Summary

Pitch decks are an essential part of the start-up funding process.

Get them right, and you’ll save yourself a lot of time and trouble. But mess it up, and you miss out on millions of start-up funding.

To increase your chances of success, we’ll introduce you to the three phases of implementing the perfect pitch deck.

• Phase 1: Prepare your content

• Phase 2: Create your investor pitch deck

• Phase 3: Use your pitch deck successfully

As a bonus, we've included links to templates, examples of successful pitch decks and tips on getting the perfect pitch deck structure and design for your investors.

What is a pitch deck?

Let’s start with some clarifications. A pitch deck is a presentation start-up founders use to showcase their business to investors when they're out to raise funding.

It provides a brief overview of their business, including the business plan, products and services, financial projections and funding needs.

An investor pitch deck is a support tool for presentations. Don’t share it as a standalone document.

Why do I need a pitch deck?

Pitch decks help describe your business to a potential investor.

Use it during a pitch meeting with an investor to convince them your start-up has growth potential. When successful, you’ll be invited for a more in-depth discussion.

Pitch decks are essential for most investor pitches. You’ll need one for one-on-one presentations, presenting to a group of interested investors or during open events like pitch nights and start-up competitions.

It's possible to raise money successfully without a pitch deck. For example, PayMongo successfully raised 12 million USD Series A funding and Airbase raised 60 million USD using an investment memo. However, these are usually exceptions. Unless you can write exceptionally well, it's best to stick to a pitch deck during fundraising.

How long does a pitch deck need to be?

Your pitch deck should be no more than 10-15 slides. Remember, VCs and investors review many pitch decks and often listen to multiple pitches in a day.

They have limited attention spans and brain space for your pitch. Your goal is to keep your message brief and attention-grabbing.

What should an investor pitch deck include?

A pitch deck should convince investors that your start-up is a substantial investment opportunity. Therefore, it should at least answer the following questions:

1. What problem are you trying to solve?

2. Why are you the best person or team to solve this problem?

3. Who is your competition, and what do you do better than them?

4. How much is your market worth?

5. How is your business performing so far?

6. What do you need this funding for?

How much time should I spend on an investor pitch deck?

Be prepared to spend up to a few weeks outlining, crafting and refining your message and design.

However, you also need time to test your pitch deck. Prepare your deck to about 70% readiness before trying it with friendly investors or your co-founders.

Allocate time to tweak your deck during your test runs or while you're making your first rounds with potential investors.

Don't expect yourself to get it entirely right the first time. Invest time and effort in creating a good initial pitch deck, but expect to constantly improve and refine your deck.

Phase 1: Preparing your investor pitch deck content

Before starting on your pitch deck, you want to ensure you have all the materials to tell an exciting story. These include:

• Business metrics that show your company has strong fundraising potential

• A straightforward answer to how much you’re asking and what you plan to use the money for

• An interesting story

Prepare your business metrics

Vision, product and personality are crucial but investors also care about numbers. They invest in a start-up’s potential, and the best way to gauge that is with metrics.

Ideally, you’ll fundraise when your business is snowballing. Find data points that will get your investors excited about your business.

• Growth rates

• Revenue numbers

• Customer testimonials (even better if they are market leaders in your customer segment. If you’re raising a pre-seed or seed round, show early feedback from your initial customers).

• Achievements: Did you launch an essential product or surpass a certain amount of traction?

Know what you want from investors and what you’re planning to use the money for

The goal of a pitch deck is to raise funds, so be clear about how much you need and what you’re going to use it for. Investors don’t only want to know how your business is performing now. They're even more interested in your possibilities with extra funding.

Here are three ways to figure out how much you should ask:

1. Look at your monthly burn rate.

2. Determine how much money you need to secure your next milestone.

3. Understand your start-up’s valuation.

Include storytelling elements

Pitches delivered as stories can be 22 times more memorable than those with just facts.

After a pitch, your audience doesn’t remember data and figures, especially when presented with cold data points multiple times a day. They do, however, recall a compelling story with critical characters, drama and emotion. Use the materials you’ve prepared to weave storytelling elements into your pitch.

It also helps your potential investor if you give them a plot they can recognise with moments of tension and release.

How do you incorporate storytelling elements into your pitch deck?

Method 1: The hero’s journey

The hero’s journey is a classic storytelling framework powering countless films and novels, but it’s also a tried-and-tested method for your start-up pitch. There are three main elements to a hero’s journey:

1. Identify the problem (Departure): Why is the problem a problem? Set out why the audience should care about your situation and why they should invest time and effort listening to your solution.

2. Present the solution (Initiation): What should the audience do with all this information? Show how they can take action.

3. Make the reward compelling (Return): What's the moral of your story? Based on the problem and solution, identify the key takeaways for your audience.

Examples:

• A simple explanation of the Hero’s Journey to craft an investment pitch

• Watch it in action: Chef José Andrés uses all three elements in his Ted talk.

Method 2: Use your customer’s perspective

Talk about your product from your customer's perspective. Zoom in on your target customer's pain points and circumstances from a single person's perspective.

You may have seen this format at work in many company introduction videos.

Examples:

•HubSpot dispenses with the boring explainer-style video format to present their marketing and sales CRM solution in a customer-friendly and memorable way.

Method 3: Tell the story from your industry’s point of view

Compared to the customer's perspective, which takes a single person's view, this method zooms out to take a birds-eye view of your industry and explains why your industry needs your product.

1. Describe the status quo and how it's always been in the industry.

2. Explain why this status quo needs to change and how this is an issue for big players in the industry.

3. Show how this problem creates a unique opportunity for new, more agile businesses like yours to step in.

4. Bring it all together by showing that this is the perfect time to launch your business.

Example:

Pitch deck company BaseTemplates positions itself as a viable solution for founder-focused slide templates:

“Today, there are over 1000 online stores selling presentation templates. Each store sells hundreds of templates, and they all look the same; fancy slide designs, fonts, and animations. But how many are really useful? Most founders don't know which template is best suited to their business. Some templates don't work properly on Mac; others require customers to buy additional design elements. In short, building engaging, professional presentations with them is hard. That's where BaseTemplates comes in.”

Phase 2: Creating your investor pitch deck

Now that you've got your raw data and metrics ready, it's time to distil them into a cohesive, well-designed pitch deck.

1. Structuring your content

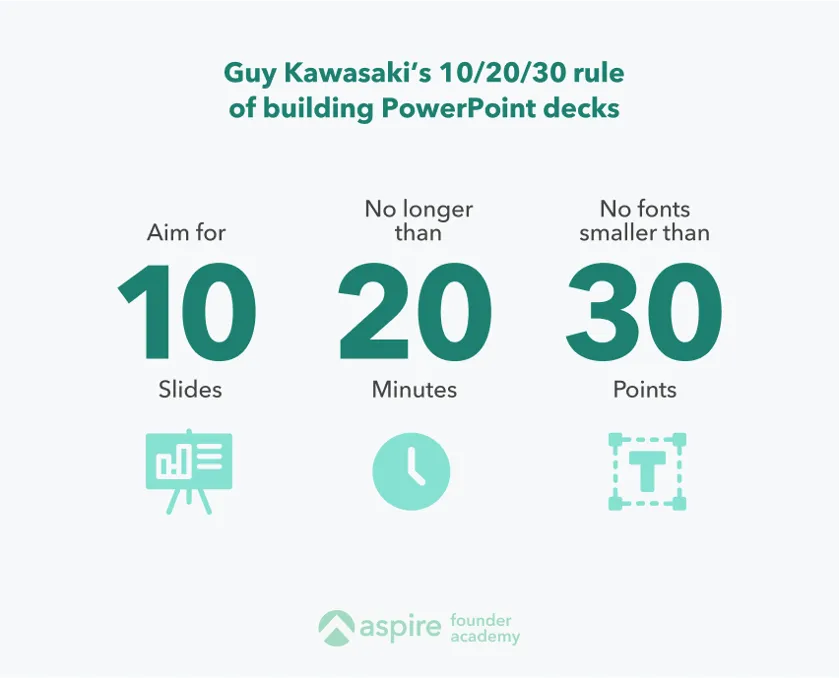

A good rule of thumb to structure your content is investor Guy Kawasaki’s 10/20/30 rule for PowerPoint decks: 10 slides, 20 minutes and no fonts smaller than 30 points.

The goal is 10 to 15 slides. Don’t go beyond this, even if you need more to show in-depth business traction for Series A and beyond rounds. Use appendixes instead.

Here’s a suggested format:

Slide 1: A clear title slide with your company name, logo and a one-sentence description of what you do.

Slide 2: Tease your current business traction.

Slide 3: Describe your problem and opportunity.

Slide 4: Explain the importance of your solution from your customer’s perspective.

Slide 5: Explain the solution you provide. Illustrate how your customer uses your product and why that’s valuable to them.

Slide 6 to 7: Show your in-depth traction and revenue numbers. Explain how you make money and show your projected growth trends.

Slide 8: How much is your market worth?

Slide 9: Show how you're better than your competition at solving the problem with a balanced approach. List out your major competitors and what they're doing well and not doing well.

Slide 10: Showcase your vision. Talk about the future and your ambitions for your business.

Slide 11: Describe your team and their strengths. Answer why you and your founders are the best people to solve this. Give a short bio for each of your key team members, including relevant experience, accomplishments, education and their role in the company.

Slide 12: Go into more detail on your financials. This should answer questions about your balance sheet, revenue, time to break even, expenses and burn rate. Expect questions on your revenue projections and whether your costs are appropriate. Investors are particularly interested in this slide. It gives them an idea of how much ROI to expect if they invest in your company, and it explains the sum you’re asking for.

Slide 13: How do you plan to use your funds? Go over what you’re raising and where this money will get you in the next 18-24 months.

Which slides in a start-up pitch deck matter the most?

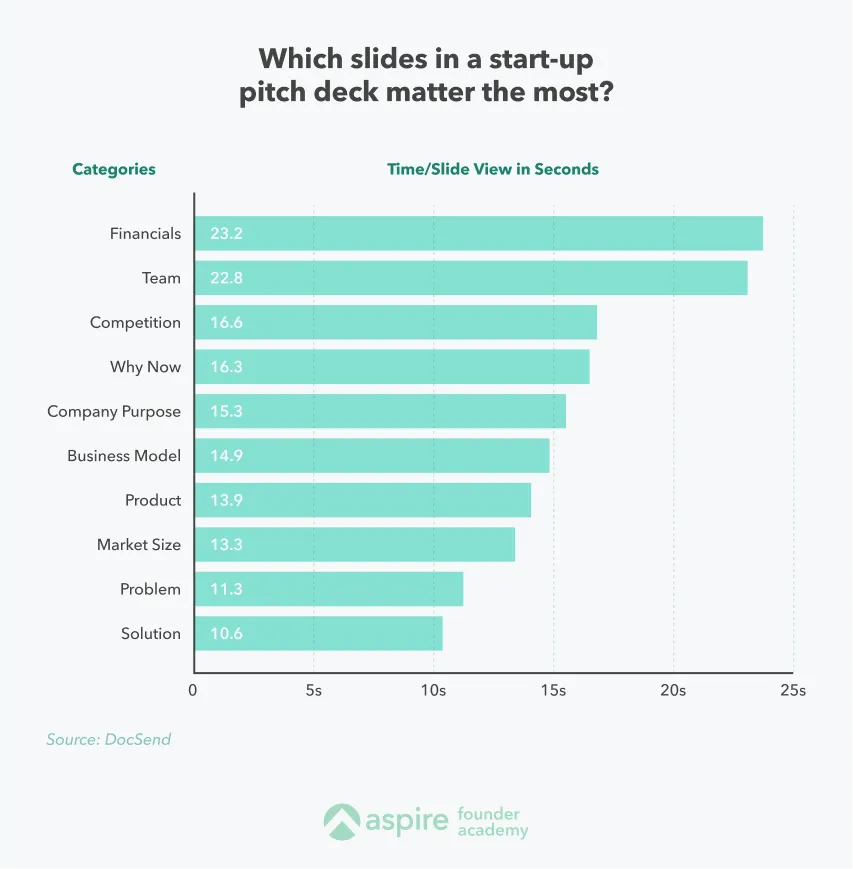

DocSend studied more than 200 pitch decks in 2015 to find out which pages in a start-up pitch deck mattered the most based on how long investors studied them. The most important pages are:

1. Financials: 23.2 seconds

2. Team: 22.8 seconds

3. Competition: 16.6 seconds

Pitch deck best practices

• If you're raising Series A or beyond, provide detailed information about your start-ups capacity to scale and its product-market fit.

• Include an appendix to support your answers during the investor’s Q&A round.

• Create a list of potential questions from investors, and have data or visuals to support your answers in the appendix as reference material. This section will expand as you start pitching and investors develop new doubts and questions.

2. Design

Your pitch deck should support your pitch and not distract people from it. Remember, investors see multiple pitches per day, so you need to capture their attention firmly and keep hold of it for the entire length of your pitch.

Keep your designs simple, your text legible and your point obvious.

1. One idea per slide. Investors should understand each one at a glance, including charts.

2. Use the first few slides to hook the investor and make them want to learn more. Excellent business traction numbers are a great way to do this.

3. Make sure photos have a title and caption.

4. Use large fonts and bold text with high contrast, so your slides are legible from a distance. Use 32-44 point fonts for headers and no font smaller than 30 points for body text or bullet points.

5. Avoid excessive text.

6. Avoid using screenshots of your product in your slides. Instead, simplify your product and make it evident in your slides.

7. Use line charts to indicate growth.

8. Keep your cover and closing slides similar in design for consistency.

9. Headers for all slides should be in the exact same location, font and size. Copy and paste your title throughout your entire deck for consistency.

Refining your pitch and presentation deck

1. Use a proven pitch deck template

There are hundreds of fantastic pitch decks out there for you to repurpose and reuse.

You don't need to reinvent the wheel or be overly creative. Start with a template with a clear structure and customise it with your data, branding and unique style.

2. Hire help or use your in-house team

Work with your in-house team to create your deck. If you don’t have a designer and a copywriter to help you with design and writing, you could either work closely with a freelance talent or hire a consultancy firm that specialises in creating materials for fundraising.

Either way, get involved with the messaging and design. You will be responsible for the pitch results after all.

60+ best pitch deck examples for start-ups

Theory and tips are good to get you started, but sometimes you need to see how it's done. So here are over 60 examples of successful pitch decks you can use and get inspiration from.

- OpenDoor Series A:

- Piktochart’s 30 best start-up pitch deck examples

- Venngage’s 30+ best pitch deck examples

- Facebook’s original 2004 pitch deck

Phase 3: Using your investor pitch deck for success

If you’ve followed the guide closely thus far, you should be well on your way to success.

There are just a few more smaller administrative tasks to make sure you get your foot in the door when meeting a prospective investor.

1. Sending your pitch deck to investors

Here are some logistical tips to ensure your investors see your pitch deck in the best possible light:

• Send your pitch deck in PDF format to prospective investors ahead of a meeting. Make this frictionless. Avoid sending a Dropbox or Google Drive link. You want to make sure your investors read your pitch deck.

• Ensure your pitch deck is updated. Regularly check your cover page, achievements and business metrics. Tip: Avoid including a date on your cover page unless you remember to update it before sending it across.

• Include your confidentiality statement in the footer of each page. For example: “Confidential and Proprietary. Copyright (c) by (COMPANY NAME) All Rights Reserved.”

2. Two more types of pitch decks to prepare alongside your main deck

While your full investor deck should include all the information above, you may also need shorter deck variants for different purposes.

1. The 1-page business blurb: Include the one-line summary of what your business does. Highlight your crucial impact metrics clearly to show your business is doing well. The business blurb is a brief introduction to your company that serves as the hook for a more extended conversation.

2. The teaser deck (3-8 slides): Describe your company's primary business areas, including strengths and weaknesses. Include quick definitions of your team, business metrics, short descriptions of the problem you're solving and your solution. A teaser deck aims to entice your audience to want to know more about your company and book a follow-up meeting.

What to do with your pitch deck?

Crafting a solid pitch deck takes time. Remember, its goal is to support your pitch and help you convey your message visually.

Once you feel comfortable with your pitch deck, it’s time to look for investors. But remember to keep updating your deck as you go.

%201.webp)

.webp)