Summary

You’ve been hard at work growing your start-up, and perhaps you’ve navigated through one or two seed-stage funding rounds.

Things are going well, but you’ve got a great vision for your young start-up. And to realise that vision, you need some fresh investor capital.

It’s time to play with the big dogs and get some Series A funding.

But what does that involve exactly? And how do you know when you're ready? Follow along for a step-by-step guide to finding the right investors.

What is a Series A funding round?

The Series A funding round is also known as the ‘puberty stage’ for companies. It’s a start-up’s first formal encounter with institutional investors and fundraising processes with venture capital financing (VC).

At the Series A stage, investors put money in your start-up in exchange for equity or ownership. It involves more significant funding than in previous rounds, averaging around 15.7 million USD as of June 2020.

.webp)

Getting to Series A can be challenging, however. Fewer than 10% of companies who successfully raise a seed funding round can also secure a Series A investment.

To raise a Series A successfully, you need to show your investors you have product-market fit and exciting growth potential.

Product-market fit means your target customers are actively buying and using your product. They’re also telling other people about how great your product is at solving their problems. Product-market fit is that “magical moment where your customers become your biggest salespeople.”

You know when you’ve achieved product-market fit when you see evident growth for your company and positive feedback from different customers.

Now, if you’re with the successful 10% and manage to raise a Series A round funding, you and your fellow founders will need to give up a percentage of ownership to bring in those new investors.

There will also be significant changes in how you operate your start-up. You’ll need to look at managing a board of directors, scale your working processes and set up a mature organisational structure.

What do you use Series A funds for?

You’ve successfully brought in a few million dollars. Now what? Start-ups typically use Series A funds to expand their business significantly.

Examples:

- Accelerating growth by expanding or doubling down on key customer markets.

- Hiring experts and growing the team.

- Scaling marketing and sales processes.

What do investors get in return?

For putting millions of dollars into your business, investors will receive a portion of ownership or equity of your start-up. They’ll also expect significant returns on their money, estimating a 200% to 300% return.

Expect this to have implications on your business plan and growth goals.

What’s the difference between seed funding and Series A funding?

Seed funding refers to smaller investments in the very early stages of a start-up’s life, while Series A funding is the first big sum of investment money coming in. It’s a huge step forward and that means there are a few critical differences.

1. Series A is more formal

Unlike a seed financing round involving individual angel investors or less formal means of capital like friends and family, Series A funding rounds are dominated by venture capitalists.

You’ll need to follow a documented process to raise a successful round, like participating in investor due diligence, valuation and signing terms sheets.

2. You give up some ownership of your start-up

In return for investing in your start-up, expect to give up about 20% to 35% of your start-up. Your chosen investor will also appear on your company board for the next ten years at least and can influence company decisions. It’s crucial to find an investor that you trust and can cooperate with.

3. You need to show precise business traction and continued results

In seed funding rounds, investors put money into the quality of a start-up’s story and the early development stage team.

Series A expectations are different.

Raising a successful Series A requires you to show how your start-up is an attractive investment opportunity. You need to demonstrate product-market fit and a positive track record. Investors also look for a clear vision with a huge potential to scale.

What about a pre-Series A round?

A pre-Series A round is the mid-round between seed-funding and Series A.

Early-stage companies use the money from a pre-Series A round as a breather to meet short-run needs between two funding milestones.

Investors participating in a pre-Series A can also promise follow-up funds if the start-up meets certain milestones in a specific time.

Pre-series A rounds for early-stage companies usually have a value of 500,000 to 2 million USD.

Step 1: Is your start-up ready for Series A funding?

Getting Series A investors for your start-up will change your life forever.

But let’s not start dreaming yet; it won’t be easy. Finding the right investor to invest the exact amount you need, won’t just happen in a few days. You need to be mentally and financially ready.

1. Do you see significant company traction?

Raising a Series A is about convincing investors that your company is ready to scale enough so they can make money.

To accomplish this, you need proof of product-market fit. For example, with business metrics that show there’s an active market-leading interest in what you have to offer.

These are some of the metrics and tools to look for:

- Growth rates like downloads or number of sign-ups

- Monthly recurring revenue (MRR)

- Customer testimonials

- Achievements: essential product launches or other note-worthy milestones

The good thing is, you don’t need to be profitable at this stage. But your metrics need to show an active market that’s keen on your offer, and there must be a clear opportunity for growth with more funding. Learn how you can create a data room for investors which include all key metrics they look for.

How strong does my business traction need to be before fundraising?

Investors will expect to see associated progress based on these factors.

- How long your company has been in business.

- How effectively you can convey your company’s story in your pitch.

- How much you’ve raised during your seed funding round.

2. Can you clearly explain what your product does and what unique value it brings to the market?

Series A investors scrutinise your product offering or service. Before attempting to raise a Series A, your product or service should have a clear value proposition, potential market, and a defined strategy on how you’re going to serve that market.

You should know your product and business model very well. Show this by preparing concise answers to questions like:

- How does your product work?

- What does your product do?

- Why is your product better than the other potential solutions in this market?

- What kind of value does your product create for prospective customers?

3. Do you have sufficient runway and time to raise funds?

Compared with seed funding, Series A funding follows a well-documented process, and therefore, it can take significantly longer than you expect.

Factor in time for due diligence, follow-ups, finding and meeting investors, and managing the pitch process.

If you can’t leave your business at least partly unattended for a few months, you aren’t ready.

Have at least 8-12 months of financial runway

Make sure you have enough cash to fundraise without having to worry about paying the bills next month. And the months after.

On top of covering your operational costs, prepare for additional out-of-pocket expenses associated with raising funds: Engaging professional services like lawyers, tax advisors and accountants costs an average of 5% of the total funding amount.

Free up sufficient time and mental energy to commit to fundraising

Fundraising is also a significant time commitment if you want to see results.

Expect the fundraising process to be physically and emotionally draining. Fundraising can take up more than half of your day and creative energy.

You’ll need to do this on top of your day-to-day responsibilities related to running your company. Either shift your duties to another co-founder or think of ways to use your limited time in fundraising mode more efficiently.

Step 2: Preparing for a Series A funding round

Feeling ready to get started?

Let’s set you up for a successful fundraising effort. Start with thorough preparation and well-thought-out processes.

In this section, we’ll cover how to:

- Prepare your Series A pitch.

- Create clear and concise presentation decks.

- Proactively communicate with potential investors.

1. Refining your Series A pitch

When you head out there, you often only get one chance to meet with potential investors. And your chances of being rejected are incredibly high.

Why?

Each fund partner makes only 1 to 3 investments a year in start-ups at the Series A level and beyond.

That’s why investors are heedful of any start-up that comes to them asking for funding. Series A investors look for start-ups with the potential to scale to a multi-billion dollar business.

Your job is to communicate that story clearly and credibly while showing you have the determination and plan to get there.

And it all comes down to preparing a pitch that will blow the investor’s socks off.

Your Series A pitch should answer these eight questions:

- What does your company do? Prepare a clear, one-sentence explanation of what your company does. Address this within the first minute of your pitch to help your investors picture the product.

- How ample is your market opportunity? Investors are drawn to significant opportunities. The clearer you highlight the potential of solving this problem at scale, the better your pitch.

- How much traction are you getting now? Highlight your business’s successes and critical achievements here. Aim to describe where your company is going and how it has the potential to scale.

- What can your company do that’s different from the competition? Explain your competitive advantage and why you and your team are the best people to solve this problem in this specific way.

- What are the weaknesses of your company? Take some time to anticipate these questions and have a plan to address possible problems.

- How do you make money? Explain your business model and the different products/services you offer.

- Why should an investor invest in your business? This question brings everything together. Think about how the extra funding will help your business generate future profits for the investors.

- What’s your ask? How much money are you raising, and in what format do you want the money?

In summary, think of your investor pitch as communicating this message:

“I’ve got a fantastic product, and I’m now seeing promising traction in the market. My key customers are super excited about it as it solves their pain points like no one else can. They now actively refer other customers to me. Based on current traction, there’s potential to scale and expand our business significantly in the next 12 months. I explain every step of the process in my documented business plan. To reach this goal, however, I need your support by committing a certain amount of money.”

Use storytelling elements in your pitch and presentation materials

Humans love captivating stories, and pitches delivered as stories can be up to 22 times more memorable than pure data points and facts.

“The average VC receives up to 3,000 start-up pitches a year, and investors spend less than two minutes assessing individual pitch decks in 2020.”

TIP: Prepare your pitch to 70% completeness and practice it with live audiences. Speak to friendly investors and fellow entrepreneurs to test your materials and delivery and refine based on feedback. It’ll help build your confidence before you start pitching.

Preparing a solid pitch deck

Your pitch deck should support your pitch and not distract people from it. Remember, investors have short attention spans, so you need to capture their attention firmly and keep hold of it for the entire length of your pitch.

Sounds daunting?

No worries. Here’s how to make a pitch deck that will keep investors at the edge of their seats.

Structuring your pitch deck content

A good rule of thumb to structure your content is investor Guy Kawasaki’s 10/20/30 rule for PowerPoint decks: 10 slides, 20 minutes and no fonts smaller than 30 points.

The goal is 10 to 12 slides, but there’s room for some extra. However, you shouldn’t have more than 15 slides, even if you need more to show in-depth business traction.

- Slide 1: A clear title slide with your company name, logo and a one-sentence description of what you do.

- Slide 2: Tease your current business traction.

- Slide 3: Describe your problem and opportunity.

- Slide 4: Explain the importance of your solution from your customer’s perspective.

- Slide 5: Explain the solution you provide. Illustrate how your customer uses your product and why that’s valuable to them.

- Slide 6-7: Show your in-depth traction and revenue numbers. Explain how you make money and show your projected growth trends.

- Slide 8: How much is your market worth?

- Slide 9: Show how you’re better than your competition at solving the problem.

- Slide 10: Showcase your vision. Talk about the future and your ambitions for your business.

- Slide 11: Describe your team and their strengths. Answer why you and your founders are the best people to solve this.

- Slide 12: How do you plan to use your funds? Go over what you’re raising and where this money will get you in the next 18-24 months.

It’s also good practice to include an appendix to help support your answers during the investor’s Q&A round.

Write out a list of potential questions from investors, and have data or visuals to support your answers in the appendix as reference material. This section will expand as you start pitching and investors come up with new doubts.

Seven tips for designing a pitch deck that communicates your ideas effectively

- One idea per slide. Investors should understand each slide with a glance, including charts.

- Use the first few slides to hook the investor and make them want to learn more. Excellent business traction numbers are a great way to do this.

- Make sure any photos used have a title and caption.

- Use large fonts and bold text with high contrast, so your slides are legible from a distance.

- Avoid excessive text and bullet points.

- Avoid using screenshots of your product in your slides. Instead, simplify what your product does and make it evident in your slide.

- Use line charts to indicate growth.

Examples of winning pitch decks

Theory and tips are great to get you started, but sometimes you just need to see how it’s done. So here are three examples of successful Series A pitches.

- OpenDoor Series A:

- Piktochart’s 30 best start-up pitch deck examples

- Venngage’s 30+ best pitch deck examples

3. Write a company investment memo

An investment memo is a tool to communicate your company’s fundraising narrative with a written document.

If you can write well, add investment memos to your arsenal to help build relationships with investors.

Sending investment memos before pitching a potential investor is a simple yet effective way to:

- Help decision-makers build conviction around your idea and set the tone for a meeting.

- Speed up decision-making on whether to take meetings or not.

- Align current and potential investors with your business messaging and the progress of your funding round.

- Provide stakeholders with a brief written document to share with outsiders.

Writing a solid investment memo also helps you later on in the funding process. A VC firm that wants to give you a term sheet writes an internal investment memo to help convince other stakeholders. Writing one cuts out a lot of the work for them, and ensures you control the presentation of your company.

Resources to help you write a good investment memo

- A sample template for an investment memo based on Y Combinator’s Series A guide.

- Published investment memos from Bessemer Venture Partners featuring memos from well-known companies like Shopify, Twilio, Twitch, and LinkedIn.

- Vertex Ventures’ retrospective and snippets from investment memo on Grab. They were Grab’s first VC investor in 2013.

Step 3: Finding and meeting Series A investors

You’re now ready to head out and find potential investors for your Series A funding round. Remember, successful fundraising hinges on building trust with potential investors in the long term, so treat the process with the care it deserves.

Aim to start at least 6-12 months before your goal to finish the fundraising process to allow enough time to nurture relationships and determine the next steps for your business.

Where to meet investors?

- Use Crunchbase to curate investor profiles.

- Ask your current seed investors if they know any Series A investors and fund partners.

- Attend start-up events like pitch competitions and start-up demo days.

- Ask your network if they can provide a warm introduction.

- Enrol in accelerator or incubator programs.

How to find the right Series A investor for your start-up?

Finding the right Series A investor happens in two stages:

- Pre-fundraising: Take your time to create a list of potential investors who would be a good match.

- During fundraising: Figure out how to coordinate an exemplary process of scheduling meetings and juggling the needs of multiple potential investors.

1. Pre-fundraising: building a list of potential investors

Build a list of 15-20 investors whom you can think of as potential partners for the entirety of your start-up’s life.

Remember, a Series A lead investor typically buys at least 20% of your company. So they can strongly influence your company’s direction for the next ten years.

If you want to find a suitable partner

- Speak with other founders in their industry. Look for an investor who genuinely helps a business versus one who only provides the money.

- Look what an investor writes or talks about. Have they published anything online? That’s an easy way to determine what the investor likes to talk about.

Next, you need to build relationships with them gradually. Focus on a group of three to five investors at a time for maximum results. Start scheduling casual meetings with these investors once every two months or once a quarter to create an initial connection.

Aim to impress and engage your potential investor without sharing so much about your company that they can fully evaluate an investment decision. Remember that you’re not fundraising yet, just making connections.

How much information about my business should I share during a casual meeting with an investor?

Do: Share high-level revenue and growth figures to pique an investor’s interest.

Do: Be clear to your potential investor about when you’re going to raise money.

Don’t: Share access to your detailed business metrics, full customer breakdown, churn figures or financial projections.

Investors prefer to decide after every meeting with potential investment opportunities if they wish to invest in the company or pass on the chance to look at a new company.

You want to share just enough to pique an investor’s interest so they keep you on their list without making a final decision.

If what you share intrigues an investor and they ask for more detailed metrics, here’s one possible answer:

“Hey, I'm not fundraising right now. I want to build this relationship because when we do go out and fundraise, I want to know if you’re the investor I want to work with….” (Source: Y Combinator)

Focus on keeping these relationships warm and provide updates on your progress so your potential investors can keep you top-of-mind when you’re fundraising.

This process may seem tiresome, but it ensures you have a ready list of strong investors to speak to. You also reduce the risk of getting a term sheet from an investor you don’t want to work with.

2. During fundraising

When you start fundraising, things can get overwhelming. Losing track of your schedule or mismanaging timing can completely ruin your fundraising efforts. You’ll need to stay in touch with different parties and send the correct information to the right people.

To avoid errors, you’ll need a meticulous and systematic project management tool.

Tips for running an excellent fundraising process overview

- Use a tracker to coordinate the process and log meetings. Investor Lenny Rachitsky has a handy Google Sheets template that can help you track all relevant information.

- Group meetings by stage: Introductions, first pitch, second pitch and partner meetings. Each stage should last one to two weeks. Try to let all the interested funds move at the same pace. Ideally, this means investors make their offers simultaneously, making your life easier when evaluating different proposals.

- Avoid dragging out initial meetings: An initial meeting should not take months. If this happens, focus on the investors who are actively responding to you.

- Avoid creating tight deadlines for term sheets: Investors don’t like this unless your company shows tremendous promise.

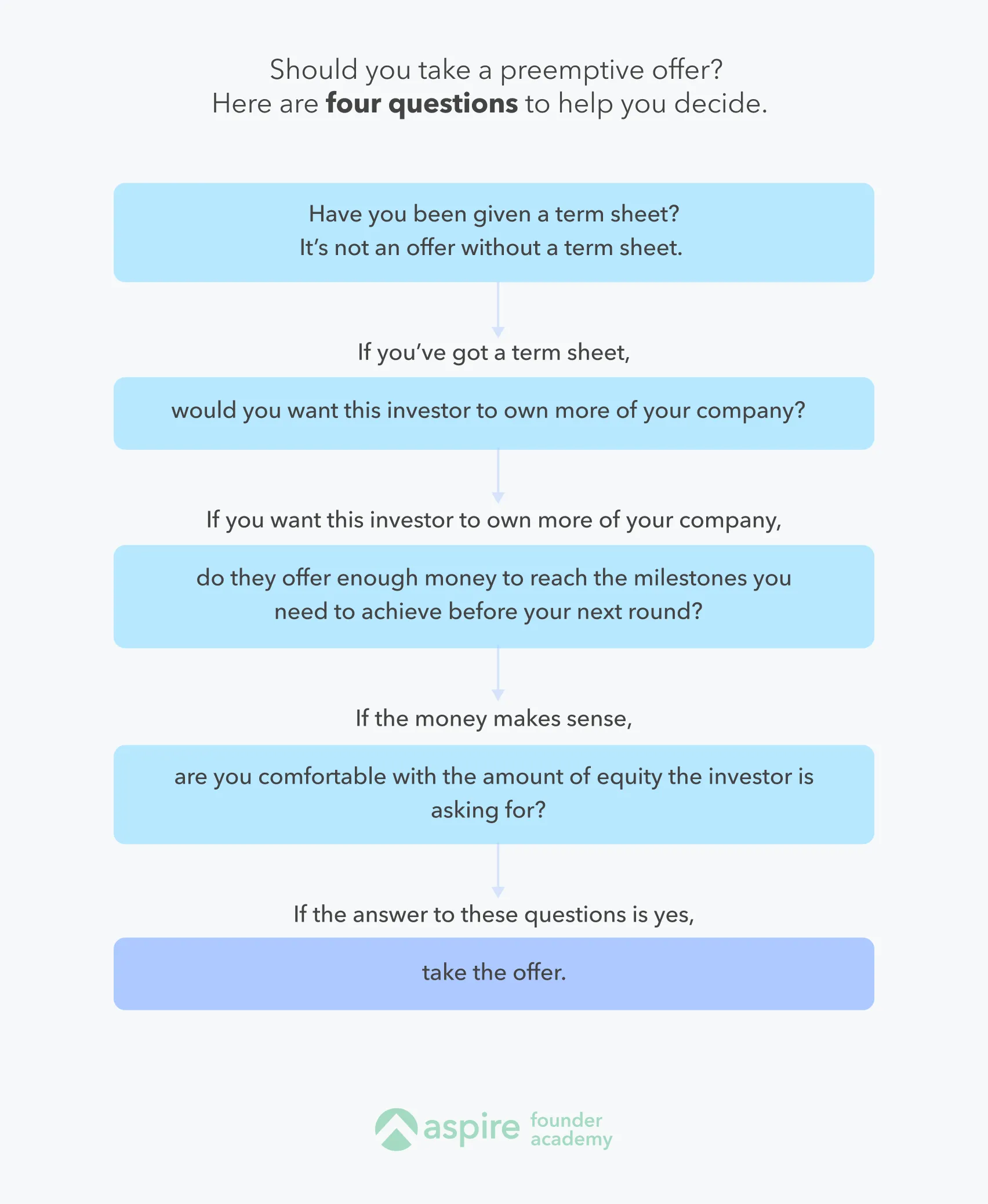

What if you get a preemptive offer from an investor?

Preemptive offers happen when an inside investor offers to invest in your company before a formal fundraising round. An investor gives you a term sheet in a preemptive bid while skipping the usual investor pitching process. They can also tell you that an offer exists verbally without going into further details.

How to choose a good Series A investor?

When you choose an investor, you should always keep in mind that they'll become your partner for the long run, and they can influence the direction of your business. Evaluating them is as crucial as evaluating an additional co-founder.

Some example criteria to help you choose a good Series A investor

- They have expertise in the domain of your company.

- They have existing connections to help you make introductions for either business development or pave the way for your subsequent funding round.

- They are someone you can respect and learn from, and you trust them to get involved with your company.

- They respond to failure or stressful situations in a positive way.

- You can be honest with them.

- You share the same goals, understanding

%201.webp)

.webp)