Summary

After each shopping spree, you can bet a paper will be waiting for you. It's got a detailed list of everything you picked up and the total cost. That's the bill. But here's the thing – it's not just for shopping; this document is pretty important. Some might even refer to them as invoices, receipts, etc. But while they all mean the same to you when shopping, do they work the same way for your business? If yes, why the different names? In this article, we explore the significance of each of these documents for your businesses.

Let's start with what is an invoice.

What Is an Invoice?

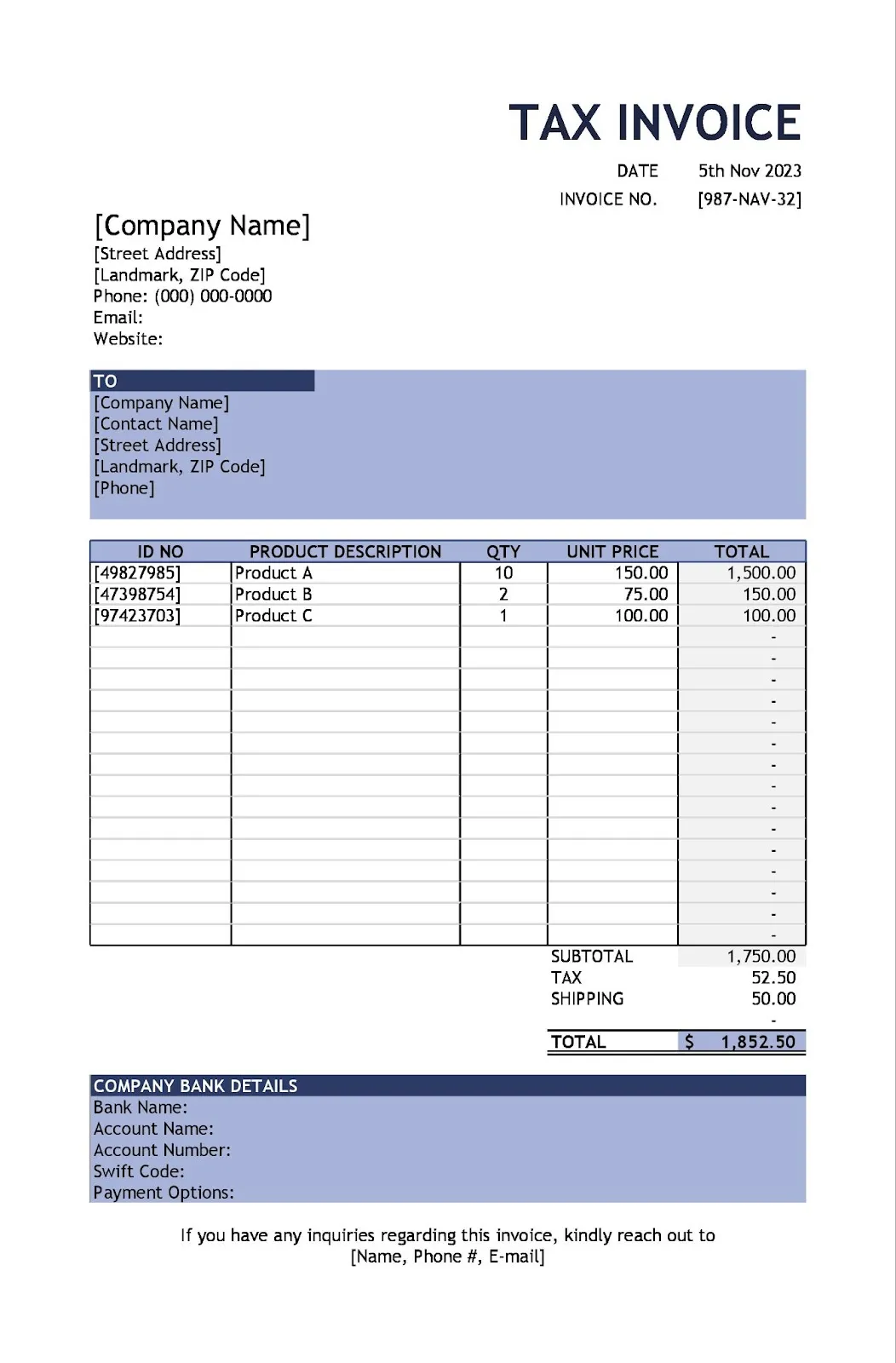

An invoice operates as a formal communication tool with esteemed customers, signifying their obligation to settle payments for goods or services you’ve offered. It functions as an official request for payment, playing a vital role in concluding a successful business transaction. Through its detailed breakdown of charges and specified payment terms, the invoice serves as a critical documentation step, ensuring clarity and formality in financial transactions between your business and the client.

An invoice warranting attention encompasses precise identification details, a unique invoice number for systematic tracking, a clearly defined timeline specifying the issuance date and payment due date, a comprehensive breakdown of the goods or services rendered, and the total amount due.

If your business is subject to sales tax regulations, the invoice seamlessly transitions into a tax invoice, incorporating essential tax-related information.

When Is an Invoice Used?

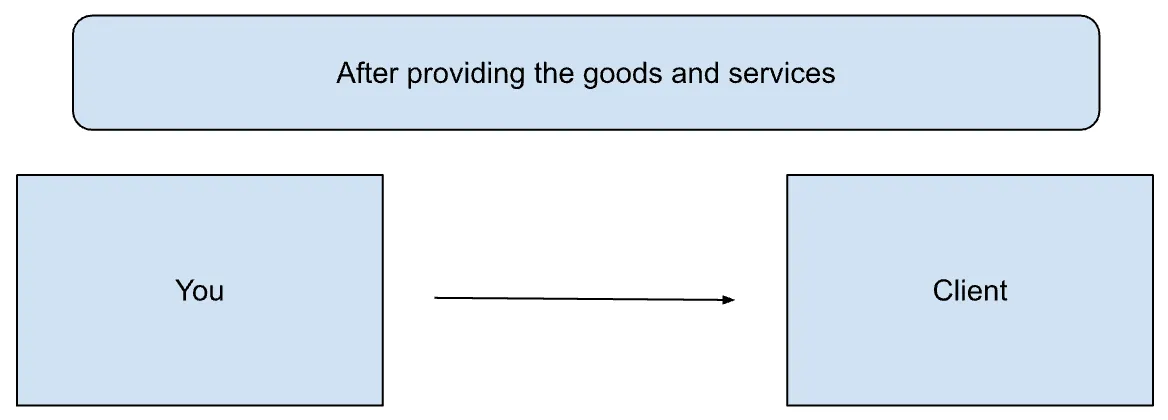

Invoices are usually issued after the delivery of products or completion of services. Sometimes, an invoice might be issued for goods before or simultaneously when the buyer receives the products. If it's a service, invoicing commonly occurs just before or right after the service is completed.

Regarding delivery, the invoice can accompany the physical product or be sent digitally via an invoice email. However, in some instances, a physical copy may be mandatory for proper accounting.

What Is the Importance of an Invoice in Business?

Facilitates Smooth Transactions

It serves as an official document asking your customer to pay for the goods or services you've provided. It establishes a formal understanding of the financial transaction. By issuing invoices, you create a systematic payment approach, helping avoid confusion and disputes. It sets a clear path for financial transactions.

Record-Keeping

Invoices are crucial for keeping track of your sales and income. They provide a detailed transaction record, which is essential for financial management and reporting. They serve as tangible evidence of the goods or services exchanged. They offer proof of your sales, which benefits you and your customers.

Business Relations

Sending invoices shows that you have organised and formalised procedures in place for your business. They also provide customers with a clear breakdown of costs and terms, fostering trust in your business.

How to Write an Invoice?

While there aren't strict standards for formatting an invoice template, adhering to best invoicing practices and maintaining a consistent template is crucial for timely payments. The following information is imperative for a straightforward and professional invoice:

- Business and customer's name and address

- Unique invoice number

- Date of issue

- Payment due date

- Detailed breakdown of goods or services sold

- Total amount due, inclusive of taxes and fees

- Payment term and accepted payment method

- Seller's bank account details

By including these details, you not only ensure clarity in transactions but also pave the way for a smoother payment process.

Example of an Invoice

What Is a Purchase Order (PO)?

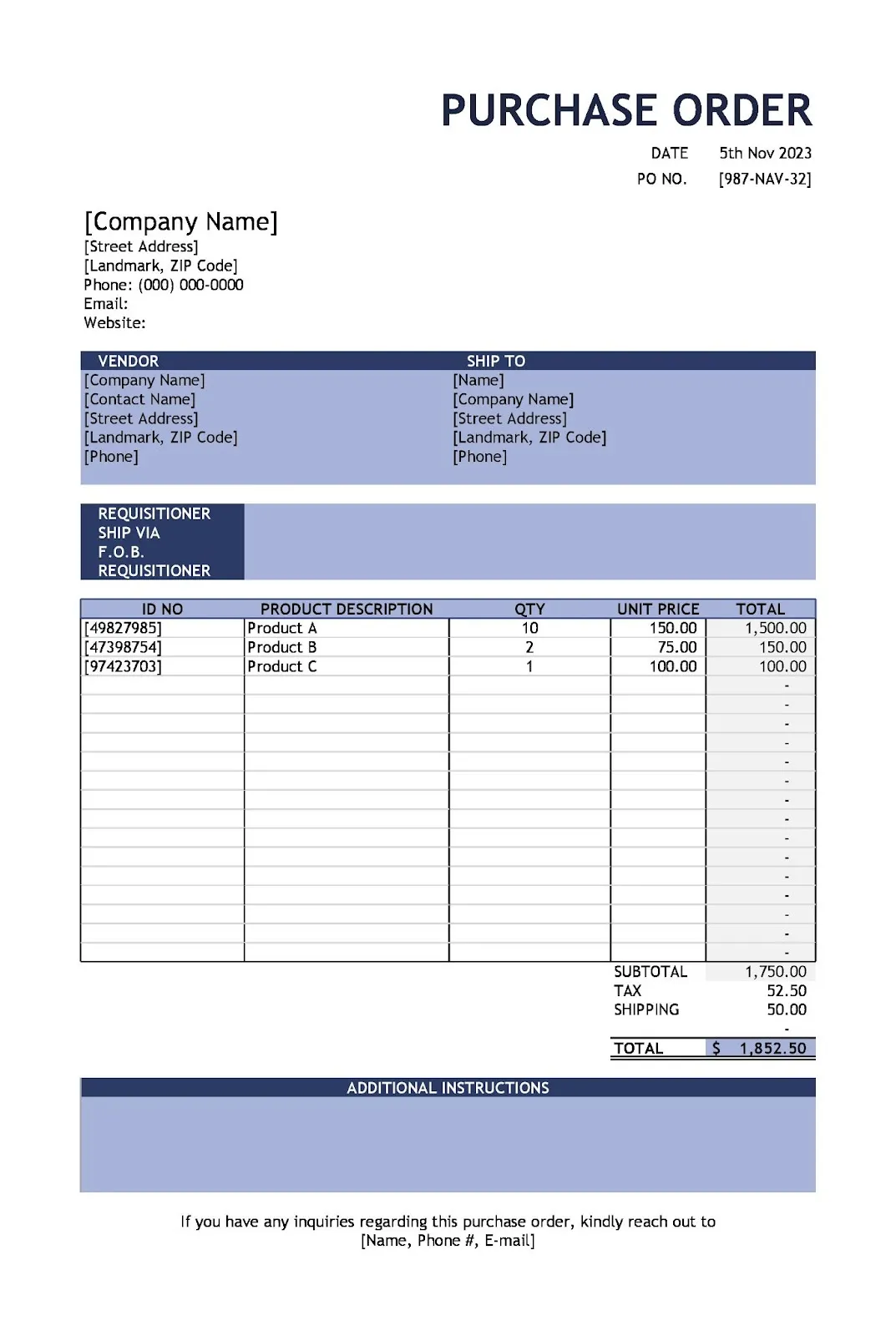

It's essentially a document that you, as the customer, send to the vendor when you're making a purchase. Its purpose is to communicate clearly with the vendor what goods or services you need, the quantities required, and the agreed-upon prices. Think of it as the formal and legal way to solidify your order with the vendor, ensuring that there's no room for misunderstandings. Sending a purchase invoice or order is a straightforward and official step to finalise your agreement with the vendor.

When Is a Purchase Order Generated?

A buyer generates a purchase order to initiate a request for goods or services from a seller. It is created before the actual transaction takes place and outlines the purchase specifics, such as quantity, price, and delivery terms.

Why Is Purchase Order Important in Business?

There are several compelling reasons to use a purchase order:

- Ensure clear communication with suppliers by using purchase orders to convey your needs precisely, minimising the need for back-and-forth calls or emails, and ensuring everyone is on the same page.

- Streamline your internal processes by involving multiple teams like accounting, procurement, and finance; purchase orders can serve as a centralised reference point during invoice processing, simplifying coordination and reducing confusion.

- Facilitate audits by using purchase orders as tangible proof of expenses, aiding auditors during audit trials and providing a transparent record of your financial transactions.

- Ensure legal protection for both you and the vendor in the absence of a formal contract by relying on the details outlined in the purchase invoice and establishing a clear understanding of the agreed-upon terms.

- Inform your budgeting decisions by using purchase order details to provide a comprehensive overview of your company's requirements, helping you control spending and avoid exceeding necessary expenditures.

How to Write a Purchase Order?

As a business owner, regardless of the format you opt for, a purchase order should incorporate the following essential details:

- Purchase Order Number and Issue Date: Essential for tracking purposes, include a unique PO number and the proper date.

- Company Information: Mention comprehensive company details, encompassing contact information for both the requisitioner and the vendor involved in the transaction.

- Order Details: List the specifics of the order, including item numbers, detailed descriptions, associated costs, and the quantities required.

- Shipping Instructions: Mention the guidelines for shipping, potentially indicating the Free on Board (FOB) shipping point, denoting the stage at which the buyer assumes responsibility for shipping costs.

- Authorisation Stamp and Signatures (Optional): Include authorisation stamps and signatures to formally accept the agreed-upon order, encompassing any specified terms and conditions.

Example of a Purchase Order

"Are invoices receipts?"; “What’s an invoice vs receipt?” - These are some of the most common queries. You are already familiar with the concept of an invoice. Now, let's understand what receipts are and how they are different from invoices.

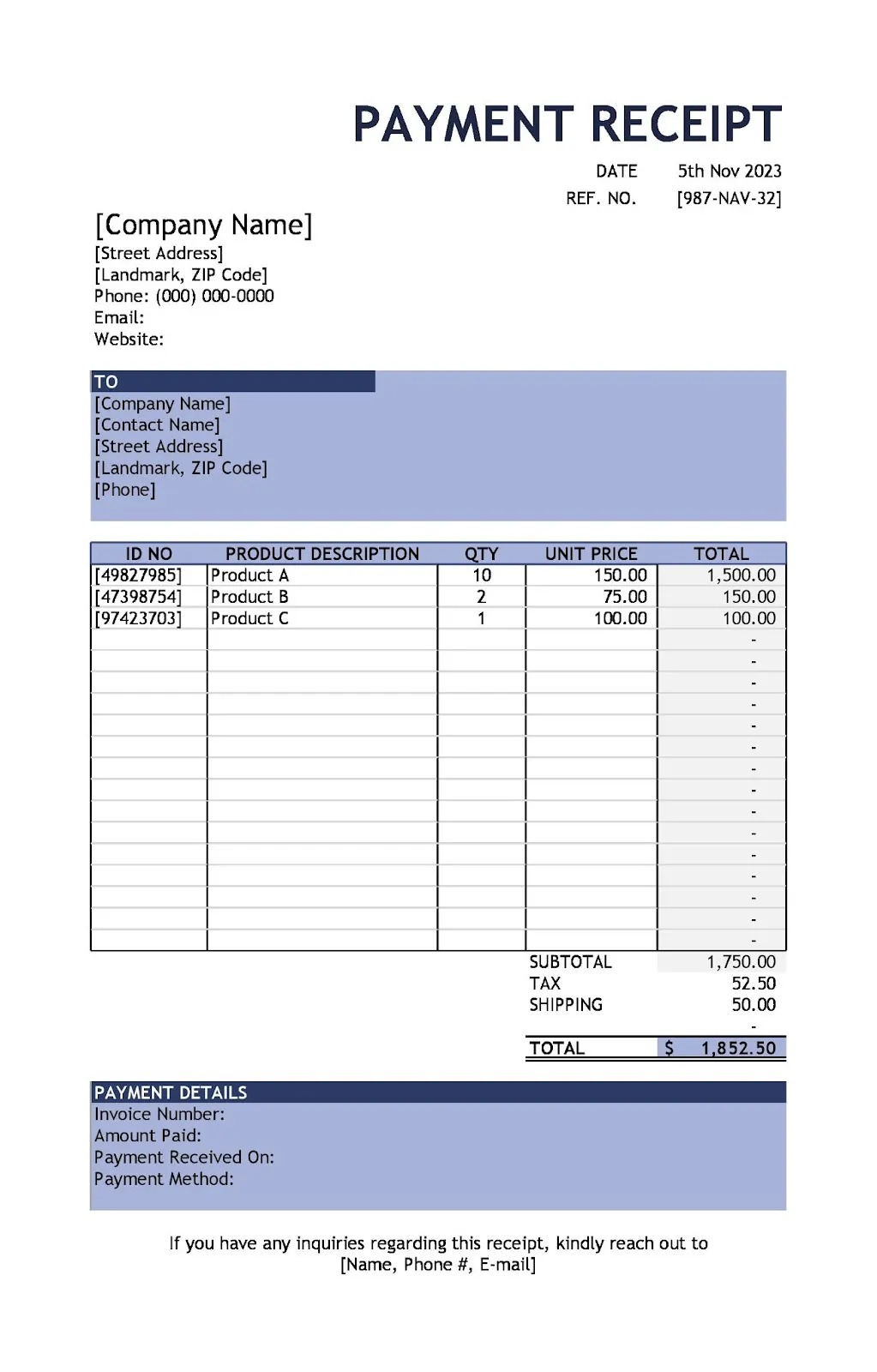

What Is a Receipt?

A payment receipt (or simply a receipt) is a formal document your business provides to customers after they have paid for goods or services. Its main purpose is to serve as evidence of the completed transaction, confirming that the client has fulfilled their payment obligation. Both you and your client benefit from this document, as it validates the financial transaction.

When Is a Receipt Generated?

In your business, receipts are generated at the point of sale or when payment is made. You issue them to the buyer as proof of payment, acknowledging that payment has been received and often including transaction details.

What Is the Importance of Receipt in Business?

The use of receipts in business holds significant importance for the following reasons:

- Transaction Documentation: Receipts are crucial for documenting completed transactions as they provide a clear record of payments received.

- Proof of Payment: Acting as tangible proof of payment, receipts offer both businesses and customers a reliable record of financial transactions, aiding in dispute resolution.

- Financial Record Keeping: Receipts contribute to meticulous financial record-keeping, facilitating accurate accounting and simplifying the tracking of revenues.

- Legal Compliance: Issuing receipts ensures compliance with legal and regulatory requirements, enhancing transparency and accountability in business operations.

- Customer Relations: Providing receipts enhances customer relations by offering professional and transparent documentation of their financial interactions with your business.

How to Write a Receipt?

When crafting a receipt, it is essential to furnish a clear and detailed record of the transaction. As a business owner, make sure your invoice receipt incorporates the following critical information:

- Business Information: Include your business name, address, phone number, and any other relevant contact details.

- Receipt Number and Date: Assign a unique receipt number for tracking purposes and include the transaction date.

- Customer Information: Include the customer's name and, if applicable, their address.

- Description of Products/Services: Clearly list the items or services purchased. Include details like quantities, unit prices, and any applicable taxes.

- Total Amount: Calculate and display the total amount due.

- Payment Details: Specify the payment method used (cash, credit card, check, etc.).

Example of a Receipt

What Is a Bill?

A bill is a document you issue to a buyer, requesting payment for provided goods or services. This document outlines the total amount owed and the terms of payment, essentially serving as a formal demand for settlement.

In the realm of business, a "bill" is a straightforward request for payment that can occur at different times. On the other hand, an "invoice" is a more detailed type of bill. It is issued after goods are delivered or services are completed and includes specifics such as quantities, prices, and payment terms. It's noteworthy that an invoice can also offer credit, allowing some time for payment, whereas a bill typically doesn't provide a credit extension. Understanding these distinctions is crucial for managing your financial transactions effectively.

When Is a Bill Generated?

A bill is typically generated by a vendor or supplier when they provide goods or services to a customer. It is issued to request payment from the customer.

What Is the Importance of Bills in Business?

The use of bills in business is crucial for several reasons:

- Formal Payment Request: Bills serve as a formal document establishing clarity and transparency in financial transactions when you request payment.

- Legal Standing: Bills have legal standing and can be used as evidence in the event of disputes, providing a clear record of the agreed-upon terms and amount owed.

- Cash Flow Management: Issuing bills helps you manage your cash flow by ensuring timely payments for goods or services rendered.

- Professionalism: Using bills enhances your business's professional image, demonstrating organised and formalised financial procedures.

How to Write a Bill?

The details presented in a bill closely resemble those found in an invoice, resulting in a consistent format for both documents.

The difference between an invoice and a receipt, a purchase order and a bill

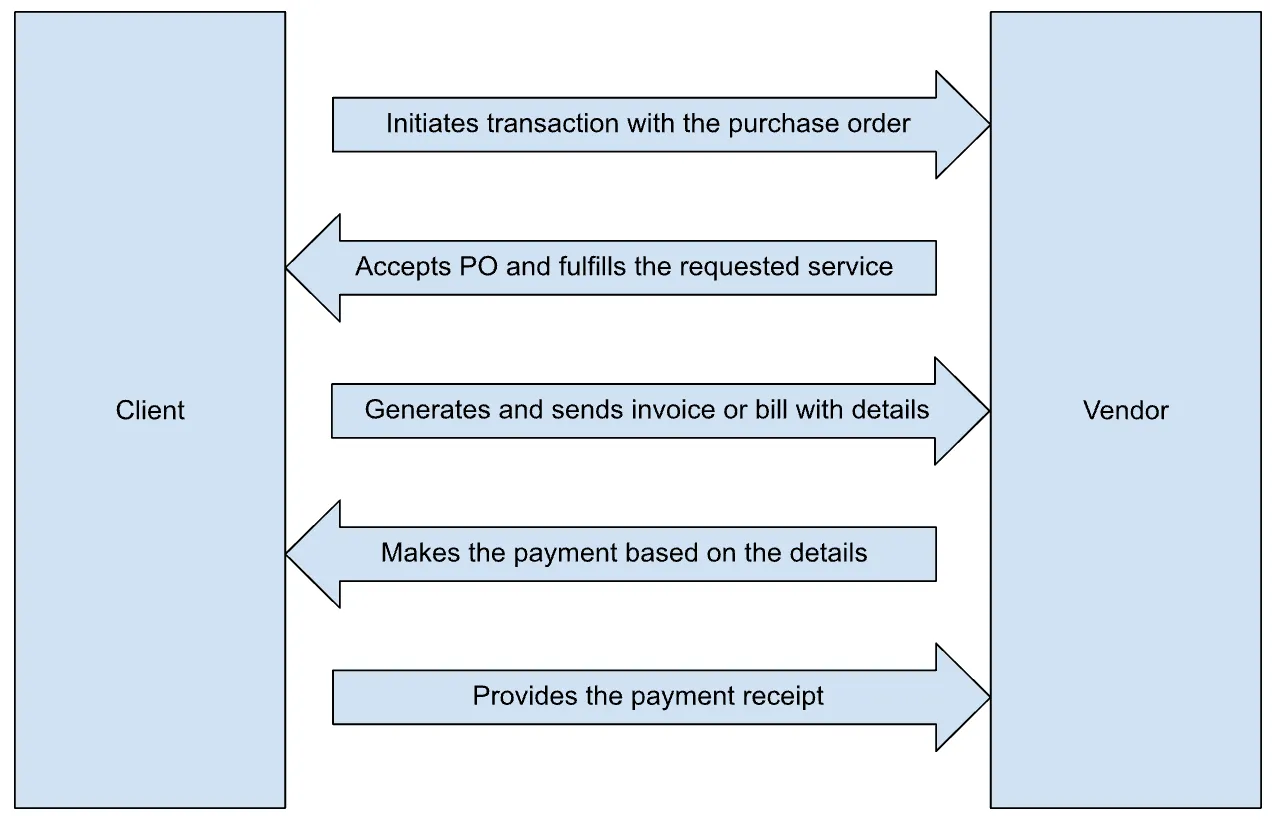

Now that you know what’s invoice vs receipt and PO vs invoice, let’s look at how these documents are used during a business transaction.

Frequently Asked Questions

Do businesses need both a receipt and an invoice?

Absolutely, both receipts and invoices play distinct roles in a business transaction for you. An invoice issued by the seller either before or after delivering goods or services acts as a formal request for your payment. It provides specifics like what you bought, quantities, prices, and payment terms. Conversely, a receipt is handed to you by the seller at the time of payment, serving as proof that you've made the payment. It typically includes transaction details such as the payment amount, date, and method. Both of these documents are crucial for your accounting, record-keeping, and overall financial clarity.

What is a paid invoice?

As the buyer, it is simply an invoice that you have settled or paid. It's considered paid once you submit the payment for the goods or services outlined in the invoice. The seller acknowledges the payment and updates their records, and a paid invoice becomes a vital financial record for you.

Can a bill be issued before the delivery of goods or services?

Yes, a bill can be issued before or after the delivery of goods or services, depending on the business's payment terms and practices.

How do businesses handle overdue bills?

Overdue bills are typically addressed by implementing late fees or interest charges. Businesses may also follow up with reminders and communication to resolve outstanding payments.

Is there a difference between a bill and an invoice?

While the terms are often used interchangeably, a bill is generally considered a request for payment, while an invoice provides detailed information about a transaction.

How long does a business owner need to keep receipts for record-keeping?

Businesses should keep receipts for an appropriate period, often several years, to comply with tax regulations and for potential audits.

Are receipts necessary for all types of transactions?

While not mandatory for all transactions, receipts are crucial for larger or business-related transactions. They provide documentation and aid in financial record-keeping.

What is the difference between a proforma invoice and a final invoice?

A proforma invoice is a preliminary bill sent to the customer before the delivery of goods or services. A final invoice is issued after the completion of the transaction.

Is the invoice a receipt?

No, an invoice is not a payment receipt. While both documents are related to financial transactions, they serve different purposes. An invoice is a request for payment issued by a seller to a buyer before or after the delivery of goods or services. On the other hand, a receipt is a document the seller provides to the buyer at the time of payment. It serves as proof that the payment has been made.

How do businesses create and send invoices to customers?

Businesses can create and send invoices using accounting software, online platforms, or customised templates. Invoices are usually sent via email or traditional mail.

Need a System to Streamline Your Business Paperwork?

A solid vendor management system is fundamental to business success. It should encompass database maintenance, terms and expense tracking, risk documentation, and performance evaluation. It should streamline vendor onboarding and administrative tasks, ensuring operational efficiency.

Aspire integrates seamlessly into this framework, offering a centralised solution for generating and managing vendor invoices, receipts and payments.

Gone are the days of uncertainty about your financial commitments. With Aspire’s vendor management system, we provide a dashboard displaying each vendor's past, present, and estimated future debt. Our platform automates expense reporting, bulk bill payments, on-time reimbursements and real-time spend alerts, simplifying expense management. Through direct integrations, Aspire not only saves time but also enhances bookkeeping efficiency, meeting all your accounting needs.

This comprehensive solution empowers your business to overcome challenges such as lost receipts, inefficient invoice & receipts processes, and constant follow-ups, allowing them to focus on strategic analysis and financial planning.

Take action now – open an account with Aspire!

%201.webp)

.webp)