Summary

What Is a Merchant Account?

A merchant account is a specialised business bank account designed to receive electronic payments from your customers, such as credit or debit card transactions. It acts as a temporary holder for the funds from these transactions before depositing them into your business bank account.

Needless to say, you must already have a business account to get a merchant account. So, ensure you have a business account before you apply for a merchant account.

Now that you know the meaning of merchant account, let's see how it actually works.

How Does A Merchant Account Work?

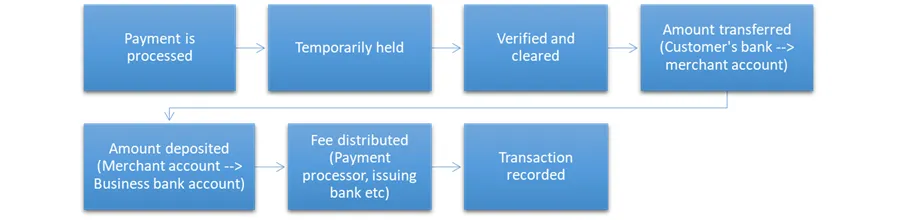

Here's how a merchant account typically operates:

- Accept Payments: With a merchant account, you can accept electronic payments from customers using credit or debit cards.

- Hold the Funds: When a customer makes a purchase, the payment details are sent to the payment processor, and the funds from their card payment are temporarily held in your merchant account. This ensures the payment is valid and enough funds are available.

- Await Verification and Clearing: The payment processor checks the transaction for validity and confirms whether the customer's bank has sufficient funds to cover the purchase. This process is known as verification and clearing. If everything is in order, the transaction is approved for processing.

- Accept Funds: After verification, the payment processor initiates the transfer of funds from the customer's bank (issuing bank) to your merchant account. The duration of this transfer may vary depending on factors like the type of card used and the customer's bank.

- Transfer Funds to Business Account: Once the funds are successfully transferred to your merchant account, they are deposited into your designated business bank account. Before depositing, the payment processor or the merchant acquiring bank deducts any applicable fees or transaction costs.

- Fee Distribution: In each transaction, various parties are involved, including the issuing bank, card networks, payment processor, and merchant acquiring bank. Each party may charge a fee for their services. The merchant account ensures that these fees are accurately distributed, and you receive the net amount after deducting fees.

- Transaction Records: Your merchant account records all transactions processed. These records are essential for tracking sales, managing refunds, handling chargebacks, and reconciling your finances.

Payment Processors vs Payment Gateways vs Merchant Accounts: Understanding the Differences

Payment processors, payment gateways, and merchant accounts each have their own unique functions.

Now that you understand the differences between a merchant account, a payment processor, and a payment gateway, let's see how these three work together.

How Does a Merchant Account Differ From a Business Bank Account?

A merchant account deals with electronic card payments for your business. It temporarily holds the funds before moving them to your business bank account. So, a merchant account primarily focuses on securely managing customer card payments.

On the other hand, your business bank account is the central hub for managing all business finances. You can use it for day-to-day operations, including receiving payments from multiple sources. Moreover, a business bank account manages and allocates funds for different business expenses, including supplier payments, employee salaries, rent, utilities, and other operational costs. Unlike a merchant account, a business bank account has a bigger role and manages all aspects of your business's finances and transactions.

What Are the Benefits of a Merchant Account?

With a merchant account, you can receive various payment options, including credit cards, debit cards, and mobile payments. This means you can cater to a broader range of customers and provide them with convenient payment options. Accepting card payments reduces the need for handling cash, making your business operations more efficient and secure.

This account simplifies your accounting process by grouping transactions and depositing them to your business account in a single deposit. This is especially helpful when you have multiple transactions per day. This makes it easier to track your business' cash flow.

A merchant account allows easy integration with your e-commerce platform, making payment processing a breeze for your online customers. The money held in your merchant account can also act as a safety net for uncertain situations as it allows you to handle refunds or chargebacks without directly impacting your business bank account

A standard payment process (without a merchant account) might involve higher fees and risks. But with a merchant account in place, you can streamline payment processing, save on fees, and gain your customers' trust.

With a merchant account, you can perform fraud checks when necessary. Suspicious payments can be flagged before they reach your business bank account. This can save you from hefty transaction fees and secure your finances.

Does Your Business Need a Merchant Account in Singapore?

You have different types of business accounts to choose from, but how do you know which one you need? Here's a simple way to determine if a merchant account is right for you.

Answer the following questions:

- Do you want to accept customer credit/debit card payments?

- If yes, it may be smart to apply for a merchant account right away.

- Are you running an online store or planning to start one? -

- If yes, you definitely need a merchant account for handling online payments.

- Have a physical store and want to offer card payment options? -

- If yes, a merchant account makes in-person transactions smoother.

- Want to expand your business and offer more payment choices? -

- If yes, a merchant account can help with that.

- Need to build trust and professionalism? -

- If yes, having a merchant account adds credibility to your business.

- Want an efficient payment process with quick fund transfers? -

- If yes, a merchant account is the way to go.

- Using e-commerce platforms or payment gateways? -

- If yes, a merchant account is usually required for smooth integration.

- Dealing with a high volume of card transactions?

- If yes, a merchant account can save you money on processing fees.

What Are the Prerequisites for Setting up a Merchant Account?

Here are the merchant account requirements in Singapore:

- Company Registration: Ensure your company is incorporated with the Accounting and Corporate Regulatory Authority (ACRA).

- Business Bank Account: Have a valid business bank account in Singapore. This account is intended for receiving payments from your merchant account.

- Necessary Documents: You may need to submit the necessary documents, including:

- Merchant account application form

- A scanned passport of the person representing your company

- Your company profiles and incorporation certificate

- Business bank account information

- Financial Stability: Some providers may check your business's financial stability and credit history before approving your application.

- Track Record: A good payment history and a low chargeback rate with previous merchant account providers can help your application.

- Nature of the Business: Some providers may have restrictions based on your business type. High-risk industries might need extra scrutiny.

- Payment Methods: After approval, set up payment processing with the provider. Depending on your payment channels and needs, integrate payment processing software with your website or point-of-sale system.

By getting these things in order and choosing the right provider, you can apply for a merchant account in Singapore and start accepting electronic payments for your business.

What Steps Should You Take To Choose the Right Merchant Account Provider?

To find the perfect merchant account for your business, follow these steps:

- Assess Your Business Needs: Evaluate your payment requirements, transaction volume, and the payment methods you want to accept.

- Compare Fees: Look into the merchant account fees charged by different merchant account providers, including transaction fees, setup costs, monthly fees, and additional charges.

- Payment Processing Time: Check how quickly the provider processes payments and transfers funds to your account, which can impact your cash flow.

- Contract Terms: Review the contract terms and understand any restrictions, cancellation fees, or contract lengths before deciding.

- Safety Protocols: Ensure the merchant account provider provides strong security features, including encryption and fraud detection, to safeguard your business and customers.

- User Experience: Consider how easily the merchant account integrates with your existing systems, like your website or point-of-sale setup.

- Credibility: Examine the merchant account provider's standing by perusing reviews and testimonials shared by other businesses.

- Customer Support: Look for a reliable provider you can easily reach in case of any issues or inquiries.

- Growth potential: Select a merchant account capable of scaling alongside your business and adjusting to your evolving requirements.

- Regulatory Compliance: Ensure the provider complies with industry standards and regulations relevant to your business.

How Does Aspire Assist in Managing Customer Payments?

With Aspire's receivable management solution, you can access an efficient platform to manage receivables, streamline payment processes, and maintain a healthy cash flow. The robust safety protocols ensure secure transactions, and the user-friendly interface makes tracking and collection easy.

Our advanced reporting provides valuable financial insights, benefiting businesses of all sizes and promoting better financial control and overall growth. It allows you to limit the number of payment options you offer. Focusing on a few cost-effective payment methods can reduce transaction fees and simplify your financial operations.

With Aspire integrated into your accounting software, you can accelerate your book-closing process. It offers seamless synchronisation with most major accounting platforms. You can also integrate your account with online platforms, giving you access to your E-commerce or SaaS revenues in advance.

Aspire also offers a reliable payment link solution. This user-friendly feature allows you to create secure payment links for convenient customer transactions. Furthermore, our interface lets you monitor payment activity to make informed financial decisions.

%201.webp)

.webp)