Summary

Thanks in large part to a rapidly growing economy and Singapore establishing itself as a regional, if not global economic powerhouse, the Singapore government has over the last 15 years maintained a stable GST of 7%, an extremely competitive rate, and the lowest in Southeast Asia. However, social, geo-political and economical factors have weighed heavily on Singapore’s economy, resulting in the government’s announcement earlier this year that the GST would be raised in 2023, and subsequently in 2024. With the first increase just over a month away, the clock is ticking for CFOs across the nation to update their financial systems to account for this increase.

The State of GST now

Since the last GST rate hike to 7% in 2007, Singapore has enjoyed strong economic growth for much of that period. However, during this same period, Government spending has risen from S$33 billion to S$75 billion thanks in large part to increased social and healthcare spending, particularly on weathering the impact of COVID-19. Coupled with rising global inflation, market uncertainty and rising global costs of commodities like oil and gas, it was only inevitable that the government would step in and announce a GST increase.

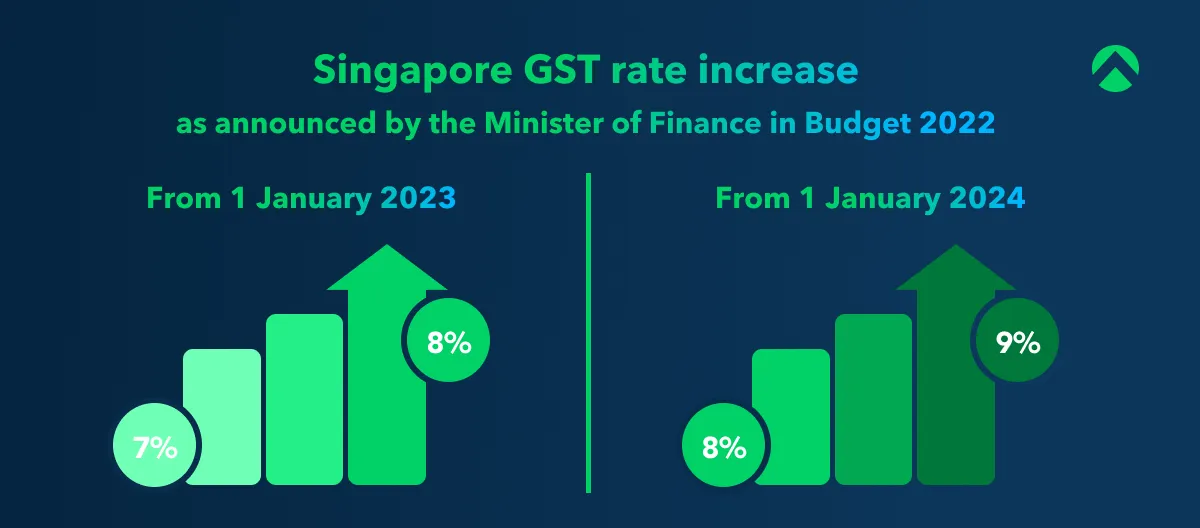

And announce that they did. Earlier this year, at Singapore’s Annual Budget release, Deputy Prime Minister Lawrence Wong announced a staggered increase of GST, to 8% from 1st January 2023, and 9% from 1st January 2024.

What This Means for Businesses

Increase in Inflation

While there is never a “good time” to raise taxes, a hike is generally seen to be more acceptable during a period of economic growth and renewed consumer spending.

Though inflation is already projected to average 6% in 2022, the raising of GST is likely to bloat inflation rates through at least the first half of 2023 as businesses and consumers adjust to the new rates. While the initial increase will be met with some market uncertainty, it will help benefit businesses in the long run as the economy stabilises. HSBC estimated that a 1 percentage point GST hike would add 0.5-0.7 percentage points to headline inflation in 2023 and 2024. Hence a 2 percentage point hike in the GST, even staggered, could push headline inflation up by another 1 per cent or more.

Impacting Consumer Spending, and Business Revenue

A GST tax hike impacts both consumers and businesses in different ways. As a tax on domestic consumption, GST is ultimately a tax on customers. Therefore, a GST-registered business, though directly liable to the Monetary Authority of Singapore (MAS), may collect the tax from its consumers.

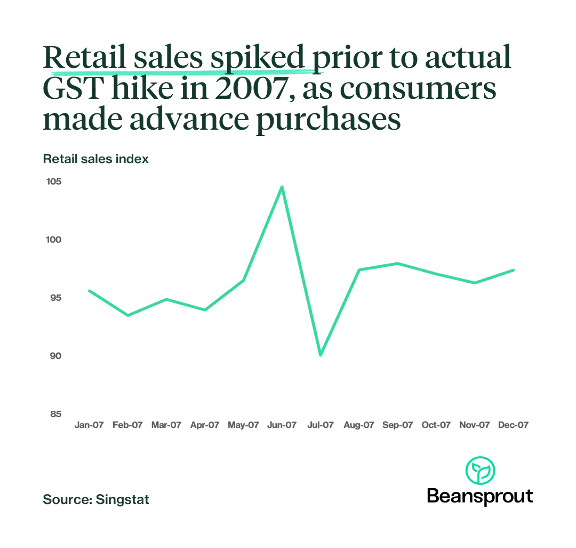

While the most obvious effect would be lower consumer spend at the beginning of 2023 as consumers would become more cost-conscious about big purchases, it is highly likely that consumers would move their big purchases forward to the final month of 2022, to capitalise on the lower GST before the hike is implemented. This was the case for much of retail sales in 2007 prior to the last launch, and was even more apparent in luxury services, where a single percentage increase in tax could turn out to be hundreds of dollars.

More cost pressure on SMEs

GST costs by themselves have a direct impact on the bottom line unless they can be recovered as input tax credits under GST rules. Therefore, an increased GST rate would result in a corresponding rise in business expenses. For smaller businesses already worried about rising costs of operations and resources, having to deal with increased taxation is never welcome news. These very businesses will need to find ways to optimise their expenses if they are to mitigate this increased cost of operation.

Regardless of your business size, it's never too early to begin preparing for this increase. Some early adopters have already begun transitioning their finance processes and workflows, which will go a long way in ensuring your business remains compliant with this increase. With just over a month left till 1st January 2023, if you haven’t already, start the transition now.

Must-dos for GST Compliance

Update Your Systems

One of your first steps should be an audit and review of your current finance management stack or finance management processes. Ensure that whatever system you are using has been updated to account for an 8% GST instead of the current 7%. If you are currently partnered with a finance management platform like Aspire, updating your systems should be easier due to the strong integration these platforms have with accounting tools. Speak to them about ensuring that you both are on the same page, and that your systems are ready-to-go from 1st January. More often than not, these partners should already be intending to push out an update or patch to ensure that your finance operations will remain compliant when the switch occurs.

If you are managing your own finance stack, fret not. Start reviewing now if you haven’t already to avoid penalties being imposed for non-compliance. You’ll want to focus on some key areas:

- Invoicing - Ensure that on all invoices issued by your company, GST is listed at 8%, and take into account the transitional time of supply rules.

- Payables - On the flip side, ensure your accounts payable workflows, processes and systems are set up to account for the new increase and transitional time of supply rules, and flag invoices received that still cite the old 7% rate.

- Price Display - For product-based businesses, ensure all price displays (physical or e-commerce based) to the public reflect the price inclusive of the new GST. Prices that are quoted, whether written or verbal, must be GST-inclusive.

Review Existing Contracts with Current Partners/Suppliers

While estimating the cost of a GST hike will be fairly straightforward for businesses when dealing with single-purchase items, it can get confusing when dealing with existing partnerships with vendors, particularly on yearly SaaS subscriptions or long term contracts on goods and services. In situations such as these, it’s always best to contact your vendors directly to clarify how the GST increase will impact your contract or partnership, and if any actions need to be taken by your business to adapt. Some vendors may update their systems directly with no involvement, and only require businesses to perform updates themselves using available self-help materials provided by the vendor, but other changes may be more complex.

As mentioned above, ensure these measures, agreements and contracts are in place before 1st January to avoid confusion or risk of non-compliance.

Voluntary GST Registration

Generally, businesses are only liable for GST registration if they make taxable income in Singapore exceeding S$1 million a year, or are projected to do so over a 12 month period. Non-GST registered businesses are generally not required to register for GST, and forgo the need to transfer that cost to their consumers.

On the other hand, non-GST registered businesses have no means to recover the GST incurred on their own business expenses, subscriptions or contracts. As a result, the dollar cost of their spending could increase in tandem with the GST rate hike. Instead of absorbing or passing the irrecoverable GST costs to their customers through price increases, such businesses could opt for GST registration voluntarily to recover the GST incurred on their business expenses. This is, however, not a silver bullet by any means. Apart from the need to put in place systems and processes to comply with the GST rules, there is also a need to consider the impact of GST on pricing. This decision should come down to a cost-benefit analysis.

Additional Measures

Introducing additional controls to manage the GST risks arising from the transition to the new GST rate is never a bad idea. Foundationally, conducting a few awareness or training sessions on the increase will go a long way in both onboarding the idea within your organisation, and ensuring they will be prepared for 2023.

If your organisation is large enough and you have the resources to spare, consider forming a GST transition task force to oversee the transition. Reporting to the task force head (ideally, the CFO), this task force should include members of your finance team, sales department, operations/product teams, and IT team. This task force can provide dedicated effort to your transition, making the process as smooth as possible.

Why GST Compliance Will be Important Moving Forward

By 2024, a 9% GST will likely make this tax the next largest contributor to our tax coffers, second only to corporate income tax. Its contribution can only grow over time given the broad tax design of the GST system, coupled with Singapore’s emphasis on business-friendly corporate tax policymaking. A logical conclusion would be to expect increased scrutiny by MAS on GST compliance moving forward.

Along with increased scrutiny, businesses found to be non-compliant, whether intentionally or unintentionally, should expect harsher punitive measures to be levied out. Scrutiny and non-compliance penalties are likely to scale even further as additional goods and services likely fall under GST purview from 2023 onwards, GST the subject of much focus for both government and business alike throughout 2023 and 2024.

In essence, the time to begin preparing for the impending GST increase was months ago, but if you haven’t, it’s not too late to start.

.webp)

.png)

%201.webp)

.webp)