Summary

Awarded the best SME Bank in Southeast Asia from 2013-2017, OCBC is definitely a crowd-favourite of business owners in Singapore. Their striking red ATMs dot the island, a testament to how popular OCBC is as a financial service provider.

As one of Singapore’s preferred SME banks, OCBC has created a corporate card that pairs with any OCBC SGD Business Account. Let’s dive into the details of this OCBC Business Platinum Card.

What is the OCBC Business Platinum Card?

The OCBC Business Platinum Card is a business debit card that allows cardholders to efficiently track expenditure and transactions.

You might be wondering what the perks are for a debit instead of a credit card? As a SME owner, a business debit card might be more practical rather than a credit card because:

- You don’t have to pay as high fees as you would a credit card

- You won’t have to worry about going into overdraft unlike a credit card

- You won’t have to constantly fear accumulation of interest rates

You might have heard that many business owners usually opt for corporate credit cards because of the rebates and rewards. Though this OCBC corporate card functions like a debit card, it still comes with a host of unique benefits.

What benefits does the OCBC Business Platinum Card offer?

First up: annual fees. OCBC Business Platinum cardholders can enjoy a lifetime waiver on annual fees! The benefits of holding this card also include being entitled to 0.2% rebate on all local currency spend, and 0.5% rebate on all foreign currency spend—with no rebate cap.

Fees aside, choosing the OCBC Business Platinum Card also means that you’ll be able to access a whole range of rewards. From discounted cab fares to up to 10% transport and travel fees, you’ll surely find a reward suited for your business.

OCBC is also integrated with mobile payment apps like Google Pay, Apple Pay, and more! Which means paying, sending, and receiving transactions has never been easier.

Looking for more debit card options?

What if we told you that there’s a card with no annual fees, ultra low FX rates, and is integrated with mobile payment apps too?

The Aspire Corporate Card is a virtual debit card that offers 1% cashback on online marketing and Saas spend on over 10 different merchants. If you’re constantly ramping up marketing efforts on Facebook and Google, Aspire is a great way to save costs.

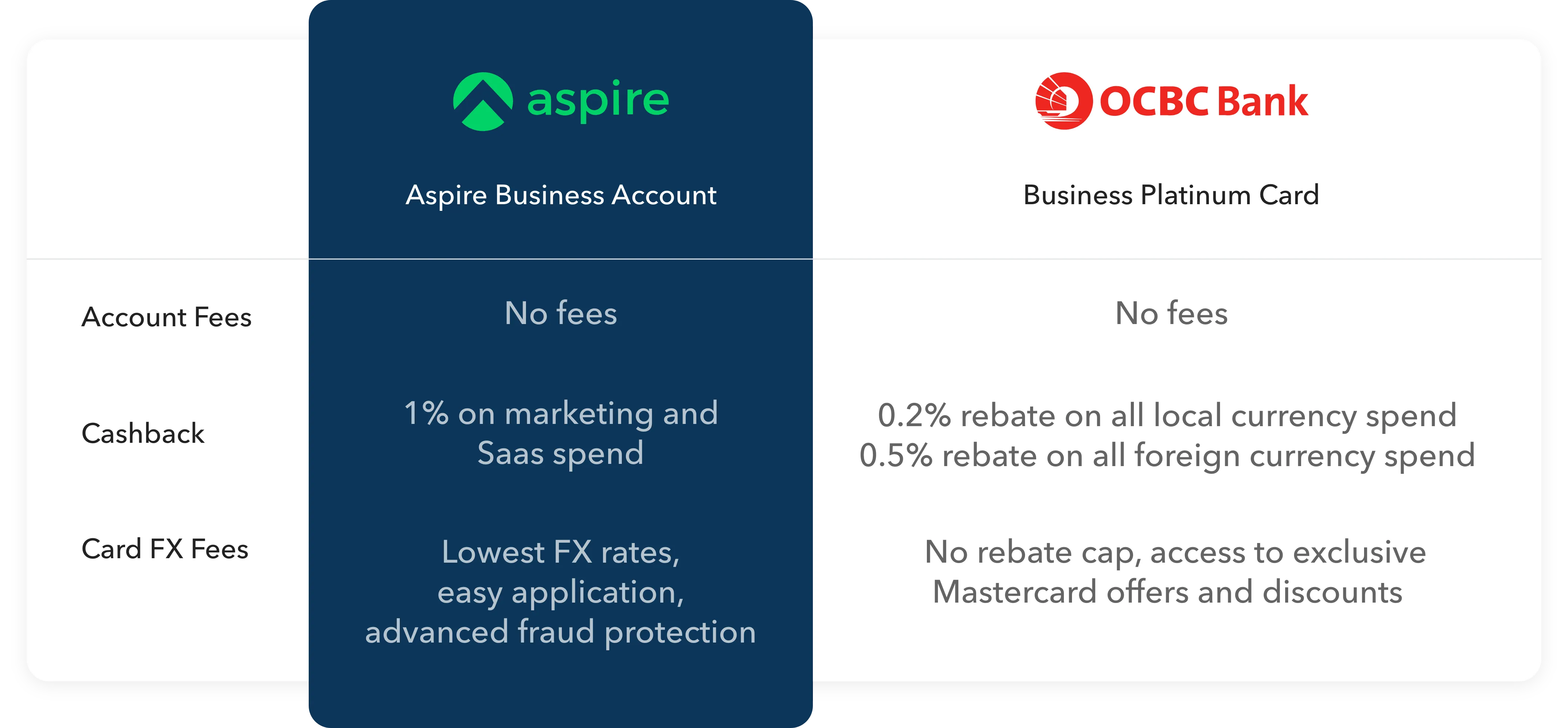

Here’s a table comparing the Aspire Corporate Card with the OCBC Business Debit Card:

Aspire is also fully integrated with Google Pay—making purchases both online and in store super convenient. Spend less and save more with Aspire.

%201.webp)

.webp)