Summary

Now that you have everything you need to know as we re-enter Phase 2, it’s time to tap into the various support schemes and resources available for businesses in Singapore. During last year’s circuit breaker, the government introduced multiple initiatives and programmes to help sectors nationwide stay afloat amidst the COVID-19 pandemic.

Coming into Phase 2 (Heightened Alert), the government has extended existing support schemes as well as new ones to support businesses in Singapore.

From special financing to business development programmes, here are some of the best government support schemes that can help you navigate COVID-19 with confidence.

Finance Assistance with Credit

1. Special Situation Fund for Startups (SSFS)

Catered towards SMEs and micro-enterprises, the Special Situation Fund for startups (SSFS) provides financial support to promising local startups to encourage innovation and growth amidst the pandemic. As part of the Fortitude Budget, S$285 million will be set aside for companies in their early to late stages and are specific sectors working on national priorities such as food security, which will end by 31 October 2021 or when the funds are fully distributed.

Special Situation Fund for Startups Eligibility criteria:

- Must be a private company incorporated in Singapore for not more than 10 years

- Must be developing, producing, or commercialising innovative products or services through technology for scale and high growth

- The company’s new and existing investors must be committed and prepared to fund 50% of the convertible note

- Must have demonstrated a commercially scalable and viable business model of at least 20% annual revenue growth before COVID-19

- Must have secured paying customers and partners

2. Enterprise Financing Scheme – Project Loan (EFS-PL)

As part of Enterprise Singapore’s enhanced support programmes, the Enterprise Finance Scheme for Project Loans seeks to support local enterprises in their international expansion effort by funding their overseas projects. With the extension effective from 1 Jan 2021 to 31 Mar 2022, eligible companies can receive risk-share loans from Participating Financial Institutions (PFIs) capped between 50% to 70%.

Enterprise Financing Scheme – Project Loan (EFS-PL) Eligibility criteria:

- Must be a business entity registered and physically presented in Singapore

- Must have at least 30% local equity held directly or indirectly by Singaporean(s) and/or Singapore Permanent Resident(s), determined by the ultimate individual ownership

- Must have a maximum borrower group revenue cap of S$500 million

3. Enterprise Financing Scheme – Trade Loan (EFS-TL)

Likewise, the Enterprise Finance Scheme for Trade Loans has been extended from 1 January 2021 to 31 March 2022 to continue providing better financial access to trade needs including stock financing, revolving working capital, factoring, AR discounting, and bank guarantee. With longer cash cycles and slower business activities, companies in challenged markets can benefit greatly from this loan and continue to fulfil overseas projects that may have been delayed due to the pandemic.

Enterprise Financing Scheme – Trade Loan Eligibility Criteria:

- Must be a business entity registered and physically presented in Singapore

- Must have at least 30% local equity held directly or indirectly by Singaporean(s) and/or Singapore Permanent Resident(s), determined by the ultimate individual ownership

- Must have a maximum borrower group revenue cap of S$500 million

4. Extension of Temporary Bridging Loan Programme

Although the Temporary Bridging Loan Program (TBLP) was introduced in Budget 2020, it has been extended for an additional six months from 1 April 2021 to 30 September 2021 to provide companies with working capital for a variety of business expenses. From the initial S$5 million maximum loan quantum, it has been lowered to S$3 million under the enhanced programme. Furthermore, the government’s risk-share loans have also been lowered to 70% from the initial 90%.

Extension of Temporary Bridging Loan Programme Eligibility Criteria:

- Must be a business entity registered and physically presented in Singapore

- Must have at least 30% local equity held directly or indirectly by Singaporean(s) and/or Singapore Permanent Resident(s), determined by the ultimate individual ownership

- Must have a maximum borrower group revenue cap of S$500 million

5. Jobs Support Scheme (JSS)

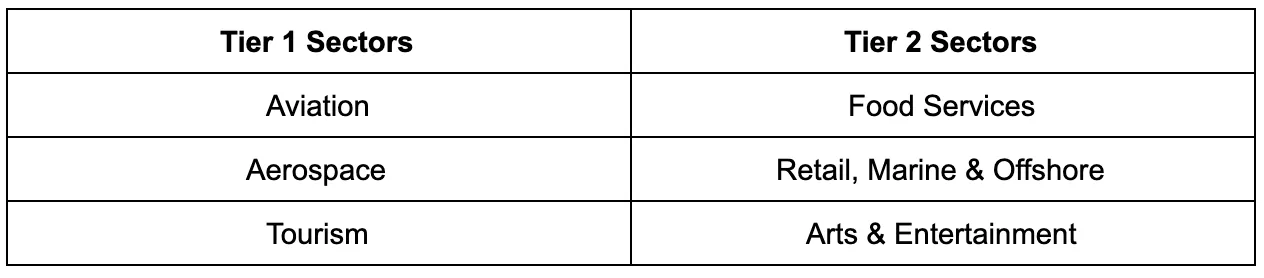

Under the Solidarity Budget, the Jobs Support Scheme was also among the programmes extended to support businesses as we re-enter Phase 2 with heightened measures. Under this scheme, eligible employers will be given wage support to retain their local employees during this pandemic for firms in Tier 1 and 2 sectors up to September 2021.

Employers are not required to apply for the JSS and will be notified directly by IRAS based on their eligibility.

Jobs Support Scheme (JSS) Eligibility Criteria:

- All active employers, except for Government organisations (local and foreign) and representative offices, are eligible for the scheme.

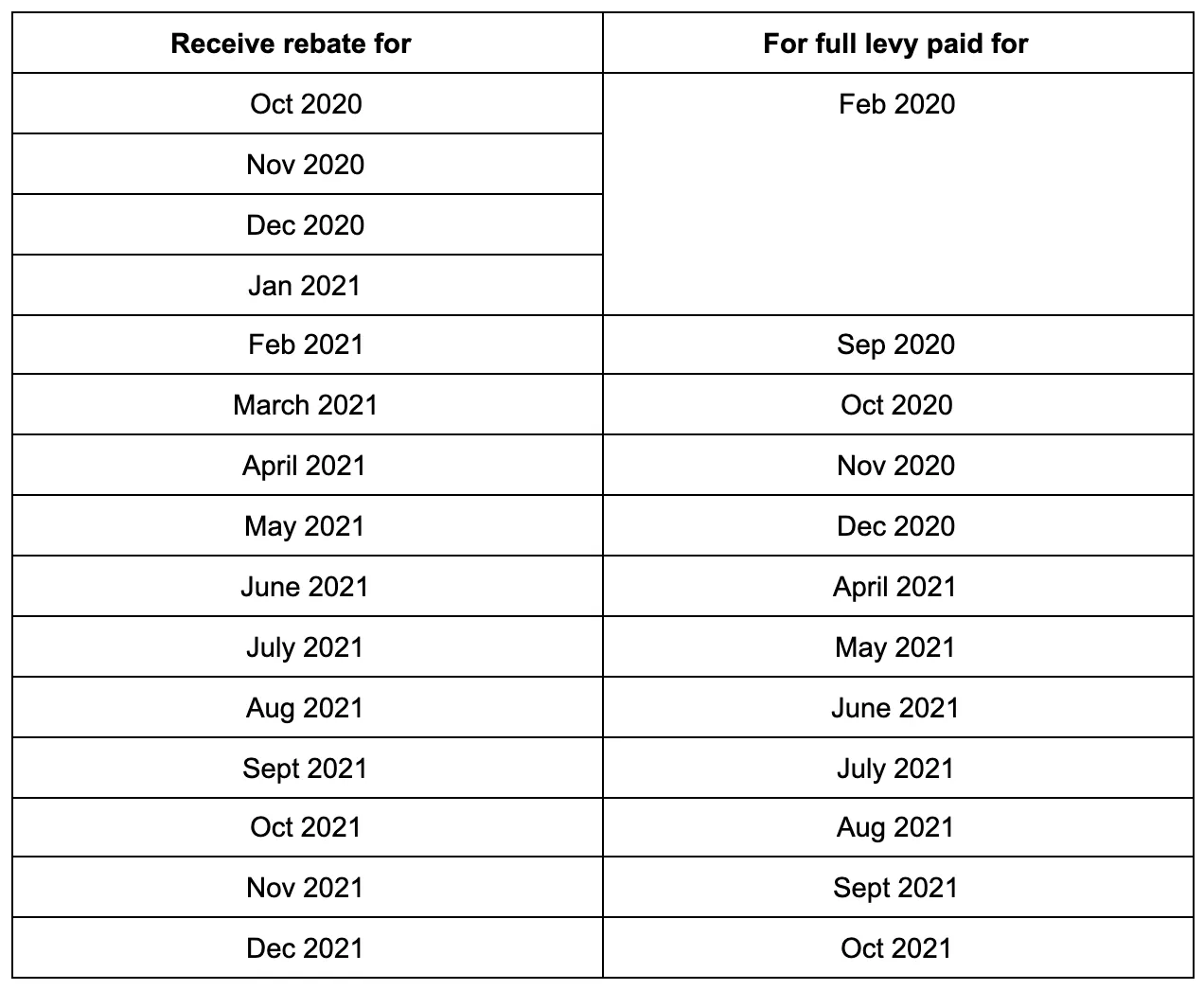

6. Foreign Worker Levy (FWL) Rebate

Until December 2021, companies and firms in the Construction, Marine Shipyard and Process (CMP) industries can receive FWL rebates for their employees who are S Pass and Work Permit holders. As of 8 May 2021, the Ministry of Manpower (MOM) announced that the rebates for each work permit holder will increase from S$90 a month to S$250 per month with the first payouts rolling out in June 2021. This can aid select firms affected by the increased costs for the CMP sectors and manpower shortages.

Eligibility criteria:

Only companies in the CMP sectors who have paid levy for the required month in full will be eligible for the FWL rebate. For reference, please refer to the table below:

*Application is not required. Eligible firms in the CMP sectors will receive the levy waiver directly.

Business Development

1. Productivity Solutions Grant and Enterprise Development Grant

Enterprise Singapore has enhanced their existing Productivity Solutions and Enterprise Development Grants to meet the needs of the affected business as a result of Phase 2. Companies who want to adopt IT solutions and equipment for the improvement of their business operations can apply for the PSG, while the EDG is more suited for companies who are looking to expand and grow their business at a larger scale. Both grants have been extended until 31 March 2022.

Productivity Solutions Grant and Enterprise Development Grant Eligibility criteria:

- Must be registered and operating in Singapore

- Must have a minimum of 30% local shareholding

- Must be in a financially viable position to start and finish the project

Apply for the Productivity Solutions Grant (PSG) here

2. Enterprise Singapore Booster Packages

In line with their roster of support programmes, Enterprise Singapore also re-introduced Booster Packages for companies in the e-commerce and food delivery sectors.

E-commerce Booster Package

The E-commerce Booster Package supports local retailers in the digitisation of their businesses by defraying business costs of going online. With this package, eligible retailers can engage with one of the appointed e-commerce platforms to commence their business operations online and receive a one-off payment to offset 80% of the qualifying costs (capped at S$8,000)

Some of the solutions offered in this package include:

- Product listing

- Channel management

- Content management

- Advertising and promotion

- Fulfilment

- Training workshops for e-commerce

Eligibility criteria:

- Must be registered or incorporated in Singapore on or before 30 April 2021

- Must have a minimum of 30% local shareholding

- Must have group annual turnover not exceeding S$100 million per annum based on the most recent audited report, or group employment not exceeding 200 employees

- Must have an SSIC code starting with 47

- Must have a physical retail storefront

Food Delivery Booster Package

From 16 May to 15 June, the Food Delivery Booster Package was re-introduced to support F&B businesses affected by the new implementations as a result of Phase 2. Through food delivery platforms and third-party logistics partners, qualified companies will be able to defray the cost involved with taking their business online.

Eligibility criteria:

- Must be selling food prepared on-premise for immediate consumption (e.g. hawker stalls, cafes, food caterers, and restaurants)

- Merchants specialised in retailing pre-packaged products are not eligible for the package.

3. Global Innovation Alliance (GIA)

With international borders closed and travel restrictions in place, getting access to a network of overseas investors or partners has been a challenge. But businesses can tap into the Global Innovation Alliance (GIA) to expand tier businesses into the overseas market without leaving the country. This initiative connects both Singapore startups scaling abroad and international startups venturing in Asia through Singapore with a network of overseas partners, similar to an incubation programme.

From there, businesses can expand their market internationally even with the ongoing pandemic.

4. Double Tax Deduction for Internationalisation (DTDi)

If you’re looking to expand your business overseas in the form of tax deductions, the Double Tax Deduction for Internationalisation (DTDi) scheme is ideal for you. With a 200% deduction on taxed on eligible expenses involved in investment development activities and international market expansion, companies qualified for the DTDi scheme can receive support across various stages of their growth journey.

Double Tax Deduction for Internationalisation (DTDi) Eligibility criteria:

- The company must reside in Singapore with the primary purpose of promoting the trade of goods or services

- Businesses enjoying discretionary incentives may also be allowed to qualify for this scheme on a case-by-case basis, subject to approval by Enterprise Singapore or Singapore Tourism Board.

5. PACT Programme

To facilitate the culture of collaboration between companies in Singapore, the PACT programme provides funding for local firms who have partnered together with a collective goal to build capabilities and explore business opportunities in both local and international markets. To apply for this programme, one of the two enterprises is required to take on the role of the ‘Lead Enterprise’ to spearhead the group’s projects. The level of support for SMEs is capped at 70% of the qualifying costs while non-SMEs are entitled to 50%.

PACT Programme Eligibility criteria:

- The Lead Enterprise must take responsibility for the implementation and successful delivery of the project, along with coordination with the participating enterprise

- While foreign companies are eligible to join, the project should include a majority of Singapore-based enterprises

Tap into your available resources

With the multitude of support schemes available for businesses, it would be a waste not tapping into these resources. Whether you’re looking for immediate cash assistance for your company or programmes that support overseas expansion, these are some of the schemes that can help your business stay afloat during these uncertain times and even take it to the next level. As we continue to ride the wave that is the pandemic, let’s continue to be resilient in the face of adversity.

%201.webp)

.webp)