Summary

Many new companies still work with traditional payment systems like petty cash or company-wide credit cards. If that’s true for your company, you will have noticed these systems are very time-consuming. There is a way around that! Enter virtual credit cards or virtual debit cards for business. They allow instant payments and are easier to manage.

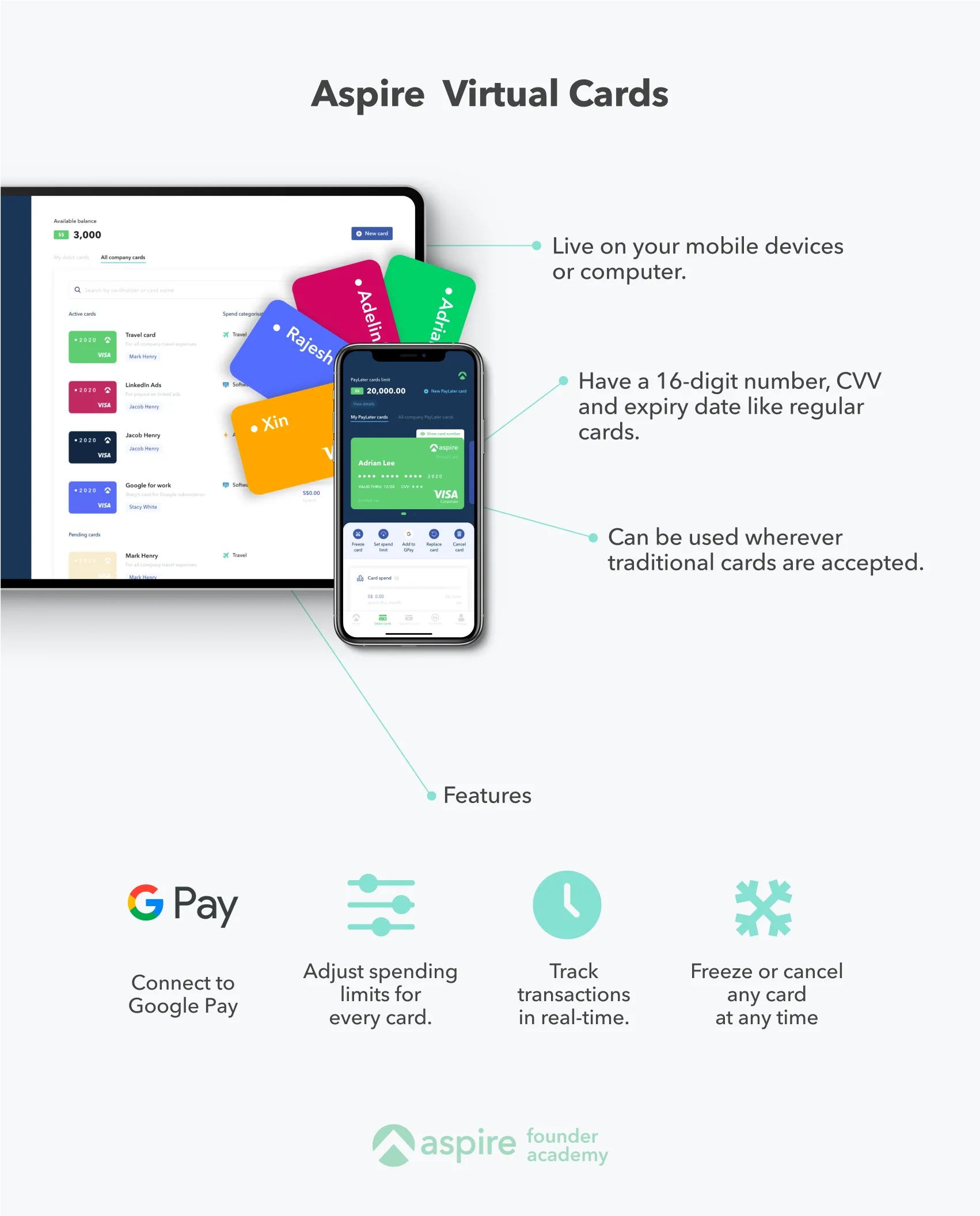

What is a virtual card?

A virtual card is a payment card stored on your phone, tablet or computer.

There are two types: Virtual credit cards and virtual debit cards. Apart from a few minor differences, they are the same as physical bank cards.

For example, they can be used wherever credit or debit cards are accepted. And of course, you can make online payments with them since they have a 16-digit card number, CVV and expiry date.

Both banks and payment service providers, like Aspire, issue virtual cards.

Virtual cards are still quite new but they come with many benefits traditional company cards simply don't offer.

How Do Virtual Credit Cards Work?

Using virtual credit cards for your business is a straightforward and efficient process. Once you’re approved for a line of credit, here’s how it typically works, step by step:

- Send Payment Details

You simply send an authorised payment file to your virtual card provider—usually your bank or financial institution. This file includes the payment amount and the recipient’s details.

- A Unique Card is Created

Your provider generates a one-time-use virtual card with its own unique 16-digit number. This card is tied to the exact payment amount you approved, making it secure and specific to that transaction.

- The Card is Sent to the Payee

The provider delivers the virtual card securely to the payee, often via email. From there, the payee uses the card details to process the transaction with their bank.

- The Payment is Settled

Once the transaction is authorised, your bank and the payee’s bank settle the payment. It’s quick, smooth, and secure.

- Automatic Reconciliation

After the payment is posted to your account, a reconciliation file is automatically sent to your accounting or ERP system. This matches the payment with the corresponding invoice, saving you time and effort on manual tracking.

With virtual credit cards, you can simplify payments, improve security, and reduce the hassle of dealing with physical cards or manual reconciliation. It’s all about making things easier and more secure for you and your business.

What can you do with a virtual card?

Virtual cards are very useful for growing businesses. If you give your employees virtual company cards, they can always make their own payments while you stay in control of spending limits.

Moreover, you’ll have visibility on every transaction from a single dashboard, making it easy to trace payments.

As a result, you’ll always be in control of your overall expenses. And if there’s any suspicion of illicit card activity, you can freeze or cancel the card right away.

Benefits of virtual credit cards and virtual debit cards

Benefit 1: Fewer cards in your wallet

No one needs more cards in their wallet. With virtual cards, you can always pay promptly via linked digital devices.

Benefit 2: Better for the environment

The amount of plastic used to produce banking cards every year is equivalent to the weight of 150 Boeing 747s. Let that sink in. Switch to virtual cards to reduce plastic pollution and postal delivery.

Benefit 3: Almost-instant activation

The paperwork involved in obtaining virtual prepaid cards is often minimal compared to credit and debit card applications. Since the approval process is swift and you don’t need to wait for the postal delivery, you can start almost immediately.

Benefit 4: Increased security

Virtual credit and debit cards are a safer alternative to physical cards. They only exist digitally, removing the risk of misplaced or lost cards.

Benefit 5: Ease of use

With the power of a virtual card, you’re able to make secure payments the same way as a physical or debit card一without the hassle of bringing along your wallet. This is because virtual cards share the same features as a typical card, such as a unique 16-digit number, CVV and an expiry date. For effortless payments, simply add your Aspire card to Apple Pay or Google Pay.

How can virtual cards help with business?

Virtual cards can be a boon when it comes to managing business expenses. Here’s how they can make your expense management leaner and easier:

Quicker payments

Virtual cards smoothen out the payment process. Employees will not have to wait for physical approval or spend out of their pockets for different business expenses. You can simply issue virtual cards with spending limits. This will make transactions faster while also monitoring the amount each employee spends.

Improves your spending control

Onboarding team members onto your virtual cards is super simple. All you need to do is request a card and provide employee details. You can also set spending limits, usage criteria and monitor the date on which it expires. This way, you can control the use of the card, preventing misuse. You can also set an upper limit for spending, thereby stopping any excess spending.

Easy monitoring

You can monitor spending directly on the dashboard or app. Most providers allow real-time monitoring, allowing you to keep a track of spending as and when they occur. You can also view details such as approvals and receipts, making monitoring extremely simple.

Consolidation of expenses becomes simpler

When you have multiple physical cards, even if they are corporate cards, consolidating all expenses at the end of the month can become tedious. You will need statements and receipts from different employees. When you issue virtual cards, they are all linked to the same account. This way, you can consolidate all transactions on one page.

Traditional Credit Cards Vs Virtual Cards

Here’s a quick comparison between virtual credit cards and traditional credit cards to help you decide which one suits your business needs:

What Sets Virtual Cards Apart From Mobile Wallets and Payment Apps?

Here’s a comparison to help you decide which payment method suits your business needs:

Why Startups Should Get a Virtual Card Online

With growing expenses and more outgoing transactions as a startup scales up, business spending gets more complicated. And the risks increase. Virtual company cards can solve these problems by making spending more accessible for all employees while adding additional control via modern software.

On top of that, payment service providers like Aspire App streamline your accounting activities with fast syncing and real-time rapports.

Things to Consider when Getting a Virtual Card Online

Easy integration

When you get a virtual card online for your business, you should scout for a provider whose product can integrate easily with your payment tools and accounting software. It should also be compatible with any upgrades that you make in the future. Therefore, you should choose a provider whose interface is compatible with different payment systems.

Security

Virtual cards online, be it virtual credit cards or virtual debit cards, are still prone to fraudulent transactions. You should be careful when using your virtual card online and keep track of any unauthorized transactions. You should look for a virtual card provider who has the best security features to keep your money safe.

Perks and privileges

You should always try to optimise your payments. Just like you would look for offers on your credit card, you should scout for a virtual card online that provides offers and discounts. This can help you save money.

Expiry dates

A virtual card Singapore, especially for business, should have an expiry date. This will help you cut off access to employees who have quit or retired. However, with expiry dates, there may be some issues. If you want to get a refund on a product, you may not be able to get it to your source account. You can always speak to your provider about how to navigate this issue.

How to keep your business expenses under check with virtual cards

Some of the top virtual card companies in Singapore allow you to put in place checks and balances to manage your business spending better. Here are some tips on what you can do to keep an eye on your business expenses when you use virtual cards:

- Issue individual virtual cards to different employees. This will help you track who is spending what and allow you to intervene on time if something goes amiss.

- Bundle up virtual cards into departments and then allocate department budgets. This will allow you to set controls for each department.

- Set limits for each expense head depending on the seniority of the employee. This will prevent overspending.

- If someone wants to spend over the limit, make sure they get authorization from the right person to do so. You can give authorization access to specific people.

- While it may be okay to allow employees to automate certain recurring payments, make sure that you check these expenses on a regular basis.

How Virtual Cards Keep Your Business Secure

Regarding payments, security is critical for your business, and virtual cards provide a level of protection that’s hard to beat. Here’s how they help safeguard your transactions and sensitive data:

Unique Card Numbers for Every Transaction

Each virtual card you issue has a unique number, often designed for single-use or limited validity. For example, when paying a supplier, the card number becomes useless after the transaction, protecting your finances even if the details are exposed.

Customisable Spending Controls

You have complete control over how your virtual cards are used. Set spending limits, restrict usage to specific vendors, or allocate cards to individual employees.

No Risk of Physical Theft

Since virtual cards are entirely digital, there’s no physical card to lose or be stolen, giving you peace of mind and added security.

Encrypted and Secure Delivery

Virtual cards are delivered through encrypted channels, such as secure emails or portals, ensuring they don’t fall into the wrong hands during transmission.

Real-Time Transaction Tracking

Monitor every transaction as it happens. This means you can quickly identify and address any suspicious activity, helping you stay one step ahead of potential fraud.

Designed to Prevent Fraud

Virtual cards Singapore are built with fraud prevention in mind. You can issue cards for specific payments or projects, such as creating a single-use card for a contractor’s invoice. This eliminates the risk of the card being used elsewhere.

Limitations of Virtual Cards for Your Business

Virtual card Singapore come with many advantages, but they also have some limitations that you’ll want to be aware of before fully integrating them into your payment system. Here’s what you should know:

1. Limited Use in Physical Transactions

- Virtual cards can’t be used for in-person transactions that require a physical card, such as withdrawing cash from ATMs or making certain in-store purchases.

- For example, if your team member needs to make an urgent cash withdrawal, a virtual card won’t help.

2. Dependence on Internet Access

- Virtual cards rely on an internet connection to process transactions, meaning they won’t work if you or your team are in areas with poor connectivity.

- For instance, if your team is working remotely in a location with weak Wi-Fi, they might struggle to make payments.

3. Vendor Acceptance Can Be an Issue

- Some vendors, particularly smaller ones, may not accept virtual cards due to outdated payment systems or a preference for physical cards.

- Imagine your team needs to pay a local vendor who only accepts physical cards – you’ll need an alternative payment method.

4. Could Be Tricky for Non-Tech-Savvy Employees

- Employees who aren’t used to digital systems might find it harder to use virtual cards efficiently.

- For example, you may have to spend extra time training your team on how to generate and use virtual cards, which could slow things down.

5. Might Not Integrate with Older Systems

- If your accounting or ERP system is a bit dated, you could run into compatibility issues with virtual cards.

- In this case, you might need to upgrade or customise your systems to ensure everything works smoothly, which could incur additional costs.

6. Single-Use Nature Can Be Inconvenient

- While single-use virtual cards are great for security, they can be inconvenient if you need to set up recurring payments or subscriptions.

How Aspire virtual cards bring value to your business

Aspire’s virtual cards are created for start-ups and small businesses with multiple costs from all sorts of angles. Think online advertising, SaaS subscriptions, overseas purchases and so on.

At this stage, early-stage founders are likely to look up corporate card options from banks to manage future payments. But virtual company cards are often a better option.

Benefit 1: Save on international payments

It's common for banks to mark up exchange rates to earn a commission from transactions between different currencies.

With Aspire, your transactions happen at the mid-market rate, without any additional mark-up.

Moreover, you can make overseas transactions in over 50 currencies at consistently lower rates, with upfront clarity about any extra fees.

Benefit 2: Earn cashback

You can earn 1% cashback on digital marketing and some of the most popular SaaS subscriptions.

Benefit 3: Integrate with your existing software

All your virtual card transactions can be automatically synced with your accounting software, saving precious time for more productive tasks.

Benefit 4: Stay in control of spending

Set up different spending limits for each card and update them anytime. See all transactions in real-time from a single dashboard and freeze any card on the spot if necessary.

Benefit 5: Issue unlimited cards

Sign up and order an unlimited number of virtual cards for your team. No hidden costs.

Frequently Asked Questions

With Aspire, all you need to do is sign up for a free business account and order the required number of virtual cards for your employees.

You use it the exact same way as a physical credit or debit card. All virtual cards come with unique 16-digit numbers, CVV and expiry dates. Enter these details for online transactions. Alternatively, you can connect your virtual card to Google Pay to pay in stores.

Yes, virtual cards are 100% legal in Singapore.

Virtual cards are designed to protect you from the typical vulnerabilities of a physical card.

- Your issued virtual card number is different from your credit or debit card number. Therefore, it can never be traced back to your credit or debit card accounts.

- Virtual cards often come paired with software that keeps track of transactions in real-time. If you detect unusual activity on your virtual card, you can cancel it on the spot and order a replacement right away.

- You can apply spending restrictions and expiration dates.

Unfortunately, we are currently unable to convert your virtual card into a physical card replica. However, you can apply for a new physical card by following the instructions here

The primary difference between a virtual prepaid card and a virtual credit card is the payment date. With a prepaid card, you need to pay upfront. And you can spend as much as you have on your card.

With virtual credit cards, you can spend up to a certain amount, and you only pay the total sum at the end of the month. Therefore, banks will do a credit check for these cards, making them more challenging to obtain.

Are you an Apple user? Sign up for an Aspire Card and bring Aspire with you wherever you go! All it takes is 5 easy steps. Here’s how to add your Aspire card to Apple Pay:

Step 1: Open your Aspire app

Step 2: If you have multiple Aspire Cards, choose the Aspire Card that you wish to add to Apple Pay

Step 3: Click on “Add to Apple Wallet”

Step 4: Verify your card

Step 5: Once that’s complete, you may set your Aspire card as the default card in your Apple Wallet if you wish

You can also add Apple Pay to your individual devices. Here’s how to go about it:

iPhone

Open the Wallet App on your iPhone -> Tap the ‘+’ symbol -> Enter the details of your Aspire card -> Wait for confirmation

iPad

Go to Settings -> Open “Wallet & Apple Pay” -> Select “Add Debit or Credit card” -> Enter your Aspire card details you want to add -> Wait for confirmation

Apple Watch

Open the Apple Watch app on your connected device (iPhone) -> Go to ‘Wallet & Apple Pay’ -> Select “Add Debit or Credit card” -> Enter the Aspire card details you want to add -> Wait for confirmation

MacBook Pro with Touch ID

Go to system preferences -> Select “Wallet & Apple Pay” -> Select “Add card” -> Enter your Aspire card details -> Wait for confirmation

Voila, you’re ready to start using Aspire via Apple Pay to tap and pay! You can also check out this video guide on how to add your Aspire Card to Apple Pay. If you are still struggling, you can check out Apple’s guide on how to add cards to Apple Pay.

With growing expenses and more outgoing transactions, business spending gets more complicated. And the risks increase.

Virtual company cards can solve these problems by making spending more accessible for all employees while adding additional control via modern software.

On top of that, payment service providers like Aspire App streamline your accounting activities with fast syncing and real-time rapports.

You can add your Aspire Card to your Google Pay with an Android device.

Go to the Google Pay app on your phone. Navigate to the “Card Payments” section -> Go to “Add a New Card” -> Enter your Aspire card details -> Choose the SMS verification option -> Enter the verification code and submit -> Your card will be successfully added.

If you have any trouble, check out this PDF visual guide on how to add your Aspire Card to Google Pay.

Companies incorporated in Singapore, Indonesia, the Philippines, Thailand, Malaysia and Vietnam can apply for Aspire virtual cards. You can also issue these cards to employees in any other country in the world.

Your Aspire virtual debit card can be used to receive funds from third-party websites like PayPal. We recommend using your Aspire SGD/USD account to receive funds.

You can do cool things on your Aspire virtual card, like changing its colour or editing information.

If you want to change the colour of your Aspire card, go to the “Cards” section on the left side of your dashboard. Click on the card whose colour you want to change. Scroll down to All card details. Click on edit. Choose your card colour. Click save changes. Do note that if you are using GooglePay, card colour change may take one week to reflect.

You can also edit details like card name and purpose. Go to the “Cards” section on the left side of your dashboard. Click on the card whose details you want to change. Scroll down to All card details. Click on edit. Change the information you want to edit. Click save changes.

As an Admin, you can issue virtual cards to employees with spend limits at no additional costs. For employees already on Aspire, Admins can issue cards in the following ways:

1. Click on Debit cards to access your company cards page

2. Click on the "+ New card" button to initiate card creation

3. Select the user that you would like to create a card for and complete the required fields

4. Card is created immediately

You can issue cards during the invitation flow. Do note that Admins will not be able to issue to other account Admins, they can issue a card on their own. Please note, Cards for account Admins (directors) will be created automatically upon account activation.

Your Aspire virtual debit card may be put on hold if you don’t meet our internal terms and guidelines. You can refer to them here

Bonus read: Complete Guide to Using Virtual Cards in Singapore (Downloadable)

%201.webp)

.webp)