Summary

So... your Shopify store's doing really well. You're making a tidy profit, and you're thinking of expanding. Having done your market research, you've honed in on a new country where your product offering will rake in that revenue.

If that's a scenario that applies to you, we have two things to say to you:

1) Congratulations, and

2) You're in luck! Here are 6 tips that will take your online store international— and the Shopify apps to help you along the way.

1. Support multiple languages

This might sound self-explanatory, but people won't buy if they can't understand what you're selling. So how can you tailor your site's content for a localised audience? Speak their language, of course! It might sound painstaking to pen a new script in a different language, but it's a step worth taking when you're breaking into a new market.

Here's the easiest way to do it: Create a copy of your store on a new domain or subdomain for your target locale. Hire a native writer to translate the copy for your online store, or for a speedier Shopify app fix: try Langify or Weglot. Just double back to make sure your business branding is consistent— so nothing gets lost in translation.

And be sure to skip the auto-translate! Google penalizes websites that use obvious machine translations, so it's not worth taking the shortcut. (Also, there's nothing more anti-climactic to a grand entrance than tripping over tongues... and falling flat.)

For the coding wizards out there, Shopify also supports selling in multiple languages from a single online store. The Admin API allows you to create and retrieve translated content for Shopify resources.

2. Support multiple currencies

Of course, another way to customise the customer experience is by supporting multiple currencies. Think like a potential buyer: Imagine seeing something you like online... with a listed price of 7000 RPH. Do you like it enough to go through the trouble of converting it to your currency, and purchasing it in another?

Don't make your customers ask that question... you might not like their answer! After all, you're not just aiming to cross their purchase intent threshold, you're trying to lower the barriers to purchase altogether. That doesn't just mean enabling currency conversions, but also accepting multiple currency payments. After all, paying in a different currency can get messy, and is often more expensive than the customer's local currency.

The good news for Shopify Plus merchants: Shopify Payments’ latest global feature lets your shoppers both browse and checkout with their native currency (which will be auto-selected by location), while you get paid in your local currency. Find out how to enable multiple currencies here.

For non-Shopify Plus sellers, you can also consider third-party apps like Auto Currency Switcher and Bold Multi‑Currency.

3. Provide multiple payment options

Speaking of checkout, it's important to remove as much friction as possible at such a critical last step in the customer journey. That's why Shopify merchants need to make a variety of payment methods available to their international customers at the point of sale.

Offering multiple payment gateways lets interested buyers opt for their preferred payment method, no matter their location. Credit cards might be the most conventional option in your native country, but that might not apply universally; bank transfers or electronic payments might be used more often in another target locale.

Look out for up-and-coming payment providers to add to your online store's payment options, like AirWallex and PayPal alternative TransferWise.

4. Work with local shipping partners

It's important to do your research here. Depending on where your shipments originate, there are tons of local or regional fulfillment and shipping services out there, so try shopping around! Working with multiple logistics partners to serve your new market will give you the leverage to provide the most competitive shipping rates for your customers.

It's a good idea to provide a range of shipping options, since some consumers are going to be willing to pay a premium price to get their item safely and quickly. For instance, a customer shopping for a last-minute birthday gift would likely opt for next-day delivery and international tracking.

Check out Shopify apps like Easyship to compare shipping rates.

5. Give yourself some credit

... Because you're doing great. And now, you can do even better.

How? Read Tip #5 again.

As we've previously covered, expansion is the perfect reason to get a business loan. After all, scaling your online store internationally comes with necessary expenditures: translating website copy, offering more currencies, payment methods, and shipping partners, and of course, purchasing inventory and launching marketing campaigns to serve a new market... these necessary steps come with necessary price tags.

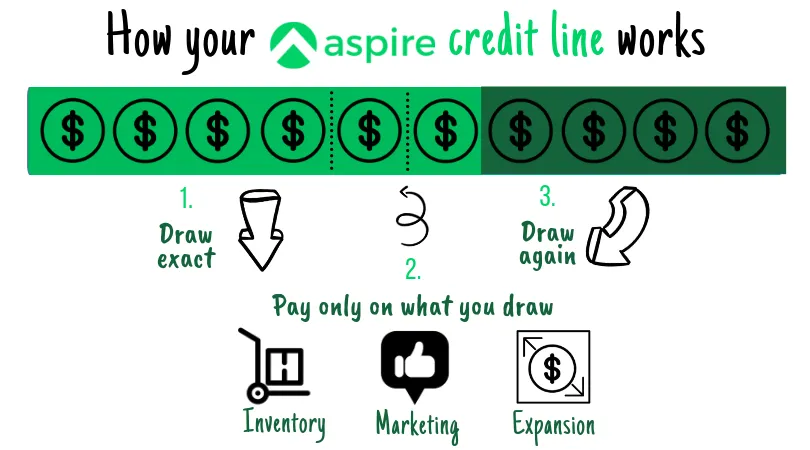

Even with the success of your native store, it's rare to be able to cover the full expenses of expansion upfront. Since entering a new market can incur unpredictable costs, opt for a revolving line of credit instead of a standard term loan, so you can draw down whenever you need. Check out a small business lender like Aspire for a funding solution.

In sum

The beauty of owning your own online store is its ability to scale up rapidly, so capitalise on that advantage. The world is your oyster! Carry these 5 tips and Shopify apps with you on your entrepreneurship journey... as you take your business global.

Good luck, and bon voyage!

When Should You Get a Business Loan?

4 Things You Can Expect When You Borrow from Aspire

The FinTech Revolution: Filling the Small Business Loan Gap in Singapore

%201.webp)

.webp)