Summary

Sales forecasting is one of the most important process in a business. Whether your business is in the early stage, or in the process to develop one, it is important to have a sales forecast to better understand how your business will grow in a certain period of time.

So, let's just jump right in! What is sales forecast? How do we forecast sales when we are just about to start a business? This article will further discuss about how to predict sales through sales forecast in simplified explanations.

What is Sales Forecasting?

If you are wondering how the sales of your business will be within several months, or even the following year, this is where the sales forecast plays its part.

Sales forecast is the process of determining the future income of your business during a certain period of time.

This process can be monthly, quarterly, or even annually done, depending on the purpose and needs of the company.

Why is Sales Forecasting important?

For established businesses, forecasting sales is important to determine the growth of the company. Forecasting sales will affect every other area of the business including the company’s cash flow, the number of employees, as well as relationships with investors.

For most startups, sales forecasting helps initiate better and well-informed business decisions. For instance, when you are looking for people to invest in your startup, rely merely on your words won't be enough. You need to present that your business is truly promising through facts and figures. Hence, the sales forecast will do the job for you.

How to Forecast Sales?

There are various methods for forecasting sales. Getting them all in detail might be a little bit confusing for people who are just about to start a business. Therefore, this article simplified sales forecast approaches that can cover different angles, like a display that your numbers have all been thought through. This way you can better convince your potential investors that you have a promising future in your business.

1. Forecasting sales based on similar businesses

If you want to open a conventional business, for example a traditional street-side retail store, you might want to start your sales forecast by finding out the average sales volume for each square foot.

Since your business has just started, or about to start, you do not have your own sales record. For that reason, the simplest approach in forecasting sales is by researching from similar stores with similar locations and sizes. Find businesses and companies that have similar circumstances to your own and use their average sales figure as an illustration for your forecast.

Compared to other long-established businesses, it is true there is a chance your business will most probably have different outcome. Granted that this approach is not entirely accurate, but it is far better than empty figures based on assumptions.

2. Forecasting sales based on location and potential clients

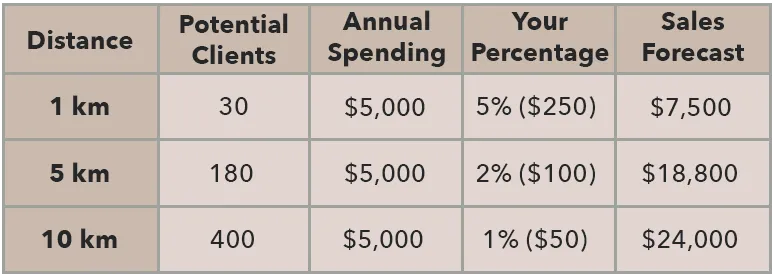

Another approach to predict sales for your startups, is to research potential clients within the area of your business. You can start by finding out how many people will be needing your particular products and services who live within a radius of 1 kilometre, for instance, how much they spend on them in a year, and how much the percentage that you might get in comparison with your competitors.

When you are done with the calculation above, try broadening your area of research and calculate your sales forecast using smaller figures. For example, based on the distance that is accessible from your business location. Here is an illustration:

3. Forecasting sales with a detailed approach

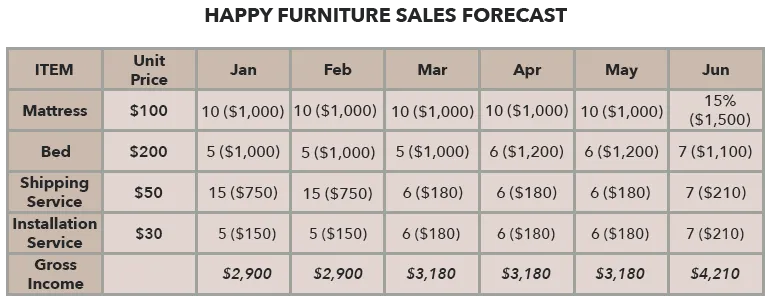

A more detailed sales forecasting approach might be needed for a more complex business that sells multiple products with additional services.

For example, you have a company that sells bedroom furniture with shipping and installation services included. You want to estimate and predict sales during the next six months for each of your products and services. Therefore, you can start by setting a target sales for each product and service, then you calculate your daily gross sales and multiply them by 30 for the whole month.

You can then scale your prediction and build up your sales target gradually for each month. See below illustration:

You can make a complete annual forecast by continuing the above forecast to the end of the year.

Pay Attention

When you are forecasting sales of your company, there are several things you need to take into consideration:

1. Combine multiple forecasting approach

For a better result, try a combination between the above forecasting approaches and create three types of sales forecasts: pessimistic, optimistic, and realistic.

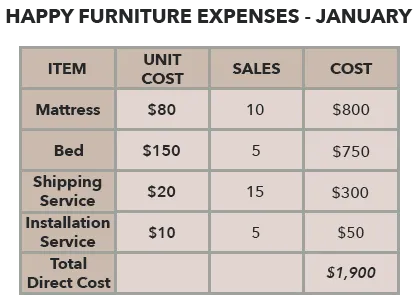

2. Don’t forget to include your expenses calculation

Always calculate your monthly expenses and include them in your forecast to estimate how much profit you can acquire. For instance, in the above case of Happy Furniture, the estimated monthly expenses are as follow:

By including this expenses in the calculation, now we know that Happy Furniture’s profits in January is $ 2900 – $ 1900 = $ 1,000. Please note that direct costs may be different for each business:

- Retail stores: the wholesale price of the product.

- Manufacturer: raw materials, labor, machinery maintenance, etc.

- Service: salaries and other expenses.

3. Use Accounting Software

For easier and more convenient implementation, there is always a software to sales forecast your business!

Finally

Sales forecasting is even more significant in special shopping days, such as the 9.9 and 11.11 Singles Day. Don't forget to forecast your sales before stocking up inventories during these special days.

At Aspire

We envision a world where business owners have fast and simple access to the funding they need to grow. That’s why we’re on a mission to re-invent banking for SMEs across Southeast Asia.

Our current product provides SME and startup owners in Singapore with financial flexibility through a line of credit of up to S$150k. Which, can also be used to make business payments to enjoy 60 days free credit terms.

With no monthly fees or obligations to withdraw, you only pay interest on the amount you end up using. Opening an account is free and can be done online here.

%201.webp)

.webp)