif)

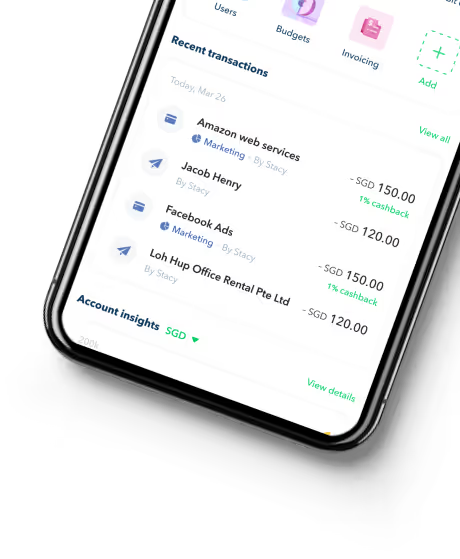

Earn unlimited cashback

Get more for your card spend on digital marketing and SaaS

Fast and transparent FX payments

Lower your transaction costs with market-leading FX rates

Over $200,000 worth of perks and rewards

We’ve partnered with the best services out there from Slack to Google Workspace to help you be more productive and save money

Close your books in hours, not weeks

The accountant’s dream. Integrate with your accounting software with Aspire for more accurate end-to-end reporting and closing

Suited for businesses of all sizes

From early stage startups to industry leading global corporations, Aspire is the choice of modern CEOs and CFOs

.png)

Startups

Easily set up spend limits and with a easy to use dashboard, you can always be on track and on budget.

.png)

SMEs

Issue unlimited cards to your team. Automate expense management and expense control policies.

.png)

Mid-sized Companies

Simplify complex budgeting procedures. Get access to our APIs for custom integration processes.

Hear it first from our customers

Gregory Van

CEO of Endowus

Holly Qian

Head of Finance, First Page Digital

William Chong

Finance Director at Glints

.webp)