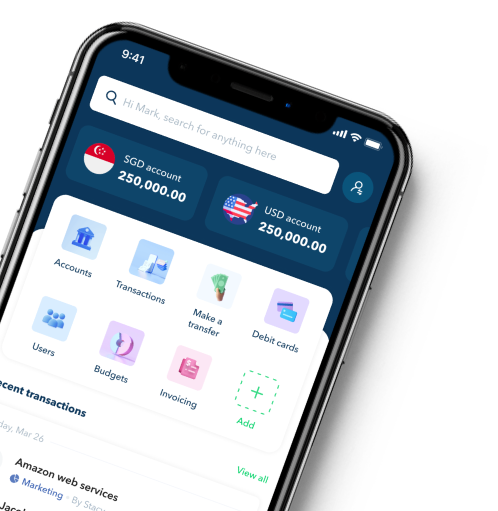

card for your business

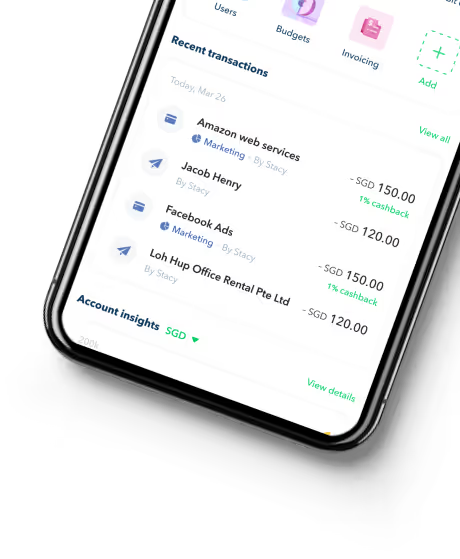

Earn 1% cashback on digital marketing spends

Pay using Aspire cashback cards for online marketing spends to promote your business, including Facebook ads, Google Ads, LinkedIn Ads and many more platforms to receive large amounts of cash back into your account every month.

Search Ads

Earn 1% cashback on software-as-a-service spends

Pay using Aspire cashback cards for subscriptions to tools that support your business operations, including hosting services, analytics, collaboration, and accounting tools to receive large amounts of cash back into your account every month.

How to earn cashback

Open your Aspire account, fast. 100% online in under 5 minutes.

Use your Aspire Card as billing payment for your business digital purchase.

Aspire calculates qualified cashback from your monthly card spending.

card for your business

All you need to know about Cashback

What is a cashback & what are cashback cards?

Cashback is a type of rewards programme where businesses can get a portion of the money they spend on their business purchases. A cashback card is one that reimburses you for a portion of your purchases. The cashback you receive will be credited to the same account that your card was linked to when making your purchase.

How cashback cards work in Singapore?

Cashback cards work in a very simple, straightforward manner. Simply use your cashback card to make your purchase, and at the end of the month or the following month, cashback will be credited to your card account. Your transaction amount will be divided by this cashback as a percentage. For instance, if your cashback card offers a 1% payback on marketing expenditures, you will receive $50 in cashback for spending $5,000 on marketing.

Typical percentages fall between 0.5% and 1%, although they might be lower or higher depending on the card issuer, card type, and your desired spending. On all eligible transactions, some cards offer flat-rate cashback incentives; other cards have a tiered system. You must spend at least the minimum amount each month specified by your cashback card in order to receive your cashback at the end of the month.

How much cashback can you earn?

Your eligibility for cashback is determined by two factors, the rewards scheme you choose, as well as your actual spending. Keep in mind that spending money is the only method to receive cashback.

Consider whether you can get benefits from a programme without altering your regular spending patterns before committing. If so, you'll probably be able to get your money back without going over your budget. If not, look for a programme that better fits the spending patterns of your company.

For each category, the majority of cashback cards impose a cashback cap. There can also be a monthly cap on the overall amount of cashback. Some cards offer cashback and have no cashback cap too. You can earn higher cashback if you look into these elements carefully.

What type of purchase is eligible to earn cashback?

This is determined by the category of spending. Higher cashback rates are often granted on certain merchant categories, such as marketing expenses, business software & hardware purchase (laptops, phones, etc.), travel (Airmiles), petrol, and so on.

For example, Aspire corporate cards offer up to 1% cashback on online marketing and software as a service goods, which are crucial to any firm. These include marketing channels like Facebook, Google, LinkedIn, TikTok, and others, as well as tools like Microsoft 365, Hubspot, Intercom, Slack, Mail Chimp, Notion and others.

You must meet the minimum spend criteria to obtain rewards on your purchases with many cashback cards. If you don't spend much, consider cashback cards with no minimum spend. Also, keep in mind the maximum cashback amount, beyond which no cashback will be provided even if you spend more.

Who offers cashback cards in Singapore?

Many banks and fintech companies, including ourselves, provide corporate cards to Singapore businesses. We've covered them in our blog; click the links to see cards from banks like DBS, UOB, Standard Chartered, AMEX, and Maybank.

However, if you are a start-up or a growing business, you may not meet the eligibility criteria for most of these banks, or you may find them too expensive. Consider the Aspire Cashback Card, which provides all of the benefits while having less stringent eligibility criteria and highly relevant rewards. For a quick and easy comparison, read our article on the best business cashback cards in Singapore.

How to apply for a corporate cashback card in Singapore?

The conditions for applying for a corporate cashback card differ depending on the provider. To apply for corporate cashback cards, you must provide documentation such as your business registration details, financials, and other information. Some businesses may also need you to submit your company's credit score. This will decide the type and amount of cards you are qualified for.

Applying for digital cards, such as the Aspire corporate card, is much easier because the entire procedure may be completed online. To apply for an Aspire card, for example, you simply open an Aspire business account (Free for new businesses), submit documentation online, and your cards will be approved.

What are virtual/digital card and how can you get one?

As banking becomes more digital, financial institutions are now offering Instant virtual cards. This means that if you are approved, you will receive a digital card that you may use right away. You don't have to wait a couple of weeks for the physical card to come in the mail before you can make a purchase. They are also entirely safe and look precisely like physical cards, except they are digital.

When applying for virtual cards, follow the card issuer's instructions on how to locate your virtual card once it has been accepted.

How to choose the best cashback card for your business?

When choosing a cashback card, you can consider features such as:

Cashback spending categories

While there are some cards that will offer you blanket cashback on all spending, the most generous ones will usually only reward you for spending on certain things. There is no point in applying for a card that gives you a ton of cashback on something you don’t spend on.

Annual fee

Most cards require you to pay an annual fee for the cards issued and the services rendered by the provider. How much you pay as an annual fee should be deducted from how much you can save on the card, to understand the real saving you can earn using the card. These fees generally range around SGD 150 to SGD 200 on average but can be more.

Minimum spend requirement

Successfully applying for a cashback card doesn’t mean you’ll benefit from the fantastic cashback they’ve been advertising on their website. Most cashback cards require you to spend a certain amount every month in order to qualify for their cashback.

Additional perks

Many providers offer free travel insurance, free accidental insurance or liability insurance as perks for businesses to select their cashback cards over others. While these are interesting perks, these benefits must be calculated along with the actual cashback you will receive using the card to understand the net benefit you can receive.

Monthly cashback cap

Another important thing to consider is the monthly cashback cap on the cards. This is the maximum amount of cashback you can receive by using your card throughout the month to its full potential. The higher the monthly cap, the better, as far as it is relevant to the categories you spend in.

Signup promotions

Similar to additional perks, cashback card providers also offer signup bonuses. In most cases, these are waivers on the annual fees that you pay for the card. It can be for a year or two. Aspire, for example, offers exclusive rewards of over SGD 50,000 with our platform partners. You must take into account these benefits before selecting a cashback card for your business.

You must read the fine print to determine whether there are any extra conditions that must be met before you can earn the cashback. At times, these can be the deal breaker for what may sound like a good offering otherwise.

Cashback cards in Singapore –should your business have one?

Cashback cards are for your business if:

You want to save time spent on redeeming points

Cashback cards are ideal for businesses wanting to save time. As long as you choose one that exactly matches your spending habits, you won't have to strain your team or bother about tinkering with e-rewards catalogues.

Your spending is predictable

Most cashback cards have a minimum spending requirement and defined cashback cap based on categories and total spends. If your business generally spends on these categories and exceeds the minimum spends per month, you are most likely to exceed the full benefits of cashback without having to overspend.

You prefer cash flowover fancy rewards

Cashback cards are known to give what your small business generally requires the most - Cash. You won’t get fancy rewards or vacations in most cases that some other cards may provide. A cashback card is ideal if you'd prefer to have additional money in your pocket than such spectacular benefits.

What should you look out for when using a cashback card?

When using a cashback card, always be cognizant of the following things:

The categories with the highest cashback rates

The categories with the lowest cashback rates

Cashback limit for each category you are spending on

What is the necessary minimum spend to obtain cashback

Cashback cap for the month and balance that is unutilized

Is cashback awarded on a statement or calendar month basis

Monthly breakdown of the annual and other fees, if any to be paid

FAQs about Cashback

What transactions qualify for cashback?

Listed below are Online Marketing and Software-As-A-Service merchants. If you are transacting with additional non-listed merchants, please let us know and we will consider adding them to the list.

Online Marketing Merchants:

- Facebook Advertising

- Google Advertising

- LinkedIn Advertising

- Microsoft Advertising

Software-As-A-Service (SaaS) Merchants:

- Adobe

- Amazon Web Services

- Active Campaign

- Canva

- Freshworks

- GoDaddy

- Google Suite

- Hellosign

- Hubspot

- Intercom

- Mailchimp

- Microsoft365

- Mixpanel

- Notion

- Quickbooks

- Salesforce

- Segment

- Sendgrid

- Shopify

- SignNow

- Slack

- Twilio

- Typeform

- Wix

- Xero

- Zoom

How does Aspire’s cashback work?

All Aspire cardholders will enjoy a minimum cashback of 1% on qualified spending (online marketing & SaaS).

Our cashback promos are designed to help your business thrive, so take advantage of them!

Cashback are computed automatically at the end of each month based on your digital marketing & SaaS expenses. The cashback is then deposited into your business account by the 1st week of next month.

You will receive a separate email notification when the cashback has been processed.

PS: You can find out more about our cashback promotions here

Who gives the best cashback?

Aspire offers 1% uncapped cashback on Marketing and SaaS spends made with your Aspire corporate debit cards as compared to 0.3% offered by traditional banks. Check our blog article Best Business Cashback Cards in Singapore

How do you maximise cashback?

You can maximise cashback by making all the purchases, applicable for that cashback, using the card of the institution that provides the cashback.

Is cashback a good idea?

Cashback allows you to earn cash on the spends you make using your credit or debit cards. Not claiming cashback will be similar to leaving money on the table - definitely a bad idea!

What is a cashback card?

A cashback is a debit or credit card that allows you to earn back a portion of your spends.

Is cashback card a debit card?

A cashback card can be a debit or a credit card. Different financial institutions have different forms of cashback cards.

.jpeg)