Summary

Favourable taxes are one of the main reasons start-ups love to incorporate in Singapore.

But how much tax will you pay when you start your business in SEA’s start-up hotspot? And are there any additional benefits?

Read on for your Singapore start-up taxing 101.

What are the corporate tax rates in Singapore?

Local and foreign companies in Singapore enjoy the lowest corporate tax rate in Southeast Asia, namely 17% of their chargeable income.

According to Singapore’s tax rules, all income generated or received in Singapore is considered taxable. This includes investments from rental properties, gains and profits from business or trade, as well as royalties and premiums sold.

The place of incorporation isn't always the same as tax residency. In order to benefit from Singapore's tax rules, the control and management of your company needs to be exercised in Singapore in the past YA.

Other benefits of being a Singapore Tax Resident

Under the Avoidance of Double Taxation Agreements (DTAs), Singapore tax residents benefit from more than low corporate tax rates.

- Zero tax on dividends distributed to shareholders.

- Zero tax rate on the company’s capital gains. This means you don’t pay any taxes for an IPO or when someone acquires your start-up.

- Zero tax on income from foreign sources, which were already subjected to taxation abroad.

General startup tax exemptions and incentives

Besides the low corporate tax rates, new businesses can reap the full benefits of generous tax incentives and exemptions offered by the Singapore government.

1. Start-Up Tax Exemption (SUTE) Scheme

The Start-Up Tax Exemption Scheme was launched in 2005 to support local entrepreneurship and allow new local start-up companies to enjoy tax relief in the early stages of their business growth.

Eligible start-ups can offset corporate income tax rates for the first three consecutive Years of Assessment (YA) or the first three years of incorporation.

New companies benefit from a 75% tax exemption on the first 100,000 SGD of normal chargeable income, while the next 100,000 SGD of chargeable income is eligible for a 50% tax exemption.

Eligibility Criteria

The start-up must:

- be incorporated in Singapore.

- be a tax resident of Singapore for that specific YA.

- have no more than twenty shareholders. Either all shareholders must be individuals, or at least one individual must hold at least 10% of the company’s issued ordinary shares.

Mind that this scheme only applies to eligible companies in their first three consecutive YAs. Afterwards, start-ups can benefit from the Partial Tax Exemption (PTE) scheme.

2. Partial Tax Exemption (PTE) Scheme

After the first three consecutive years of assessment, companies can benefit from the Partial Tax Exemption (PTE) Scheme.

Just like the SUTE Scheme, the PTE scheme has two brackets. The initial 75% tax exemption, however, only applies to the first 10,000 SGD of chargeable income. On the next 190,000 SGD, the company can still benefit from a 50% tax exemption.

To be eligible for the PTE Scheme, you must have gone through the SUTE scheme first and have completed your first three years of incorporation.

What are the tax filing requirements for companies in Singapore?

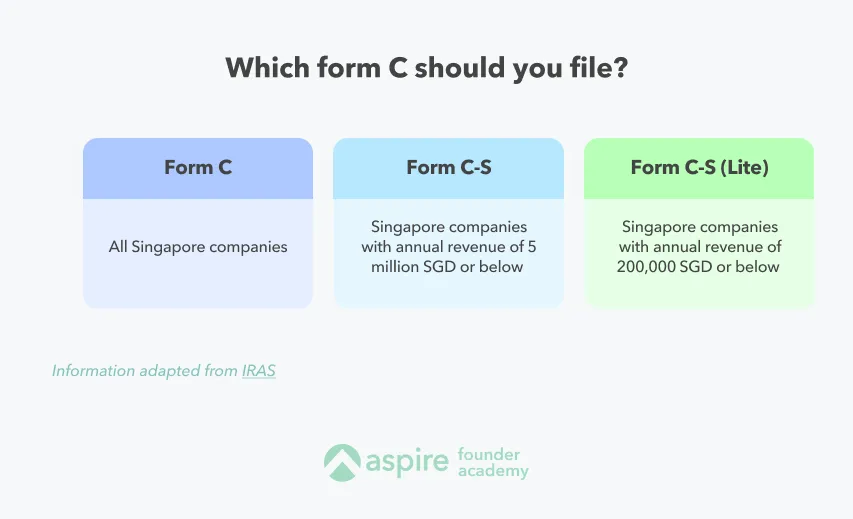

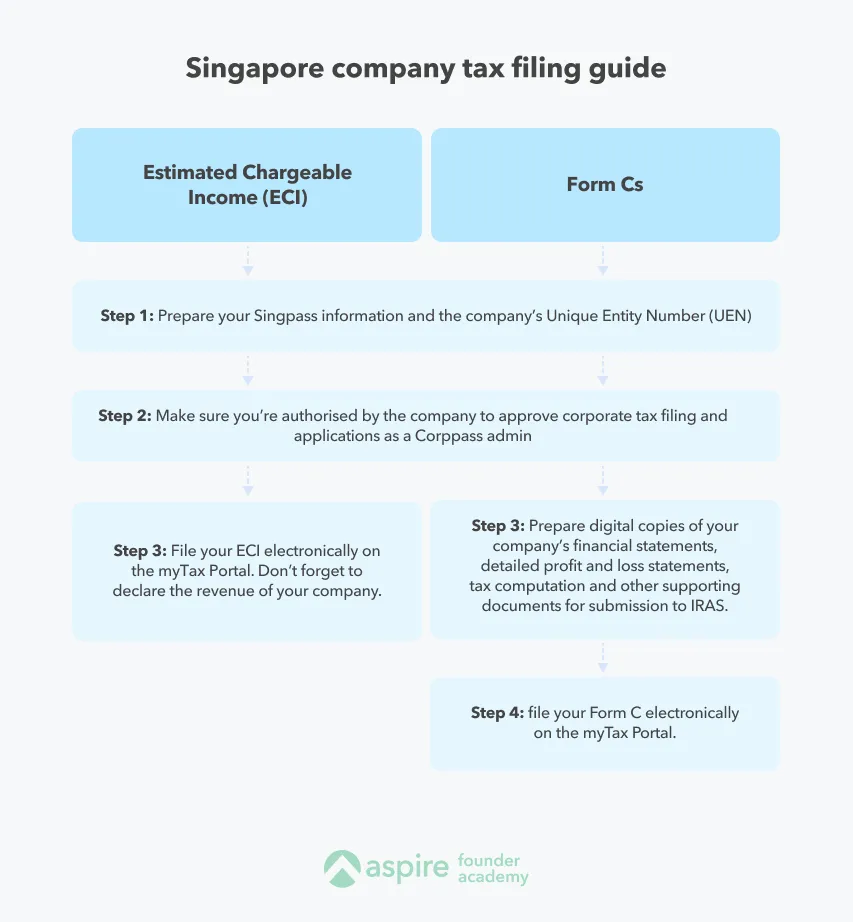

Two key filings must be submitted to ACRA: the Estimated Chargeable Income (ECI) form and the Form C/Form C-S/Form C-S Lite.

The purpose of the ECI is to state the estimate of a company’s taxable income for a particular YA. The different types of Form Cs are used to determine the company’s actual taxable income.

Form Cs are to be filed by 30 November each year, while ECIs need to be filed within three months of a company’s financial year-end (FYE). Companies that are eligible for the ECI filing waiver need not file an ECI for the YA.

Singapore company tax filing guide

Frequently Asked Questions (FAQ)

1. What are the penalties for late or non-payment of corporate tax?

If a company fails to pay their taxes on time, a 5% penalty applies. Every month the company fails to pay its taxes, another 1% will be added.

2. What are the penalties for inaccurate tax filings?

The jurisdiction of Singapore is very serious about accurate tax filing. Failure to submit accurate tax filings may result in:

- A fine of up to $5,000

- A penalty of up to 200% of the undercharged tax and/or

- Imprisonment of up to three years

3. What are the penalties for tax evasion?

Tax evasion is a serious criminal offence. Therefore, it has more significant consequences than late payments and inaccurate tax filings.

- A fine of up to $50,000

- A penalty of up to 400% of the undercharged tax and/or

- Imprisonment of up to five years

Apart from the above-mentioned penalties, IRAS and other relevant authorities will investigate tax evasion cases thoroughly.

Incorporate your business in Singapore

Set up your business in Singapore so you can benefit from more favourable tax rates for your company.

With Aspire Kickstart, you can incorporate your start-up from anywhere in the world in just a few clicks. On top of exclusive perks and an entirely digital registration process, you’ll also receive a free Aspire Business Account with your package.

%201.webp)

.webp)